Click image to open full size in new tab

Article Text

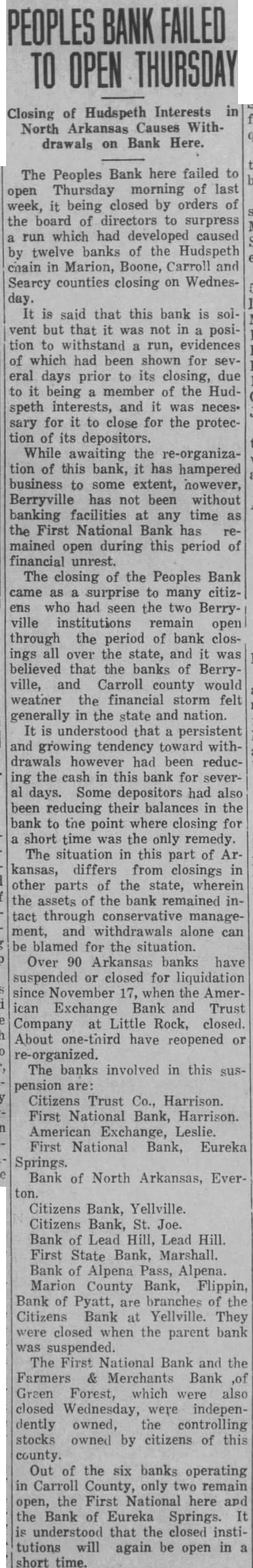

Closing of Hudspeth Interests North Arkansas Causes Withdrawals on Bank Here.

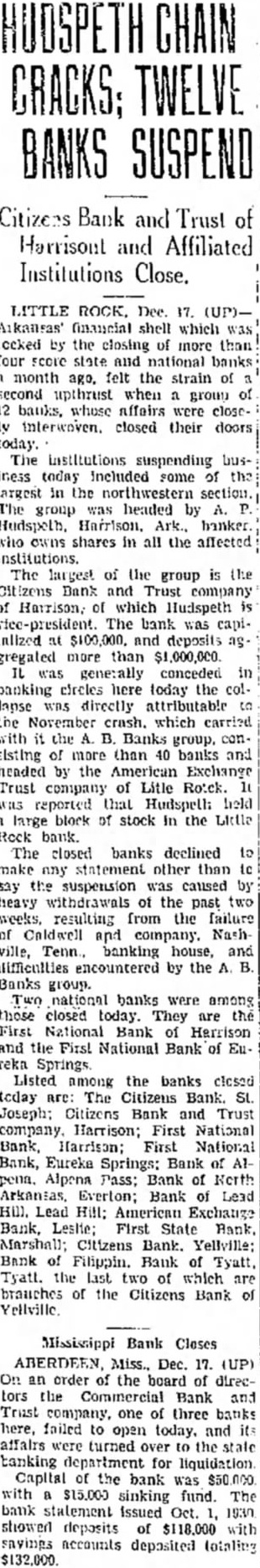

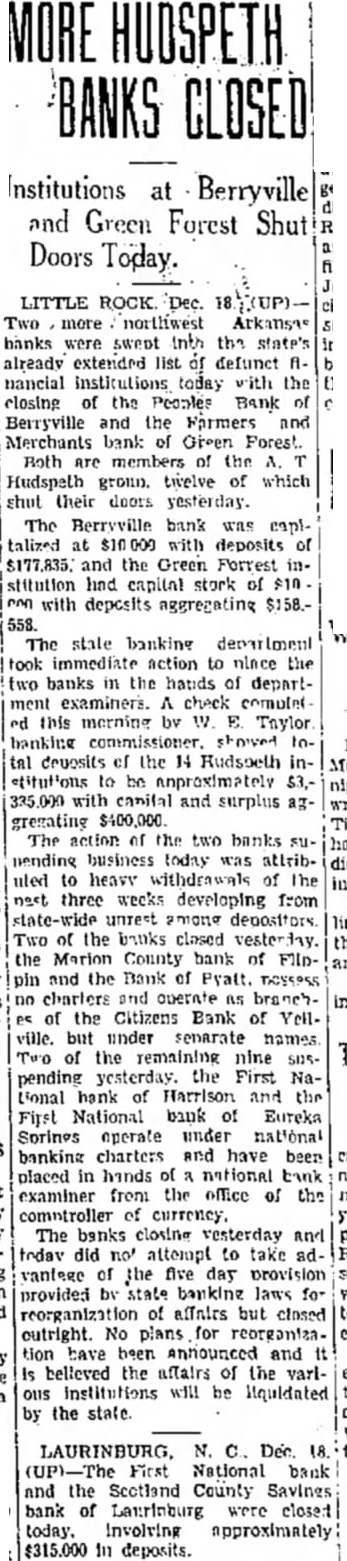

The Peoples Bank here failed to Thursday morning of last it being closed by orders of the board of directors to surpress which had developed caused twelve banks of the Hudspeth chain in Marion, Boone, Carroll and Searcy counties closing on Wednesday. It is said that this bank is vent but that was not in position to withstand run, evidences which had been shown for eral days prior to its closing, due to being member of the Hudspeth interests, and it neces. sary for it to close for the protection of its depositors. While awaiting the re-organization of this bank, has hampered business some extent, however, Berryville has not been without banking facilities at any time the First National Bank has mained open during this period of financial unrest. The closing of the Peoples Bank came as surprise to many citizwho had seen the two Berryville institutions remain open through the period of bank closings over the state, and was believed that the banks of Berryville, and Carroll county would the financial storm felt generally in the state and nation. is understood that persistent and growing tendency toward withdrawals had been reducthe cash in this bank for days. Some depositors had also been reducing their balances in the bank to the point where closing for short time was the only remedy. The situation in this part of Arkansas, differs from closings in other parts of the state, wherein the assets of the bank remained tact through conservative management, and withdrawals alone can be blamed for the situation. Over 90 Arkansas banks have suspended or closed for liquidation since November 17, when the ican Exchange Bank and Trust Company at Little Rock, closed. About have reopened or re-organized. The banks involved in this suspension are: Citizens Trust Co., Harrison. First National Bank, Harrison. American Exchange, Leslie. First National Bank, Eureka Springs. Bank of North Arkansas, Ever-

Citizens Bank, Yellville. Citizens Bank, St. Joe. Bank of Lead Hill, Lead Hill. First State Bank, Marshall. Bank of Alpena Pass, Alpena. Marion County Bank, Flippin, Bank of Pyatt, are branches of the Citizens Bank at Yellville. closed when the parent bank suspended. The First National Bank and the Farmers Merchants Bank Green Forest, which were also closed Wednesday, were independently owned, the controlling stocks owned by citizens of this county. Out of the six banks operating Carroll County, only two remain open, the First National here and the Bank of Eureka Springs. understood that the closed institutions will again in open short time.