Click image to open full size in new tab

Article Text

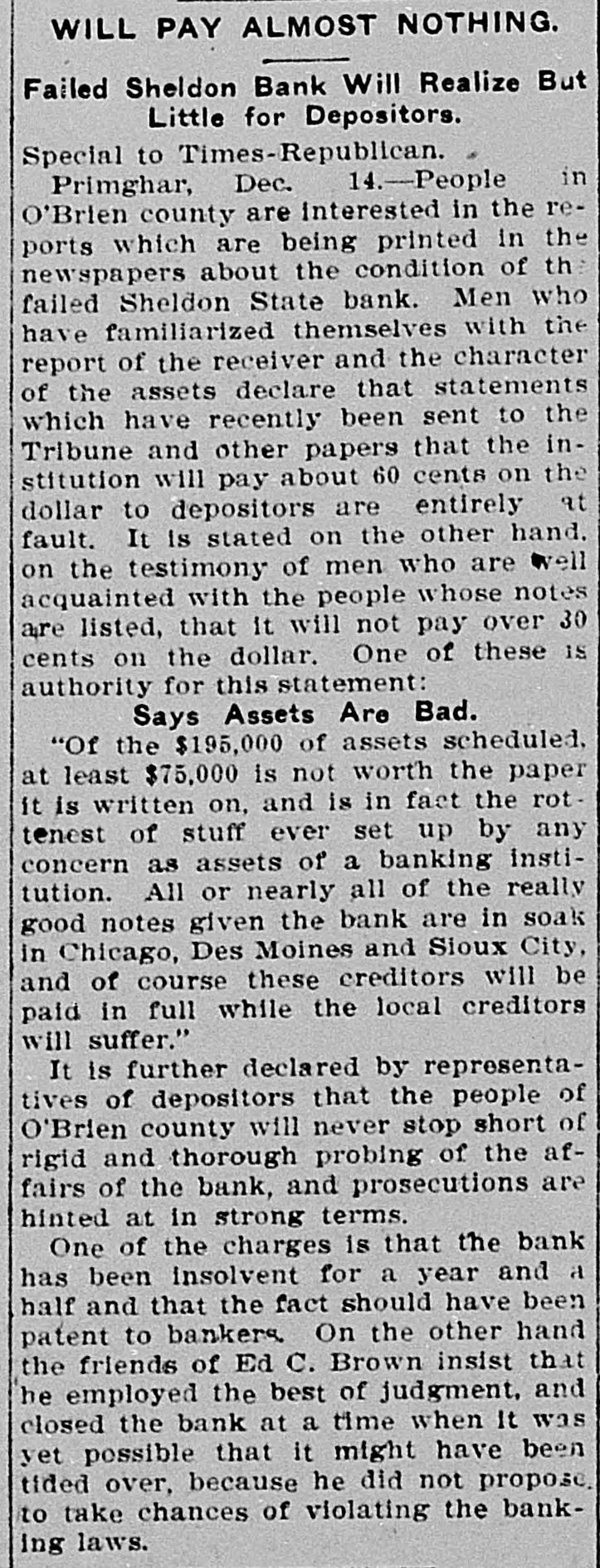

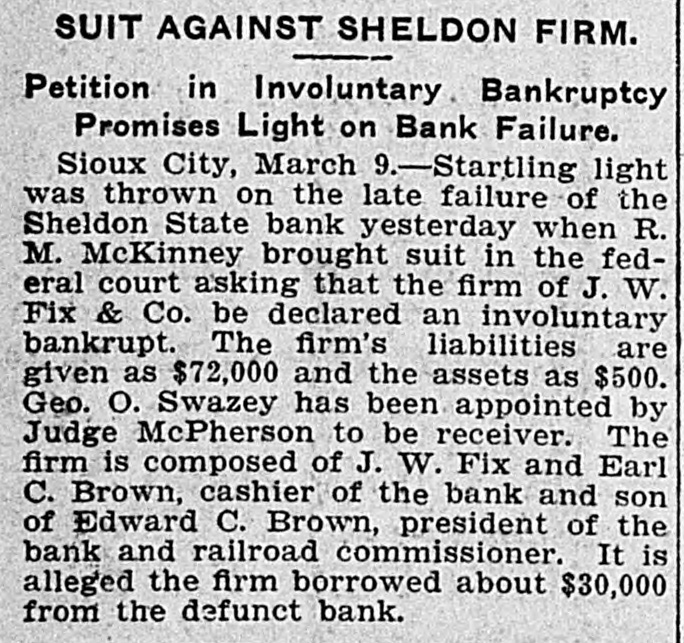

The town of Fenton has Incorporated Davenport is to have an automobile club. A new bank is to be launched at Mel bourne. Art Vinall, a Davenport bowler, rolled a perfect score, 300. The town of Thor is undergoing an epidemic of robberies. It is estimated the recent election cost Woodbury County about $3,000 a The Burlington road is building $40,000 coal chute at Hastings The Wilson House, recently destroyed by fire at Denison, will be rebuilt. The Updike elevator, recently burned at Missouri Valley, will be rebuilt. P. C. Rich of Lora was robbed of $5, 200 by two footpads in Kansas City The burned district of Albia will be rebuilt in a more substantial manner. Henry Steffen, sent to prison from Le Mars for manslaughter, is seeking a pardon. The management of the Burlington street railway have provided club rooms for their employes. F. L. Bennett is under arrest at Des Moines charged with stealing a horse and buggy at St. Paul. Capt. and Mrs. J.T. Parker of Sigour ney have just celebrated their fiftieth wedding anniversary A new national bank is being organized at Sheldon to take the place of the one recently suspended. William Nevins of Bloomington, Minn., the is under arrest at Loveland on charge of passing forged checks. A movement is on foot, fathered by the State anti-saloon league, to raise the mulet tax assessed against saloons. The Postmaster General has allowed the postmaster at Des Moines three additional letter carriers on Dec 1. The Waterloo health department is getting after the doctors who disregard the law regarding contagious diseases. Conductor R. S. Hibbard, one of the ploneer employes of the Dubuque division of the Milwaukee, is dead at Savanna, III. The average attendance in the Iowa City schools the past year was 1,350, and the average cost per pupil per month $17.00. A large portion of the C., B. & Q doubie ack between Creston and Council Bluns is now ready for regular train service. The Council Bluffs library trustees are planning trips to a number of cities to secure ideas before beginning their new building. The postmaster at Fort Dodge has made application for the appointment of a mounted mail carrier for the suburbs of that city. While P. W. Hutchinson was-cutting wood near Muscatine the ax glanced from a log and struck his foot, cutting off two toes. Great numbers of carp are being taken from the 'Coon river at Auburn, and many of them weigh from ten to twelve pounds apiece. Henry Ohsann of Lyons fell from a roof and is suffering a number of fractured bones and severe bruises as a result of the fall. There are a number of cases of diphtheria in Muscatine, and a strict quarantine is being enforced to prevent the disease spreading. The supervisors of Woodbury County have voted to issue 5 per cent bonds to the amount of $37,000 to take up outstanding 6 per cent bonds. A Le Mars woman, Jennie Schaarts, has broken the matrimonial record. Her husband was killed last month, and she has just married a feeble minded man. Rev. Howard Cramblet, who has been pastor or the Christian Church at Hampton for the past two years, has tendered his resignation in order to accept a larger pastorate at Mansfield, Ohio. The gasoline launch, Helen Louise, belonging to J. B. Morrison, burned to the water's edge at Fort Madison. Three employes, Clyde Mills, William Schulte and George Whittington, were badly burned, narrowly escaping with their lives. The Bank of Ireton, a private institution, with H. F. McKeever as cashier, has closed Its doors. A notice reading, "Closed for Liquidation" was posted on the doors and no further statement was given out. The failure of the Sheldon State Bank is said to have been respon sible for the closing. T. A. Redden, a retired Clinton farm er, was swindled out of $3,000 by a man giving his name as William Lunger. Lunger borrowed the money from Redden, and gave as security a forged deed for another man's farm, near Maquoketa which he declared he had bought. Lunger's present whereabouts are unknown. The body of a woman found in the woods near Belle Plaine has been identi fied as that of Mrs. William Myers of Keister, Minn. William Myers identified the body as that of his wife, who disappeared from her home several weeks ago. Myers is a wealthy German farmer. A woman answering his wife's de scription passed through Belle Plaine in a light covered wagon, accompanied by an unknown man. The coroner's jury returned a verdict of murder. Officers are endeavoring to find the woman's companion. John Booth of Colorado, now attending Drake University in Des Moines, who won the State college oratorical contest. has been charged with plagiarism and has admitted the charge. Booth advances the novel defense that thought is a common product and he therefore had the right to it. Booth's oration was entitled "The Sublimity of Great Convictions," and was largely a reproduction from a chapter in "Patriots and Principles,' called "The Value of Decision.' The plagiarism was discovered by a girl in the sophomore class. Leonard W. Haley, editor of the Ana mosa Prison Press, now serving a life sentence for the murder of Officers Talcott and Frith of Dubuque in 1893, will be among those who will petition the Legislature for a pardon at the approaching session. Fire broke out in the business section of Pocahontas and the buildings occu pied by the Mutual Telephone Exchange, the the Quinn Hardware Company Morse Clothing Company and the Whitney pool room and bowling alley were consumed. The loss is estimated at $50, 000. James Casey set a new example in Fort Dodge the other day, by walking into court to make personal application to be sent to the dipsomaniac ward of the Cherokee hospital for the insane. Mrs. Mary Boyer of Oskaloosa, aged 82 years, is suffering from a bad fracture of the left femur near the hip joint. A heavy door was blown against her, throwing her to the ground and inflicting the injury.