Article Text

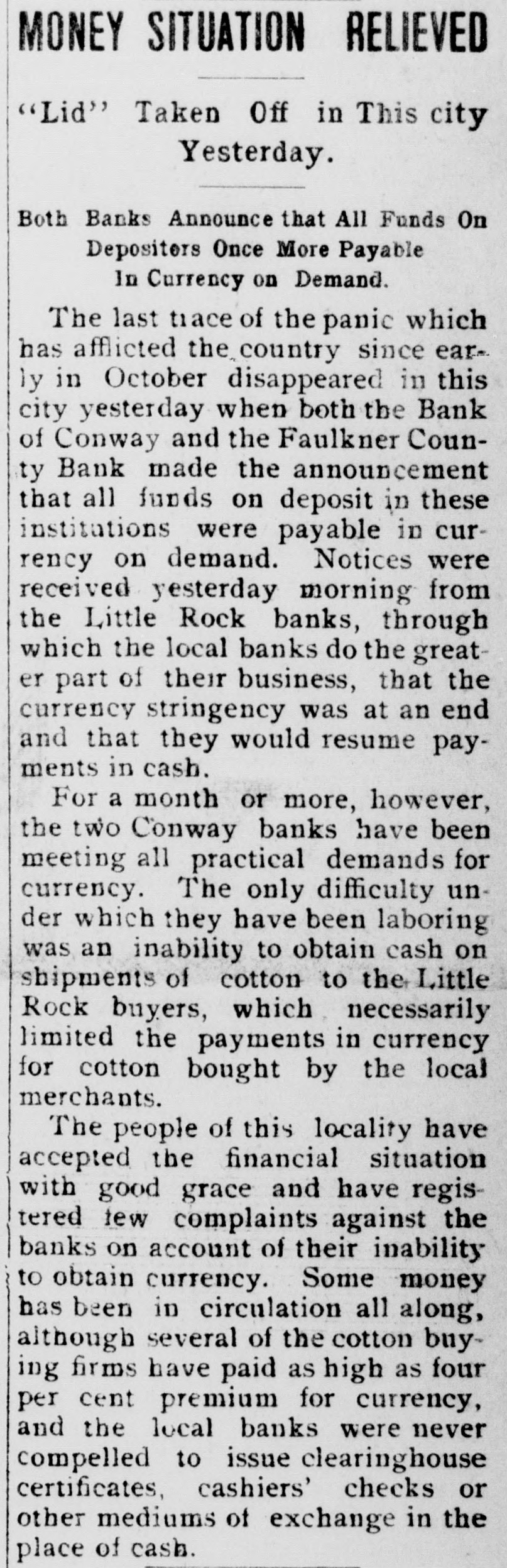

MONEY SITUATION RELIEVED "Lid" Taken Off in This city Yesterday. Both Banks Announce that All Funds On Depositors Once More Payable In Currency on Demand. The last trace of the panic which has afflicted the country since early in October disappeared in this city yesterday when both the Bank of Conway and the Faulkner County Bank made the announcement that all funds on deposit in these institutions were payable in currency on demand. Notices were received yesterday morning from the Little Rock banks, through which the local banks do the greater part of their business, that the currency stringency was at an end and that they would resume payments in cash. For a month or more, however, the two Conway banks have been meeting all practical demands for currency. The only difficulty under which they have been laboring was an inability to obtain cash on shipments of cotton to the Little Rock buyers, which necessarily limited the payments in currency for cotton bought by the local merchants. The people of this locality have accepted the financial situation with good grace and have registered few complaints against the banks on account of their inability to obtain currency. Some money has been in circulation all along, although several of the cotton buy~ ing firms have paid as high as four per cent premium for currency, and the local banks were never compelled to issue clearinghouse certificates, cashiers' checks or other mediums of exchange in the place of cash.