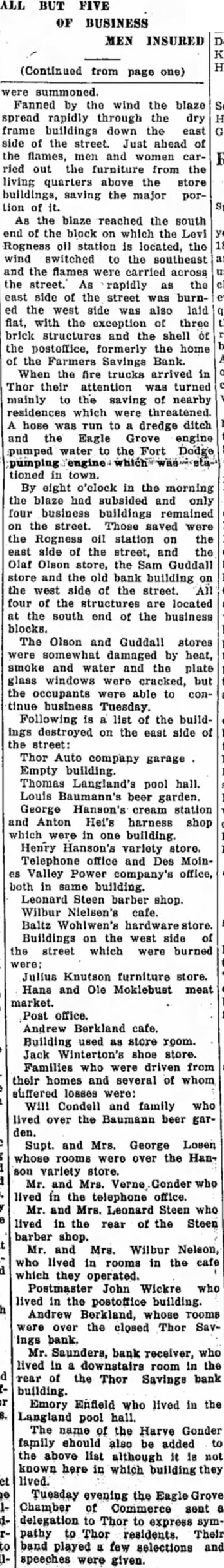

Article Text

ALL BUT FIVE OF BUSINESS MEN INSURED (Continued from one) page summoned. Fanned by the wind the blaze spread rapidly through the dry frame buildings down the east side the street. Just abead the flames, men and women carried the furniture from the living quarters above the store buildings, saving the major porLion of As the blaze reached the south the block which the Levi Rogness oil station located, the wind switched the southeast and the flames were carried across the street. As rapidly the east side of the street was burnthe west side was also laid flat, with the exception of three brick structures and the shell the postoffice, formerly the home the Farmers Savings Bank When the fire trucks arrived Thor their attention was turned mainly the saving of nearby residences which were threatened hose was run to dredge ditch and Eagle Grove engine pumped water the Fort Dodge tioned town. By eight o'clock in the morning the blaze had subsided and only four business buildings remained the street. Those saved Rogness oil station the east side the street, and the Olaf Olson store, the Sam Guddall store and the old bank building the west side of the street. All four of the structures are located the south end the business blocks. The Olson and Guddall stores damaged by heat, smoke and water and the plate glass windows were cracked, but the occupants were able to tinue business Tuesday. Following of the buildings destroyed on the east side street: Thor Auto company garage Empty building. Thomas Langland's pool hall. Louis beer garden. George Hanson's cream station and Anton Hei's harness shop which were in one building. Henry Hanson's variety store. Telephone office and Des Valley Power company's office, both in same building. Leonard Steen barber shop. Wilbur Nielsen's cafe. Baltz Wohlwen's Buildings on the west side the street which were burned Julius Knutson furniture store. Hans and Ole Moklebust meat market. Post office. Andrew Berkland cafe. Building used store room. Jack Winterton's shoe store. Families who were driven from their homes and several of whom suffered losses were: Condeil and family who lived over the Baumann beer gar- Supt. and Mrs. George Losen whose rooms were over the Hanvariety store. Mr. and Mrs. Gonder the telephone office. and Mrs. Leonard Steen who lived in the rear the Steen barber shop. Mr. and Mrs. Wilbur Nelson, who lived rooms the they operated. Postmaster John Wickre who lived in the postoffice building. Andrew Berkland, whose rooms the closed Thor ings bank. Saunders, bank receiver, who lived downstairs room the rear of the Thor Savings bank building. Emory Enfield who lived in the Langland pool hall. The name of the Harve Gonder family should also be added to the above list although not known here in which building lived. Tuesday evening the Chamber of Commerce sent delegation Thor to express pathy Thor residents. Their band played few selections and speeches were given.