Article Text

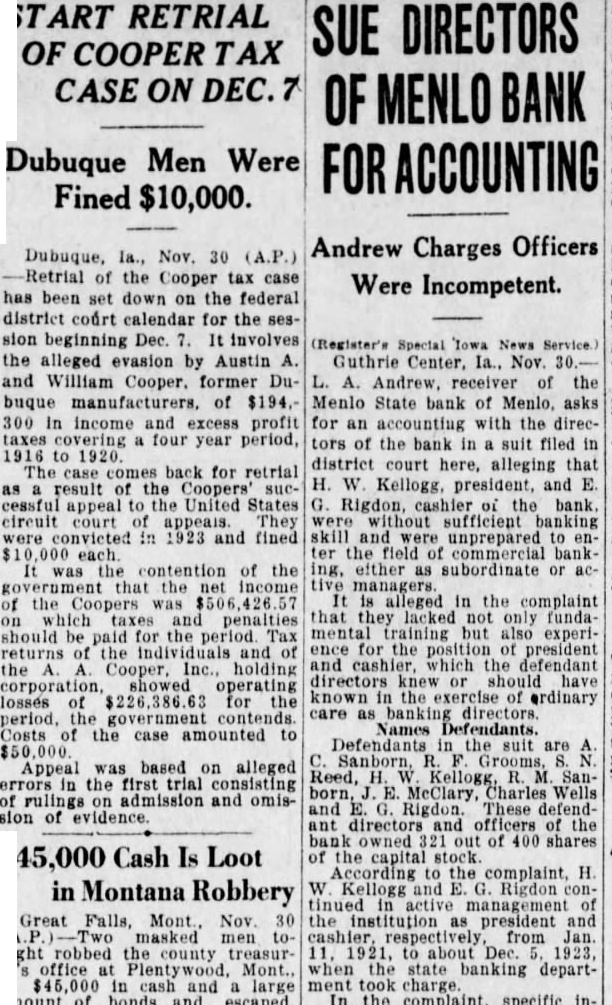

START RETRIAL SUE DIRECTORS OF COOPER TAX CASE ON DEC. OF MENLO BANK Dubuque Men Were FOR ACCOUNTING Fined $10,000. Dubuque, la., Nov. 30 (A.P.) Retrial of the Cooper tax case has been set down on the federal district court calendar for the ses sion beginning Dec. 7. It involves the alleged evasion by Austin A. and William Cooper. former Dubuque manufacturers, of $194.300 In income and excess profit covering four year period, 1916 to 1920. The case comes back for retrial as result of the Coopers' cessful appeal to the United States circuit court of They were convicted in 1923 and fined It was the contention of the government that the net income of the Coopers was $506. and penalties should be paid for the Tax returns of the individuals and the Cooper, Inc., holding corporation, showed operating losses of for the period, the government Costs of the case amounted to Appeal based on alleged errors the first consisting of rulings on admission and omission of evidence. Andrew Charges Officers Were Incompetent. (Register's Special Towa News Service Guthrie Center, Ia., Nov. L. A. Andrew receiver of the Menlo State bank of Menlo. asks for an accounting with the directors of the bank in suit filed in district court alleging that H. W. Kellogg, president, and E. G. Rigdon, cashier the bank sufficient banking skill and were unprepared to enthe field of commercial bank ing. either as subordinate or ac tive managers. It is alleged in the complaint that they lacked not funda mental training but also experience for the position of president and cashier, which the defendant directors knew should known in exercise of erdinary care as directors Names Defendants. Defendants in the suit are Sanborn, Grooms, Reed, Kellogg, born, McClary Charles Wells and Rigdon. These defendant directors and officers of the bank owned 321 out of 400 shares of the capital stock According the complaint, H W Kellogg and Rigdon management the institution as president and from Jan about Dec. when the state banking department took In the complaint. specific in-