Click image to open full size in new tab

Article Text

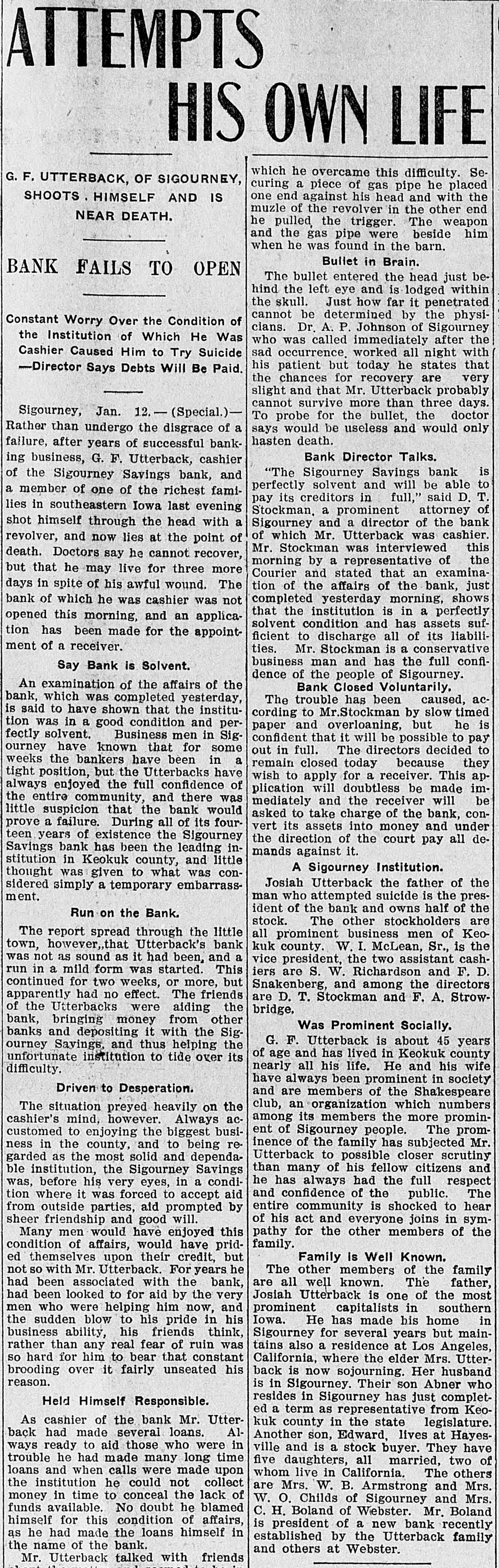

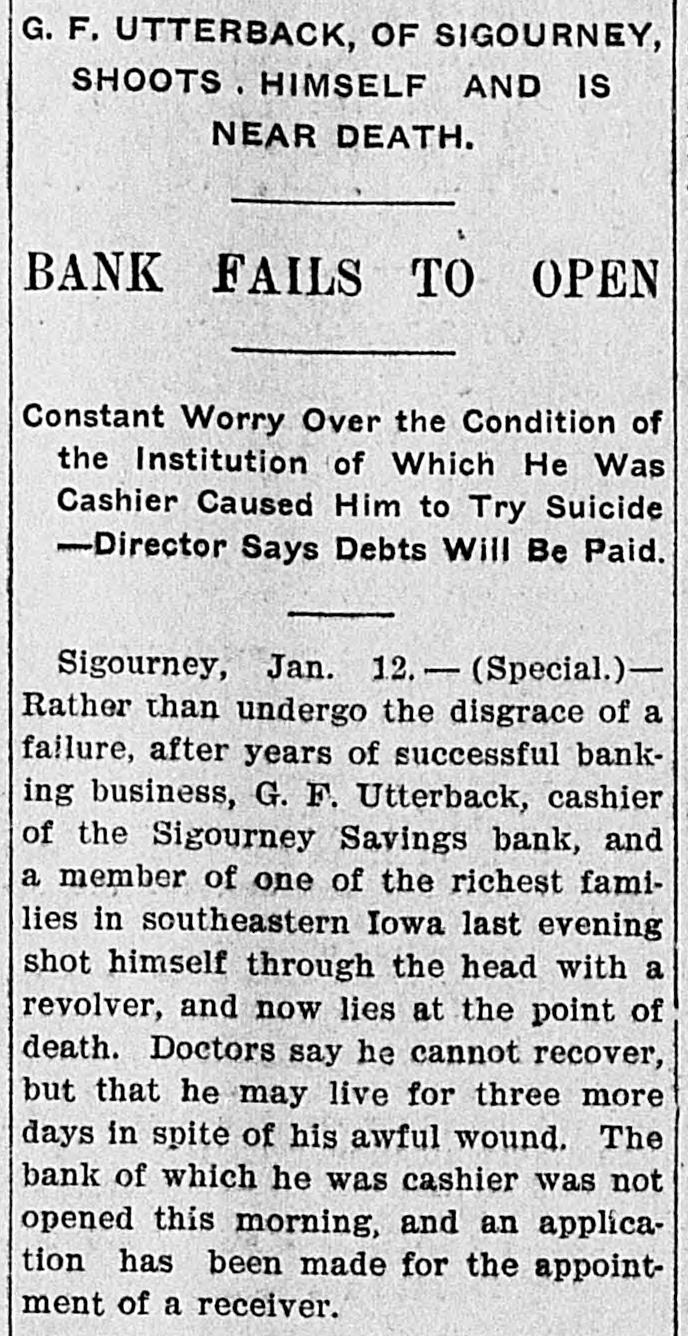

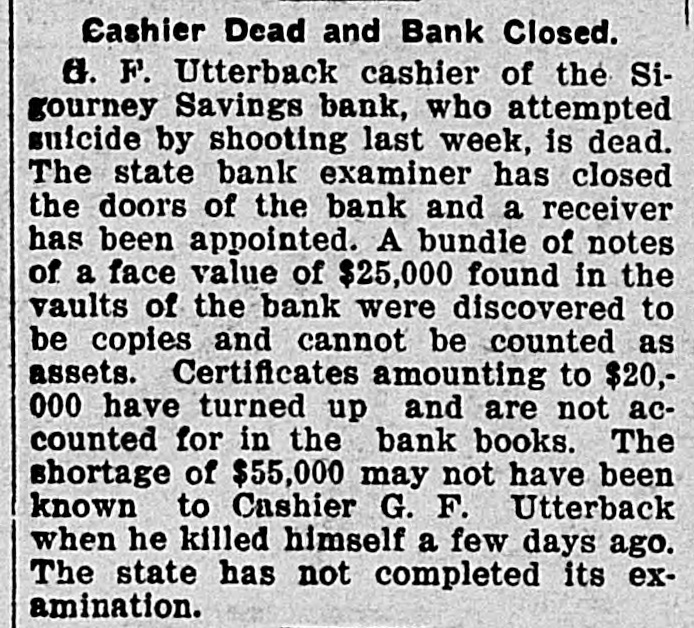

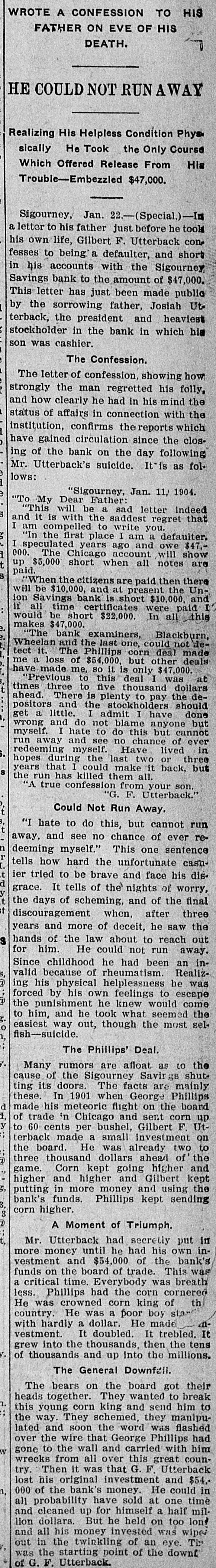

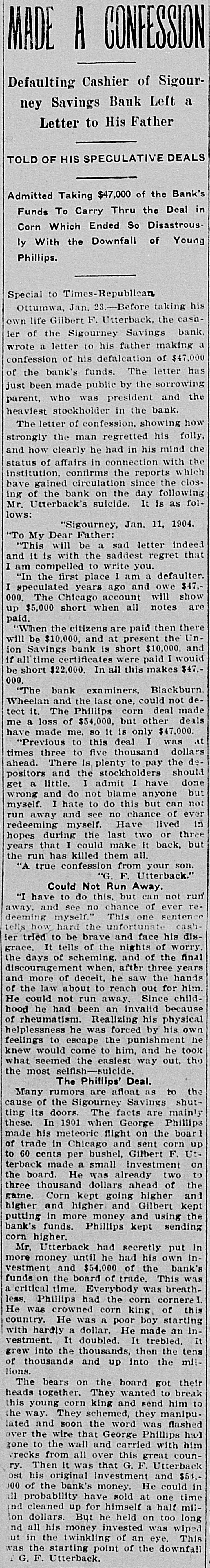

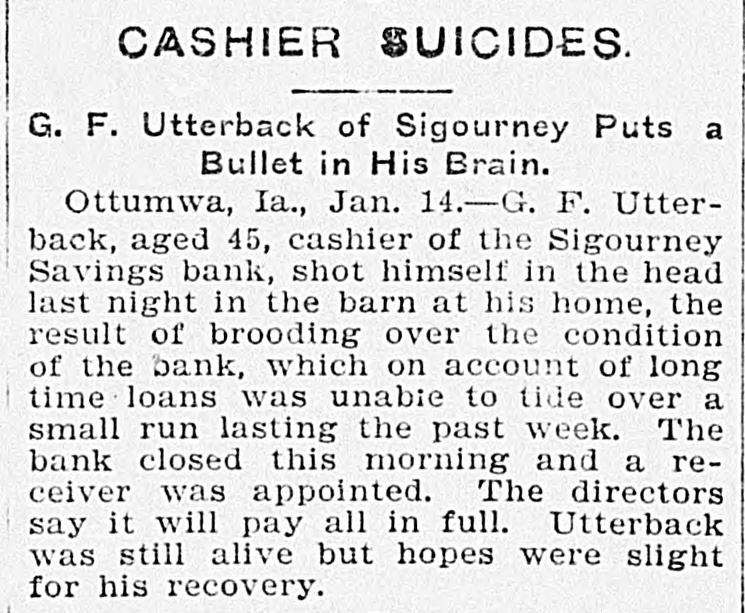

TEN BANKERS IN IOWA SELF-SLAIN Record Year of Disaster in That State. CATTLE BROUGHT DOWNFALL Faced by Ruin, Half a Score of Hawkeye Officials Committed Suicide. DES MOINES, Dec. 28.-An unprecedented record of disaster among Iowa banks will be disclosed by a report now being prepared at the State auditor's office for 1904. Culminating last week with the closing of the savings bank at Dedham, this is the year's startling record: Ten bank cashiers dead by suicide. Forty banks wrecked and their surplus squandered. Twelve millions of dollars lost to depositors. In two instances bank officers have absconded with funds, thus accounting for the failure, but the remarkable number of failures due to similar circumstances has aroused the curiosity of the whole State to ascertain the cause. These are the suicides of the year due to bank failures, so far as the State officials know: H. C. Spencer and his son, cashier and assistant cashier of the Grinnell National Bank. George D. Wood, cashier of the Bank of Colfax, Colfax, Iowa. Charles Wood, cashier of the Citizens' Bank of St. Charles. F. L. La Rue, cashier of the Corning State Bank. G. D. Utterback, cashier of the Sigourney Savings Bank. H. W. Main, cashier of the Linn Grove Bank. Cashier of the Lone Tree Bank. Two other suicides early in the year, whose names are not recalled by the attaches of the State auditor's office. Tragedy Follows Tragedy. It is only within the past few days that the State has become aware of the magnitude of the disasters and the tragedies attending them, many of the failures having been kept quiet. Not until the two suicides in quick succession at Lone Tree and Linn Grove, and the failure of the Sheldon State Bank, with losses amounting to many thousands, created a State-wide sensation was general attention attracted to the serious condition of affairs. The failure of the bank at Collfax, the National Bank at Storm Lake, and the bank at Sigourney, with the suicide of the cashier, added to the sensation. The suicide of Cashier Utterback, of the Sigourney Bank, was followed by the discovery of extensive forgeries which he had perpetrated to cover up a shortage which had been running for some time. His shortage, like those of the eight other cashier suicides, was apparently due to one of two causesspeculation on the Chicago board of trade and the juggling of prices by the meat trust. Meat Trust Blamed. The meat trust is blamed by thousands throughout Iowa for the year's tragedies. In almost every bank that failed large quantities of paper, based on higher prices for five stock, were found, the makers being unable to meet their loans owing to the cut in prices of live stock. In almost every case the cashier had trusted to the prices of cattle remaining high, and this, coupled with speculative plunges on the board of trade, accomplished their ruin. Back of this recklessness. State Bank Examiner Cox declares, is the lax banking law of the State, and as a result of the year's melancholy record efforts are already making to amend this law. The epidemic of banking suicides started with that of Cashier George D. Wood, of the Bank of Colfax He was regarded as one of the shrewdest and most trustworthy bankers of the State, and his suicks caused a great sensation. Investigation developed that he personally had been a large investor in live stock and had loaned extensively for cattle purchases. The drop in eattle prices brought him face to face with ruin, if not dishonor, and he took his life. Wood had been accounted the wealthiest and most public-spirited man in his county, and imputation of dishonesty is hotly resented by every man in his home city. The cause of his downfall is illustrated by the sale, after his suicide, of paper representing a par value of $175,000 for $640. State Bank Examiner Cox declares that such worthless paper would never have been admitted to the bank if the institution had been subject to State inspection. A Six-Figure Failure. The death of E. H. McCutchon, one of the best-known politicians in the State, precipitated the wreck of the bank at Holstein. Directly after his death it was discovered that the loss at this bank would run into the six