Article Text

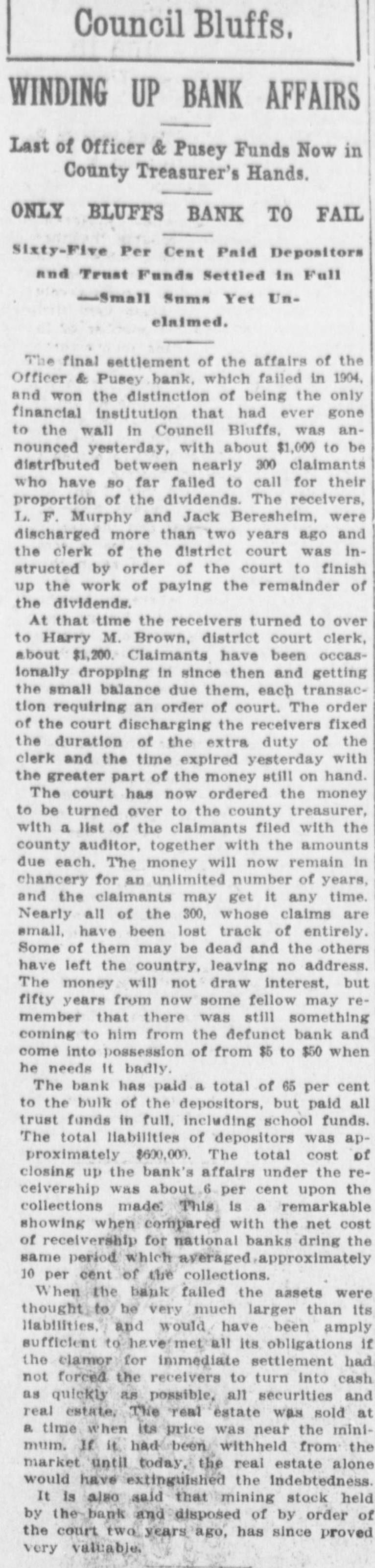

Council Bluffs. WINDING UP BANK AFFAIRS Last of Officer & Pusey Funds Now in County Treasurer's Hands. ONLY BLUFFS BANK TO FAIL Sixty-Five Per Cent Paid Depositors and Trust Funds Settled in Full -Small Sums Yet Unclaimed. The final settlement of the affairs of the Officer & Pusey bank, which failed in 1904, and won the distinction of being the only financial institution that had ever gone to the wall in Council Bluffs, was announced yesterday, with about $1,000 to be distributed between nearly 300 claimants who have so far failed to call for their proportion of the dividends. The receivers, L. F. Murphy and Jack Beresheim, were discharged more than two years ago and the clerk of the district court was instructed by order of the court to finish up the work of paying the remainder of the dividends. At that time the receivers turned to over to Harry M. Brown, district court clerk, about $1,200. Claimants have been occasIonally dropping in since then and getting the small balance due them, each transaction requiring an order of court. The order of the court discharging the receivers fixed the duration of the extra duty of the clerk and the time expired yesterday with the greater part of the money still on hand. The court has now ordered the money to be turned over to the county treasurer, with a list of the claimants filed with the county auditor, together with the amounts due each. The money will now remain in chancery for an unlimited number of years, and the claimants may get it any time. Nearly all of the 300, whose claims are small, have been lost track of entirely. Some of them may be dead and the others have left the country, leaving no address. The money will not draw interest, but fifty years from now some fellow may remember that there was still something coming to him from the defunct bank and come into possession of from $5 to $50 when he needs It badly. The bank has paid a total of 65 per cent to the bulk of the depositors, but paid all trust funds in full. including school funds. The total liabilities of depositors was approximately $600,000. The total cost of closing up the bank's affairs under the receivership was about 6 per cent upon the collections made: This is a remarkable showing when compared with the net cost of receivership for national banks dring the same period which averaged approximately 10 per cent of the collections. When the bank failed the assets were thought to be very much larger than its liabilities, and would have been amply sufficient to have met all its obligations if the clamor for immediate settlement had not forced the receivers to turn into cash as quickly as possible, all securities and real estate, The real estate was sold at a. time when its price was near the minimum. If it, had been withheld from the market until today the real estate alone would have extinguished the indebtedness It is also said that mining stock held by the bank and disposed of by order of the court two years ago, has since proved very valuable.