Article Text

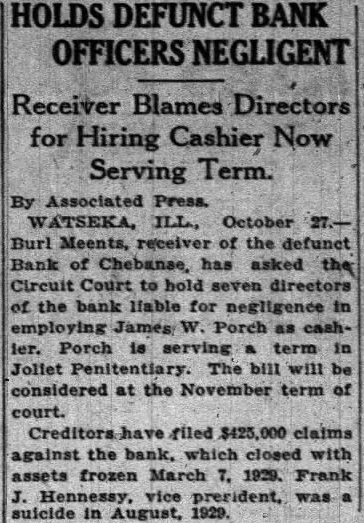

HOLDS DEFUNCT BANK OFFICERS NEGLIGENT Receiver Blames Directors for Hiring Cashier Now Serving Term. By Associated Press. WATSEKA, ILL, October Burl Meents, receiver of the defunct Bank of Chebanse, has asked Circuit Court hold of the bank liable for negligence in employing James as cashPorch is serving term Joliet The bill will considered at the term of court. Creditors filed claims against the closed with assets frozen March 1929. Frank vice suicide in August,