Article Text

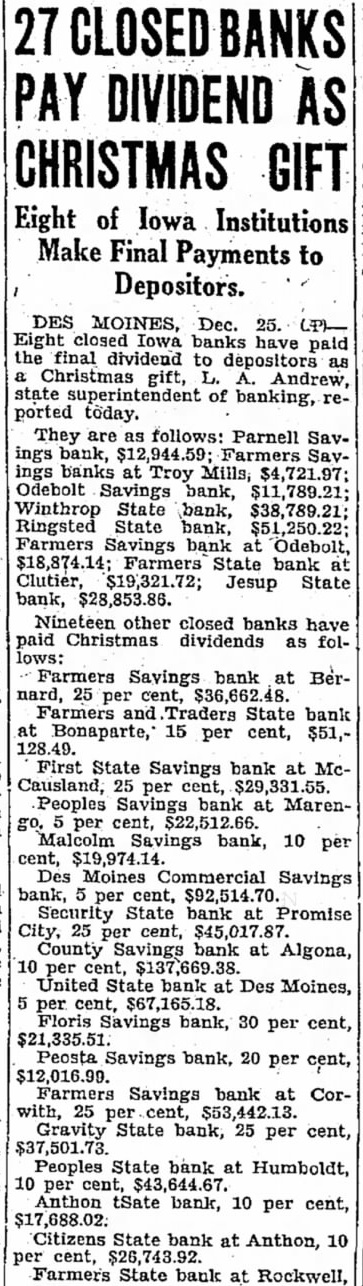

CLOSED PAY DIVIDEND AS CHRISTMAS GIFT Eight of Iowa Institutions Make Final Payments to Depositors. DES MOINES, Dec. 25. (P)Eight closed Iowa banks have paid the final dividend to depositors as a Christmas gift, L. Andrew, state superintendent of banking, reported today. They are as follows: Parnell Savings bank, $12,944.59; Farmers Savings banks at Troy Mills, $4,721.97; Odebolt Savings bank, $11,789.21; Winthrop State bank, $38,789.21; Ringsted State bank, $51,250.22; Farmers Savings bank at Odebolt, $18,874.14; Farmers State bank at Clutier, $19,321.72; Jesup State bank, $28,853.86. Nineteen other closed banks have paid Christmas dividends as follows: Farmers Savings bank at Bernard, 25 per cent, $36,662.48. Farmers and Traders State bank at Bonaparte, 15 per cent, $51,128.49. First State Savings bank at McCausland, 25 per cent, $29,331.55. Peoples Savings bank at Marengo, 5 per cent, $22,512.66. Malcolm Savings bank, 10 per cent, $19,974.14. Des Moines Commercial Savings bank, 5 per cent, $92,514.70. Security State bank at Promise City, 25 per cent, $45,017.87. County Savings bank at Algona, 10 per cent, $137,669.38. United State bank at Des Moines, 5 per cent, $67,165.18. Floris Savings bank, 30 per cent, Peosta Savings bank, 20 per cent, $12,016.99. Farmers Savings bank at Corwith, 25 per cent, $53,442.13. Gravity State bank, 25 per cent, Peoples State bank at Humboldt, 10 per cent, $43,644.67. Anthon tSate bank, 10 per cent, Citizens State bank at Anthon, 10 per cent, $26,743.92. Farmers State bank at Rockwell,