Click image to open full size in new tab

Article Text

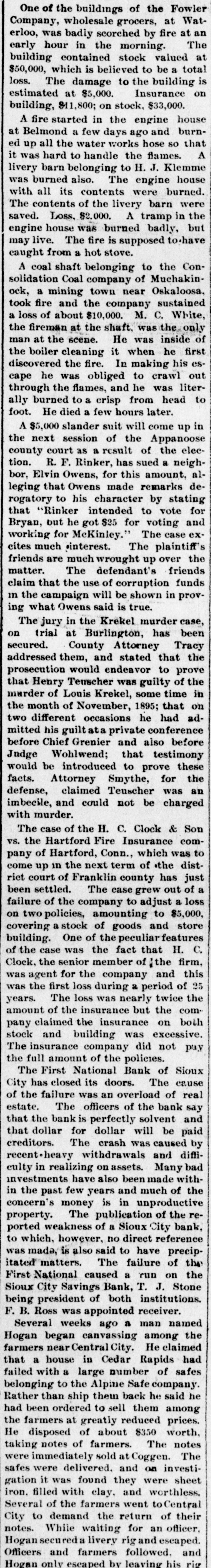

One of the buildings of the Fowler Company, wholesale grocers, at Waterloo, was badly scorched by fire at an early hour in the morning. The building contained stock valued at $50,000, which is believed to be a total loss. The damage to the building is estimated at $5,000. Insurance on building, $11,800; on stock, $33,000. A fire started in the engine house at Belmond a few days ago and burned up all the water works hose so that it was hard to handle the flames. A livery barn belonging to H. J. Klemme was burned also. The engine house with all its contents were burned. The contents of the livery barn were saved. Loss, $2.000. A tramp in the engine house was burned badly, but may live. The fire is supposed to.have caught from a hot stove. A coal shaft belonging to the Consolidation Coal company of Muchakinock, a mining town near Oskaloosa, took fire and the company sustained a loss of about $10,000. M. C. White, the fireman at the shaft, was the only man at the scene. He was inside of the boiler cleaning it when he first discovered the fire. In making his escape he was obliged to crawl out through the flames, and he was literally burned to a crisp from head to foot. He died a few hours later. A $5,000 slander suit will come up in the next session of the Appanoose county court as a result of the election. R. F. Rinker, has sued a neighbor, Elvin Owens, for this amount, alleging that Owens made remarks derogatory to his character by stating that "Rinker intended to vote for Bryan, but he got $25 for voting and working for McKinley." The case excites much ...interest. The plaintiff's friends are much wrought up over the matter. The defendant's friends claim that the use of corruption funds in the campaign will be shown in proving what Owens said is true. The jury in the Krekel murder case, on trial at Burlington, has been secured. County Attorney Tracy addressed them, and stated that the prosecution would endeavor to prove that Henry Tenscher was guilty of the murder of Louis Krekel, some time in the month of November, 1895; that on two different occasions he had admitted his guilt ata private conference before Chief Grenier and also before Jndge Wohlwend; that testimony would be introduced to prove these facts. Attorney Smythe, for the defense, claimed Teuscher was an imbecile, and could not be charged with murder. The case of the H. C. Clock & Son VS. the Hartford Fire Insurance company of Hartford, Conn., which was to come up in the next term of the district court of Franklin county has just been settled. The case grew out of a failure of the company to adjust a loss on two policies, amounting to $5,000, covering a stock of goods and store building. One of the peculiar features of the case was the fact that H. C. Clock, the senior member of |the firm, was agent for the company and this was the first loss during a period of 25 years. The loss was nearly twice the amount of the insurance but the company claimed the insurance on both stock and building was excessive. The insurance company did not pay the full amount of the policies. The First National Bank of Sioux City has closed its doors. The cause of the failure was an overload of real estate. The officers of the bank say that the bank is perfectly solvent and that dollar for dollar will be paid creditors. The crash was caused by recent·heavy withdrawals and difficulty in realizing on assets. Many bad investments have also been made within the past few years and much of the concern's money is in unproductive property. The publication of the reported weakness of a Sioux City bank, to which, however, no direct reference have 04 pies also sp 'epear SEM itated matters. The failure of the First National caused a run on the Sioux City Savings Bank, T. J. Stone being president of both institutions. F. B. Ross was appointed receiver. Several weeks ago a man named Hogan began canvassing among the farmers near Central City. He claimed that a house in Cedar Rapids had failed with a large number of safes belonging to the Alpine Safe company. Rather than ship them back he said he