Article Text

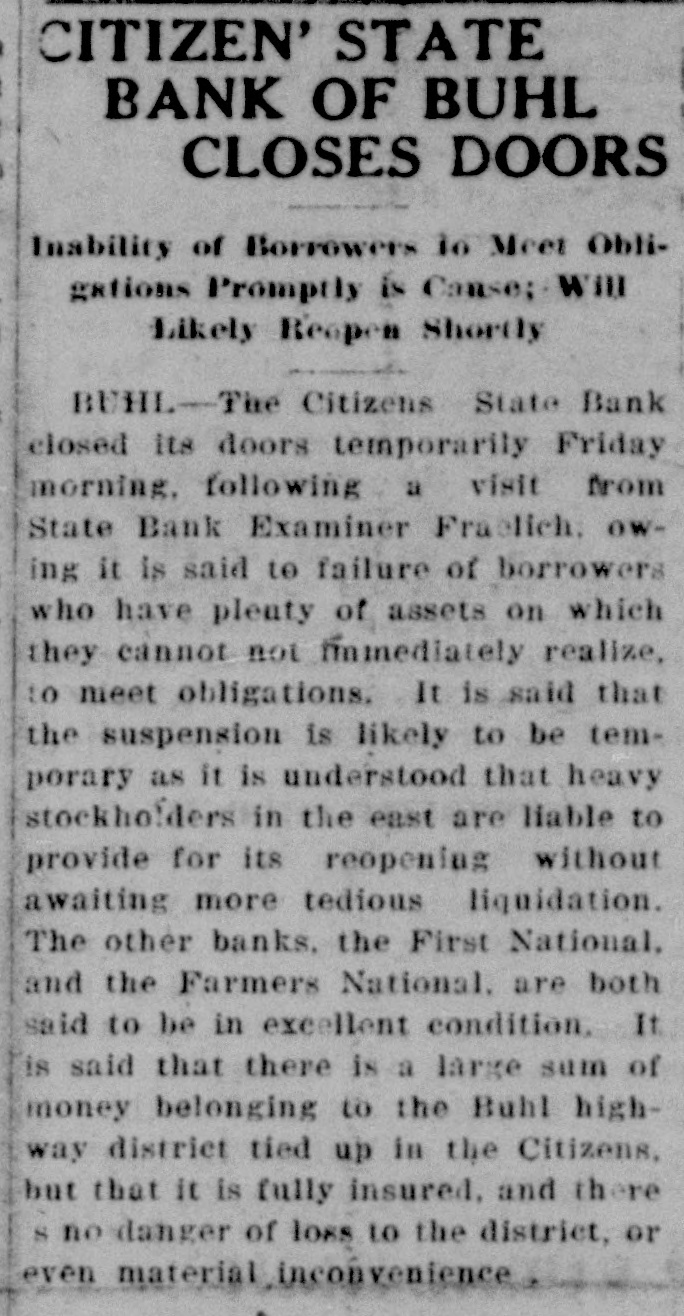

CITIZEN' STATE BANK OF BUHL CLOSES DOORS Inability of Borrowers to Meet Obligations Promptly is Cause: will Likely Reepen Shortly BUHL-The Citizens State Bank closed its doors temporarily Friday morning, following a visit from State Bank Examiner Fraelich. owing it is said to failure of borrowers who have plenty of assets on which they cannot not immediately realize, to meet obligations. It is said that the suspension is likely to be temporary as it is understood that heavy stockholders in the least are liable to provide for its reopening without awaiting more tedious liquidation. The other banks, the First National, and the Farmers National. are both said to be in excellent condition. It is said that there is a large sum of money belonging to the Buhl highway district tied up in the Citizens, but that it is fully insured. and there S no danger of loss to the district, or even material inconvenience