Click image to open full size in new tab

Article Text

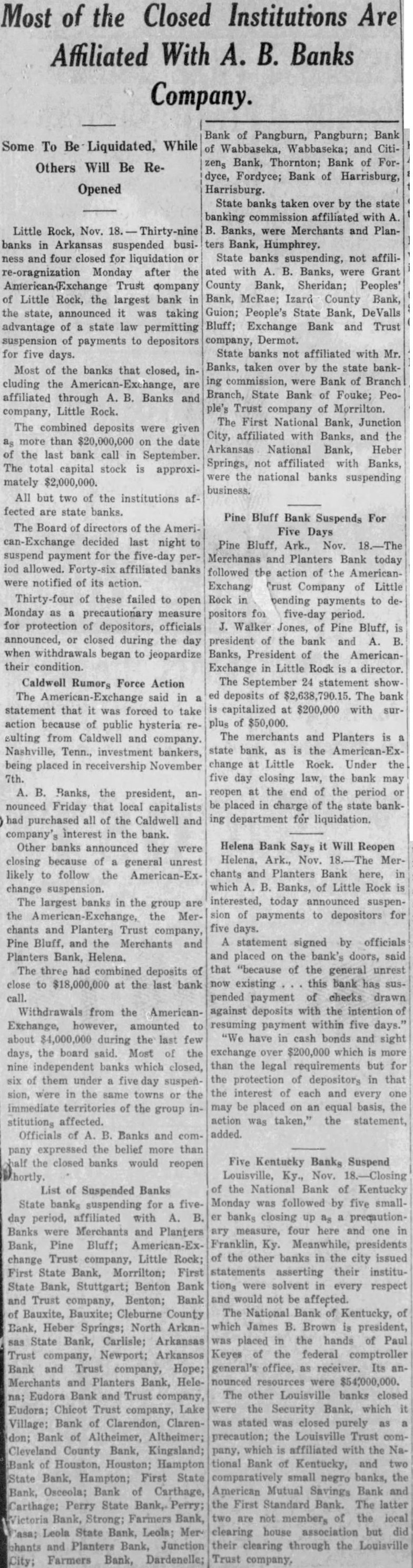

Most of the Closed Institutions Are Affiliated With A. B. Banks

Company.

Some To Be Liquidated, While Others Will Be Re-

Opened

Little Rock, Nov. Thirty-nine banks in Arkansas suspended business and four closed for liquidation or re-oragnization Monday after the American-Exchange Trust company of Little Rock, the largest bank in the state, announced it was taking advantage of a state law permitting suspension of payments to depositors for five days. Most of the banks that closed, including the American-Exchange, are affiliated through A. B. Banks and company, Little Rock. The combined deposits were given as more than $20,000,000 on the date of the last bank call in September. The total capital stock is approximately $2,000,000. All but two of the institutions affected are state banks. The Board of directors of the American-Exchange decided last night to suspend payment for the five-day period allowed. Forty-six affiliated banks were notified of its action. Thirty-four of these failed to open Monday as a precautionary measure for protection of depositors, officials announced, or closed during the day when withdrawals began to jeopardize their condition.

Caldwell Rumors Force Action The American-Exchange said in a statement that it was forced to take action because of public hysteria resulting from Caldwell and company. Nashville, Tenn., investment bankers, being placed in receivership November 7th.

A. B. Banks, the president, announced Friday that local capitalists had purchased all of the Caldwell and company's interest in the bank. Other banks announced they were closing because of a general unrest likely to follow the American-Exchange suspension. The largest banks in the group are the American-Exchange, the Merchants and Planters Trust company, Pine Bluff, and the Merchants and Planters Bank, Helena. The three had combined deposits of close to $18,000,000 at the last bank call.

Withdrawals from the AmericanExchange, however, amounted to about $4,000,000 during the last few days, the board said. Most of the nine independent banks which closed, six of them under a five day suspension, were in the same towns or the immediate territories of the group institutions affected. Officials of A. B. Banks and company expressed the belief more than half the closed banks would reopen

List of Suspended Banks State banks suspending for a fiveday period, affiliated with A. B. Banks were Merchants and Planters Bank, Pine Bluff; American-Exchange Trust company, Little Rock; First State Bank, Morrilton; First State Bank, Stuttgart; Benton Bank and Trust company, Benton; Bank of Bauxite, Bauxite; Cleburne County Bank, Heber Springs; North Arkansas State Bank, Carlisle; Arkansas Trust company, Newport; Arkansos Bank and Trust company, Hope; Merchants and Planters Bank, Helena; Eudora Bank and Trust company, Eudora; Chicot Trust company, Lake Village; Bank of Clarendon, Clarendon; Bank of Altheimer, Altheimer; Cleveland County Bank, Kingsland; Bank of Houston, Houston; Hampton State Bank, Hampton; First State Bank, Osceola; Bank of Carthage, Carthage; Perry State Bank, Perry; Victoria Bank, Strong; Farmers Bank, Casa; Leola State Bank, Leola; Merchants and Planters Bank, Junction City; Farmers Bank, Dardenelle;

Bank of Pangburn, Pangburn; Bank of Wabbaseka, Wabbaseka; and Citizens Bank, Thornton; Bank of Fordyce, Fordyce; Bank of Harrisburg, Harrisburg. State banks taken over by the state banking commission affiliated with A. B. Banks, were Merchants and Planters Bank, Humphrey. State banks suspending, not affiliated with A. B. Banks, were Grant County Bank, Sheridan; Peoples' Bank, McRae; Izard County Bank, Guion; People's State Bank, DeValls Bluff; Exchange Bank and Trust company, Dermot. State banks not affiliated with Mr. Banks, taken over by the state banking commission, were Bank of Branch Branch, State Bank of Fouke; People's Trust company of Morrilton. The First National Bank, Junction City, affiliated with Banks, and the Arkansas National Bank, Heber Springs, not affiliated with Banks, were the national banks suspending business.

Pine Bluff Bank Suspends For Five Days Pine Bluff, Ark., Nov. 18.-The Merchanas and Planters Bank today followed the action of the AmericanExchang Trust Company of Little Rock in pending payments to depositors for five-day period. J. Walker Jones, of Pine Bluff, is president of the bank and A. B. Banks, President of the AmericanExchange in Little Rock is a director. The September 24 statement showed deposits of $2,638,790.15. The bank is capitalized at $200,000 with surplus of $50,000. The merchants and Planters is a state bank, as is the American-Exchange at Little Rock. Under the five day closing law, the bank may reopen at the end of the period or be placed in charge of the state banking department for liquidation.

Helena Bank Says it Will Reopen Helena, Ark., Nov. 18.-The Merchants and Planters Bank here, in which A. B. Banks, of Little Rock is interested, today announced suspension of payments to depositors for five days. A statement signed by officials and placed on the bank's doors, said that "because of the general unrest now existing this bank has suspended payment of checks drawn against deposits with the intention of resuming payment within five days." "We have in cash bonds and sight exchange over $200,000 which is more than the legal requirements but for the protection of depositors in that the interest of each and every one may be placed on an equal basis, the action was taken," the statement, added.

Five Kentucky Banks Suspend Louisville, Ky., Nov. 18.-Closing of the National Bank of Kentucky Monday was followed by five smaller banks closing up as a prequtionary measure, four here and one in Franklin, Ky. Meanwhile, presidents of the other banks in the city issued statements asserting their institutions were solvent in every respect and would not be affected. The National Bank of Kentucky, of which James B. Brown is president, was placed in the hands of Paul Keyes of the federal comptroller general's office, as receiver. Its announced resources were $54,000,000. The other Louisville banks closed were the Security Bank, which it was stated was closed purely as a precaution; the Louisville Trust company, which is affiliated with the National Bank of Kentucky, and two comparatively small negro banks, the American Mutual Savings Bank and the First Standard Bank. The latter two are not members of the local clearing house association but did their clearing through the Louisville Trust company,