Click image to open full size in new tab

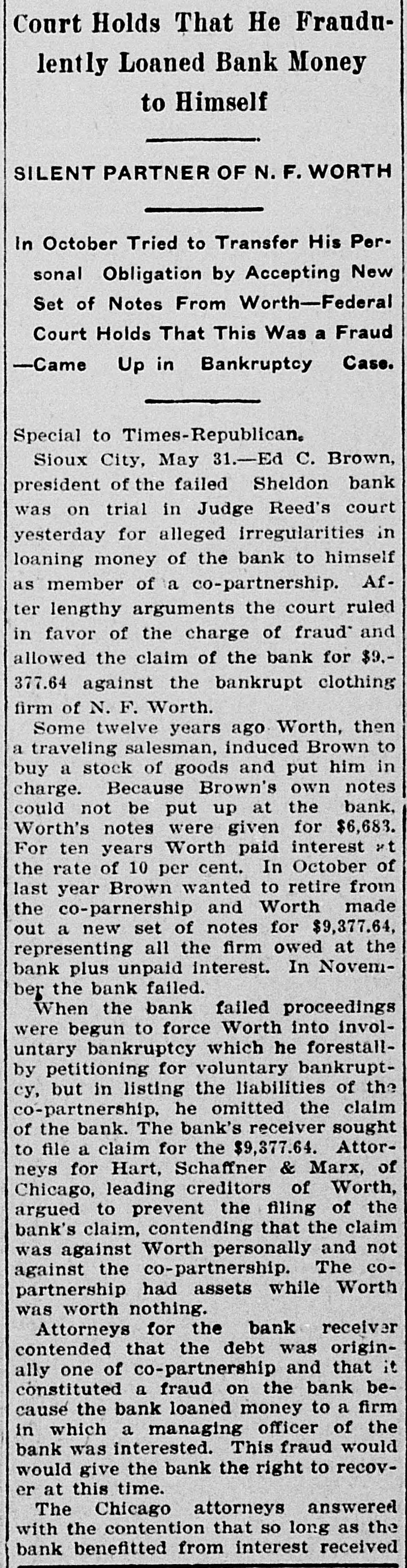

Article Text

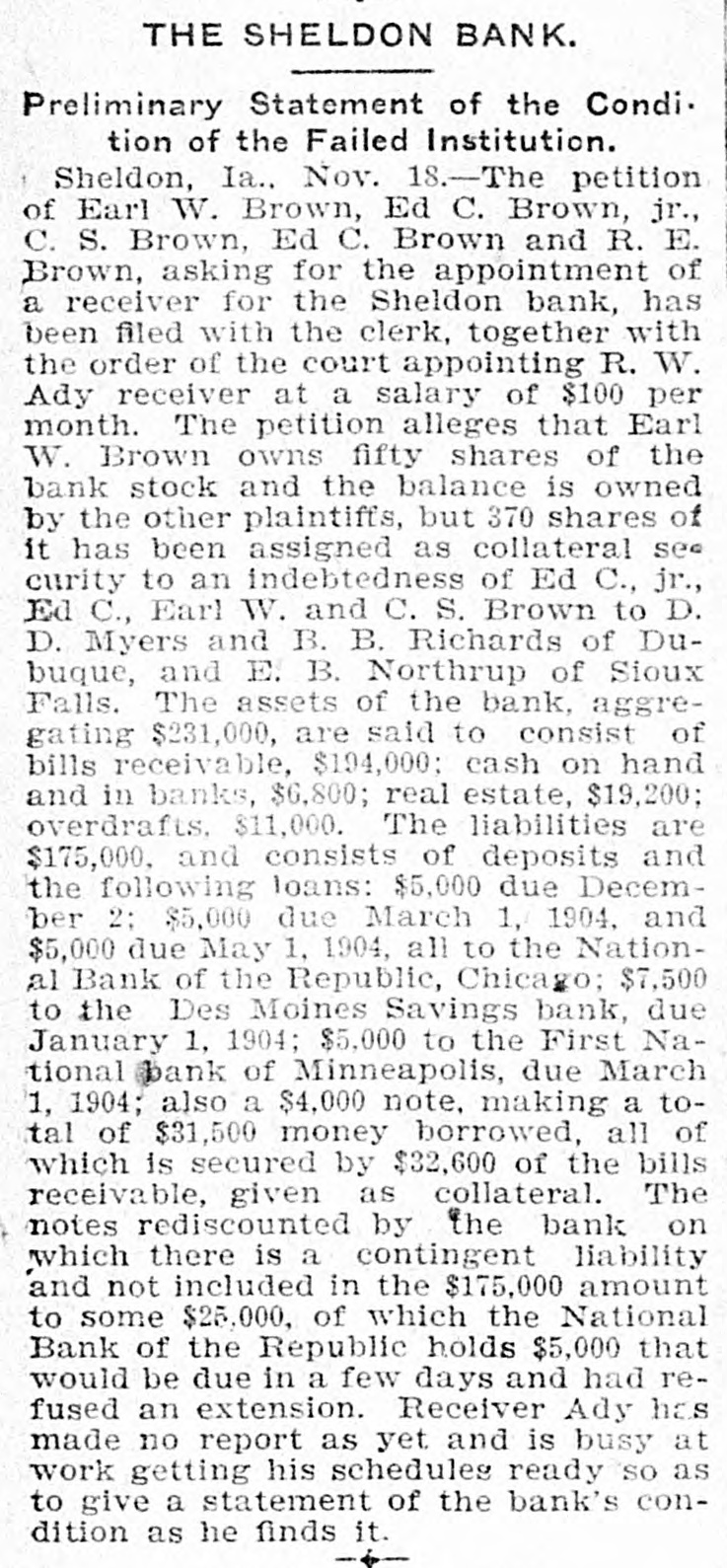

THE SHELDON BANK. Preliminary Statement of the Condition of the Failed Institution. Sheldon, Ia., Nov. 18.-The petition of Earl W. Brown, Ed C. Brown, jr., C. S. Brown, Ed C. Brown and R. E. Brown, asking for the appointment of a receiver for the Sheldon bank, has been filed with the clerk, together with the order of the court appointing R. W. Ady receiver at a salary of $100 per month. The petition alleges that Earl W. Brown owns fifty shares of the bank stock and the balance is owned by the other plaintiffs, but 370 shares of it has been assigned as collateral see curity to an indebtedness of Ed C., jr., Ed C., Earl W. and C. S. Brown to D. D. Myers and B. B. Richards of Dubuque, and E. B. Northrup of Sioux Falls. The assets of the bank, aggregating $231,000, are said to consist of bills receivable, $194,000; cash on hand and in banks, $6,800; real estate, $19,200; overdrafts. $11,000. The liabilities are $175,000, and consists of deposits and the following loans: $5,000 due December 2; $5,000 due March 1, 1904, and $5,000 due May 1, 1904, all to the National Bank of the Republic, Chicago; $7,500 to the Des Moines Savings bank, due January 1, 1904; $5,000 to the First National bank of Minneapolis, due March 1, 1904; also a $4,000 note, making a total of $31,500 money borrowed, all of which is secured by $32,600 of the bills receivable, given as collateral. The notes rediscounted by the bank on which there is a contingent liability and not included in the $175,000 amount to some $25,000, of which the National Bank of the Republic holds $5,000 that would be due in a few days and had refused an extension. Receiver Ady has made no report as yet and is busy at work getting his schedules ready so as to give a statement of the bank's condition as he finds it.