Article Text

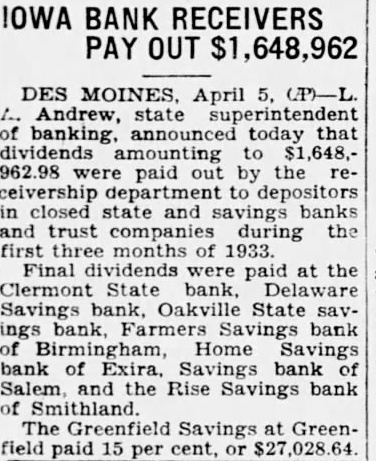

IOWA BANK RECEIVERS PAY OUT $1,648,962 L. Andrew, state superintendent of banking, announced today that dividends amounting to $1,648,962.98 were paid out by the receivership department to depositors in closed state and savings banks and trust companies during the first three months of 1933. Final dividends were paid at the Clermont State bank, Delaware Savings bank, Oakville State savings bank, Farmers Savings bank of Birmingham, Home Savings bank of Exira. Savings bank of Salem, and the Rise Savings bank of The Greenfield Savings at Greenfield paid 15 per cent, or $27,028.64