Article Text

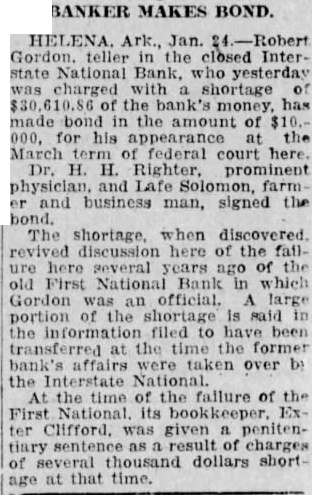

BANKER MAKES BOND. HELENA. Ark., Jan. teller the closed Interstate National Bank. who yesterday charged shortage money, has made 000, his appearance March term federal court H. H. prominent physician, and Lafe Solomon, farm. business man, signed the The shortage. when discovered. here the fallhere several years ago of the First National Bank in which Gordon was official. large portion of the shortage is said the to been at the former the National the time of the failure of the ter Clifford. was given penitenthousand dollars shortage at that time.