Article Text

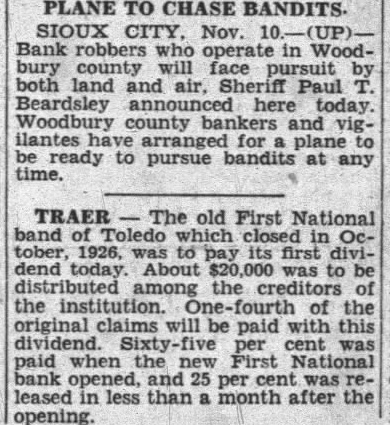

PLANE TO CHASE BANDITS. SIOUX CITY, Nov. 10. (UP) Bank robbers who operate in Woodbury county will face pursuit by both land and air, Paul T. Beardsley announced here today. Woodbury county bankers and vigilantes have arranged for plane to be ready to pursue bandits at any time. TRAER The old First National band Toledo which closed in October, 1926, to pay its first dividend today. About $20,000 was to be distributed among the creditors of the institution. One-fourth of the original claims will be paid with this dividend. Sixty-five per cent was paid when the First National bank opened, and 25 per cent was released in less than month after the opening.