Article Text

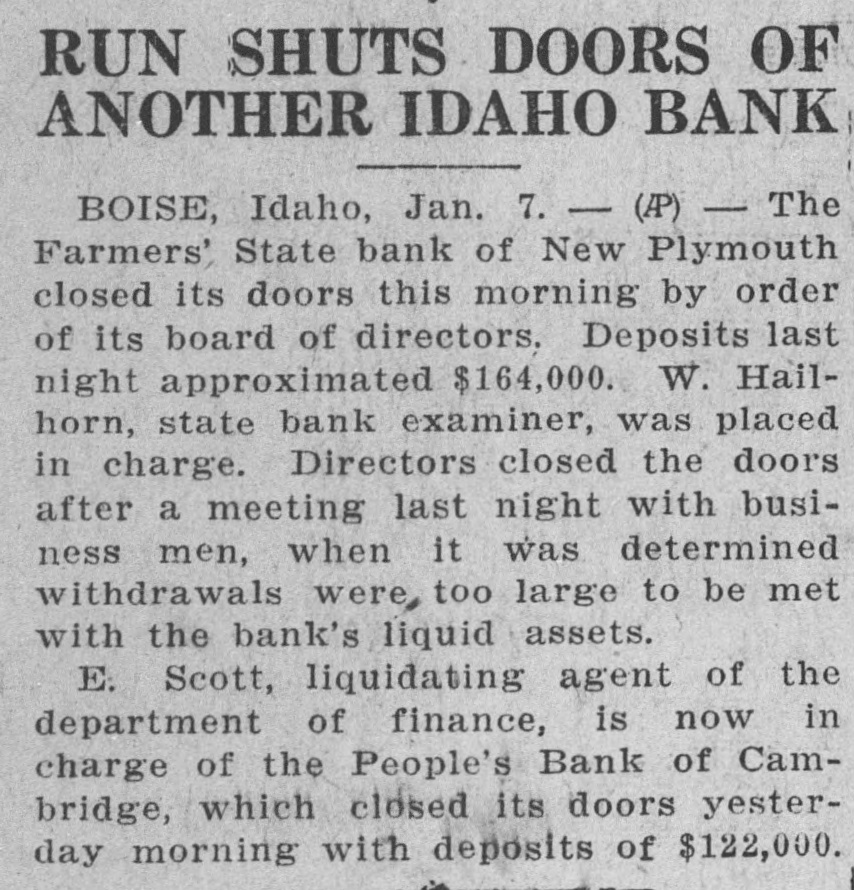

RUN SHUTS DOORS OF ANOTHER IDAHO BANK BOISE, Idaho, Jan. 7. - (AP) / The Farmers' State bank of New Plymouth closed its doors this morning by order of its board of directors. Deposits last night approximated $164,000. W. Hailhorn, state bank examiner, was placed in charge. Directors closed the doors after a meeting last night with business men, when it was determined withdrawals were, too large to be met with the bank's liquid assets. E. Scott, liquidating agent of the department of finance, is now in charge of the People's Bank of Cambridge, which closed its doors yesterday morning with deposits of $122,000.