Article Text

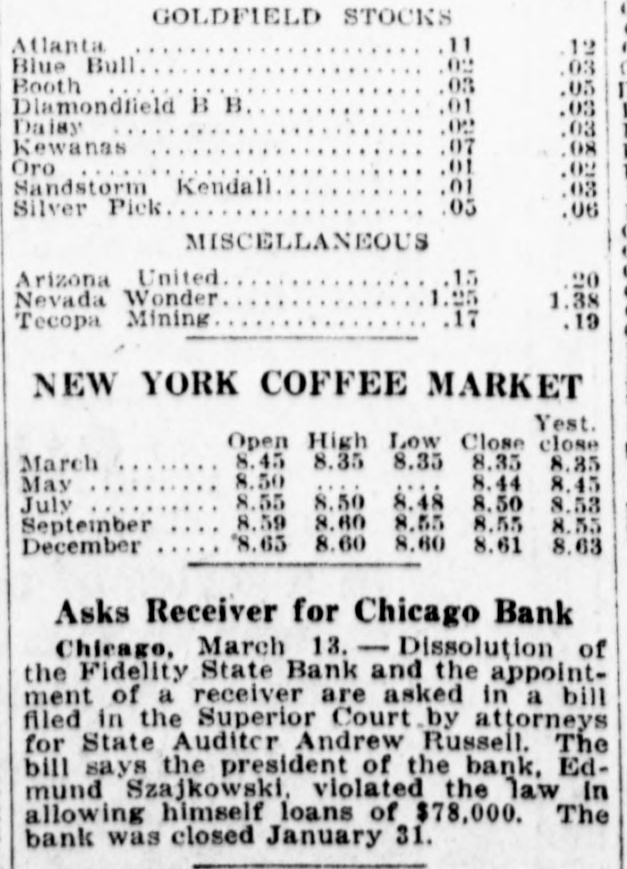

# NOTATKI REPORTERA. Dzisiaj wieczorem w hotelu La Selle, w śródmieściu odbędzie się bankiet przy udziale reprezentantów 75 narodowości zamieszkałych, w celu ponowienia swej lojalności dla sztandaru Stanów Zjednoczonych. Ze branie to i bankiet urządza liga „Na- tional Security League". Spodziewa- nem jest, że na dzisiejszy bankiet stawi się przynajmniej 1,800 osób różnych narodowości. Przewodniczą- cym będzie p. Jan F. Smulski, prezes banku „Northwestern Trust and Sa- vings Bank". Bankiet rozpocznie się o godz. 6:30 wieczorem. Bilety nabyć można jeszcze przy drzwiach sali ban- kietowej. Do hali Warszyńskiego przy No. Cen tral Park avenue i Wolfram ulicy, ze- brało się wczoraj wieczorem około 750 akcyonaryuszy i depozytorów banku u- padłego Fidelity State Bank. Zebranie to zagaił Wincenty Najdowski - na przewodniczącego powołano adwokata Piotra H. Schwabę. Do zdania raportu z tego co słyszeli u rewizora i u p. Smulskiego, powoła- no p. Jana Konopę. Powiedział on iż tak Stanowy rewizor bankowy Russell jak i p. Jan F. Smulski uważają to za rzecz niemożliwą uchronienie banku raz już upadłego i w takim stanie jak bank Fidelity. Rewizor Russell nawet słyszeć nie chciał o przyjęciu owych ze- branych $50,000 w celu spłacenia dłu- gów tegoż banku. Depozytorzy banku tego otrzymać mają nie mniej jak 50c na dolarze a może i nawet 65c na dolarze. Podczas posiedzenia przyszło także do paru u- tarczek dość ostrych ale obeszło się bez bójki. Wybrano Komitet składający się z adwokatów Piotra H. Schwabę i Józefa Lisak, oraz pp. Szymona Sikor- skiego, Jana F. Bartkowskiego i Kirch nera, w celu udania się do rewizora Russella dzisiaj by ten z pomiędzy nich wybrał „receivera" dla depozytorów banku Fidelity. Komitet ma zdać ra- port w przyszłą sobotę. Administracye wszystkich Towa- rzystw na Jackowie zbiorą się w przy- szłą niedzielę, dnia 10-go b. m., popo- łudniu o godzinie 3-ciej w sali parail nej w celu postarania się o flage ho- norową (service flag) i wywieszenia jej dla uczczenia naszych wojaków z Jackowa. Na zebranie to stawić się ma- ją reprezentanci wszystkich Towa- rzystw tak męskich jak i żeńskich na Jackowie. Dwóch dzisiaj znajduje się w szpita- lu „Bridewell" a dwóch na policyi pod kluczem a powodem tego jest bójka ja- ka zaszła wezoraj w domu przy Elston ave. Historya taka: Bolesław Szcze- pański, i Anna Krysiak, żona Jana Kry- siaka, matka trojga dzieci, mieszkali pnr. 1430 Fleetwood ulica przez jakiś czas; naraz naprzykrzyło się życie ta- kie Annie Krysiak i tak powróciła do męża i dzieci, rzeczy swoje zostawiając tymczasem w domu Szepańskiego. Mąż Krysiakowej wraz z Janem Olesiewi- czem z pnr. 1001 No. Ashland avenue udał się do domu Szozepańskiego i roz- biwszy zamek weszli do domu jego aby zabrać z powrotem rzeczy należące de Krysiakowej. W czasie jak to się dzia- ło ktoś dał znać o „mufówce" Szeze- pańskiemu do fabryki gdzie on praco- wał. Przybiegł Szczepański i począł okładać obu rurą żelazną po głowie, tamci też, że krew nie woda, poczęli nawzajem Szczepańskiego okładać ku- łakami. Zakończyło się na tem, że Kry- siakowie odstawieni zostali na stacyę policyjną przy Chicago ave. a Szcze- pańskiego i Olesiewiczą ambulansem za wieziono do szpitali w „Brajdwili" - gdzie lekarze orzekli iż obaj mają szan sę wyzdrowienia. ran na głowie i lewej nodze; prz pomocy innego obywatela zaszedł do kancelaryi Dra Jana Bony, który u- dzielił mu pierwszej pomocy lekar- skiej. Wczoraj o godzinie 3-ciej rano włamali się rabusie do wyszynku ob. Kuczkiewicza, nar, 118-tej ul. i Mi- chigan ave., i zabrali z kasy $6.50 gotówce. Franciszek Potulski przyznał się wczoraj w sądzie przed sędzią Saba- them do zastrzelenia swego przyja- ciela, Wojciecha Zeli. W domu pnr. 2649 W. 21-sza ul., ale powiada, że uczynił to w obronie własnej. Zela doniósł policyi że Potulski jest „slakierem" a ten pono w złości za- bił Zelę. Sprawę Potulskiego roz- strzygnie dzisiaj ława przysięgłych. Stan żądać będzie kary śmierci. Wieczór z powodu 10-letniego ist- nienia Towarzyswa „Promień" od- będzie się w sobotę, dnia 9go lute- go, b. r., w sali Związku Polek. Pro- gram wieczoru jest nadzwyczaj uro- maicony. Oprócz części muzykalno- wolkalnej, zostanie wystawiony ury- wek z „Dziadów" arcydzieła naszej poezyi. Dochód z uroczystości ja- ko zwykle, tak i tym razem przezna- cza Tow. „Promień" na głodnych w Czczyźnie. Wczoraj o godzinie 9:30 rano w kościele Najśw. Maryi Panny w Bridgeporcie odbył się ślub panny Rozalii Tomaszewskiej z panem Ja- nem Kamka. Ślubu dzielił i Mszą św. na intencyę nowożeńców odprawił X. S. Sehnke. Drużbowali: panna Maryanna Ke- bierska, kuzynka pani młodej, z pa- nem Stanisławem J. Kamka, kuzy- nem pana młodego; panna Janina Tomaszewska, kuzynka pani młodej, z panem Stanisławem Wojciechow- skim. Państwo Kamka zamieszkali na stałe pnr. 1005 W. 32ga ulica. Na czternaście lat więzienia skaza- ny wczoraj został Piotr Puszczyński liczący lat 19 wieku, za branie u- działu w zamordowaniu Adolfa Se- dingera, właściciela składu żywności. Edwarda Bolla, robotnik pracujący dla kompanii gazowej, w czasie na- prawiania rur gazowych w sutere- nach budynku pnr. 1322 Milwaukee ave., zaczadzony został uchodzącym gazem. Oddano go przyjaciołom jego którzy nieszczęśliwym zaraz się za- cpiekowali. Sędzia Edmund K. Jarecki oddał wczoraj Stefanowi Masaresowi z In- diana Harbor, Ind., szesnaście 10- dolarówek jakie od niego wyłudził Paweł Engler i Łukasz Król, sprze- dając mu maszynkę do robienia pie- niędzy. Pieniądze te znalazła policyja w kieszeniach dwóch wyżej wymie- nionych naciągaczy. Sprawę ich odło- żono na później. # TELEGRAMY KRAJOWE # DALSZE ATAKI NA SEKR. BAKERA. Waszyngton, 6. lutego. — Są widoki, że debaty w senacie trwać będą czas nieograniczony w spra- wie rzekomej nieudolności wojen- nej w rządzie amerykańskim, oraz obu bilów wojennych, które mają