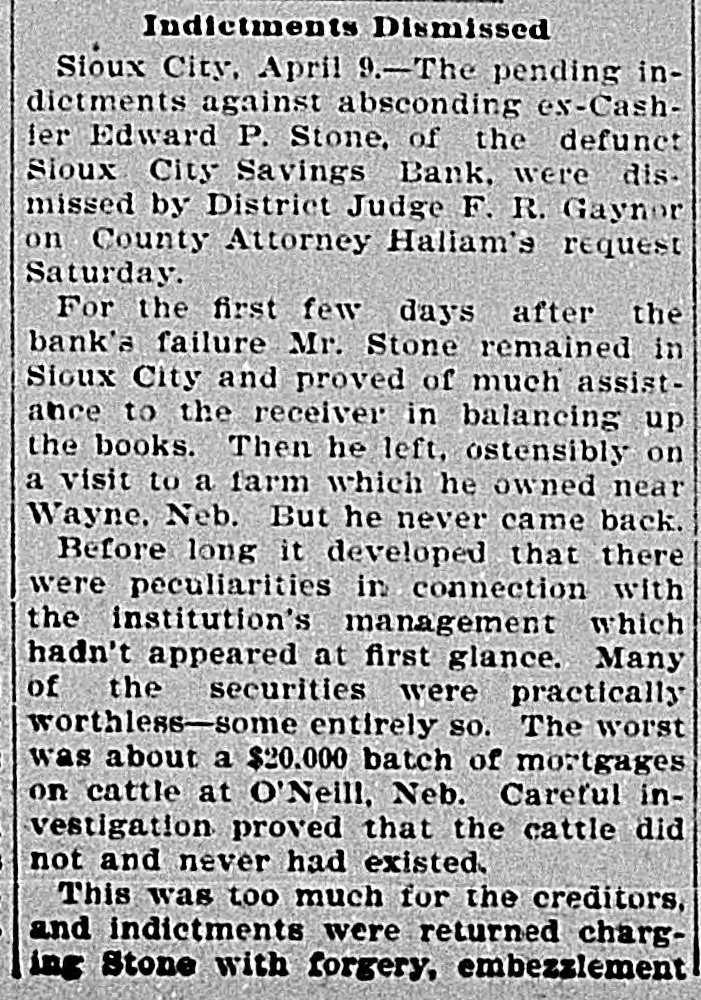

Article Text

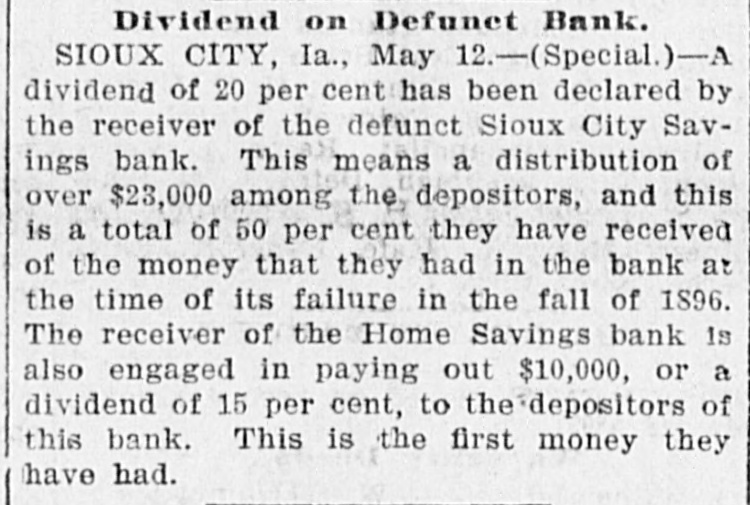

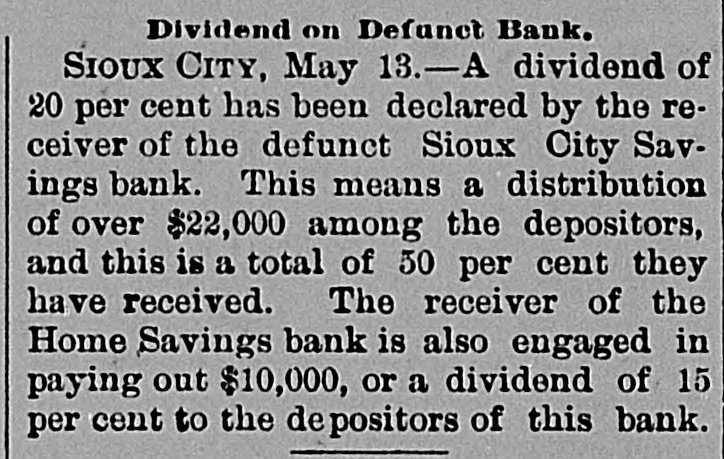

Dividend on Defunct Bank. SIOUX CITY, Ia., May 12.-(Special.)-A dividend of 20 per cent has been declared by the receiver of the defunct Sioux City Savings bank. This means a distribution of over $23,000 among the depositors, and this is a total of 50 per cent they have received of the money that they had in the bank at the time of its failure in the fall of 1896. The receiver of the Home Savings bank is also engaged in paying out $10,000, or a dividend of 15 per cent, to the depositors of this bank. This is the first money they have had.