Article Text

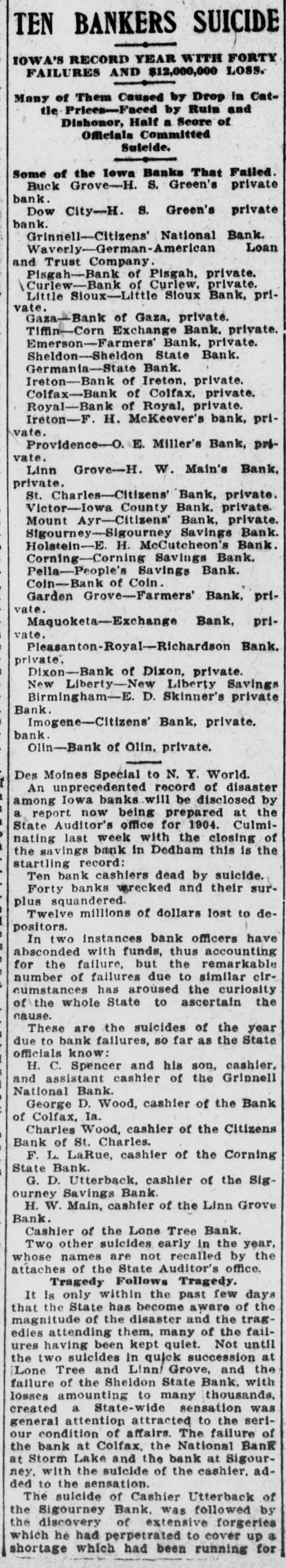

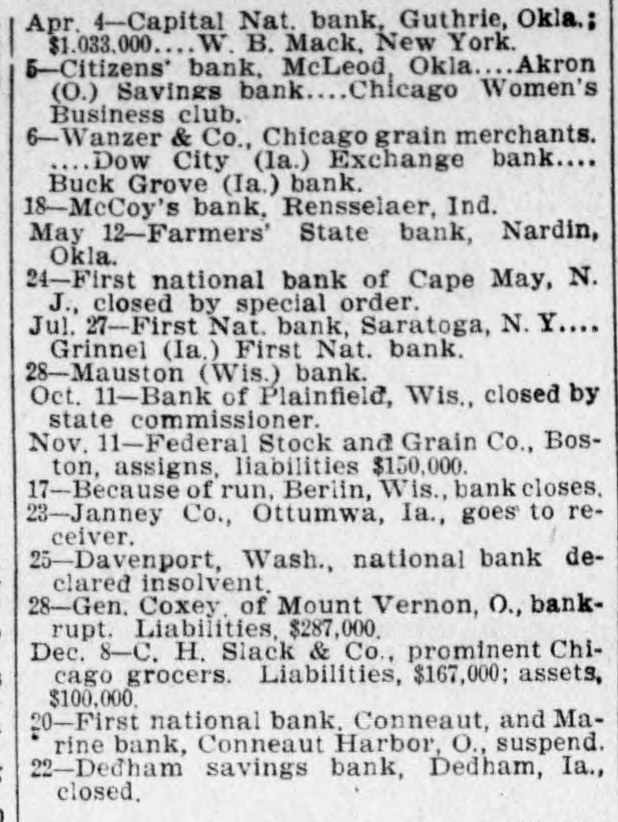

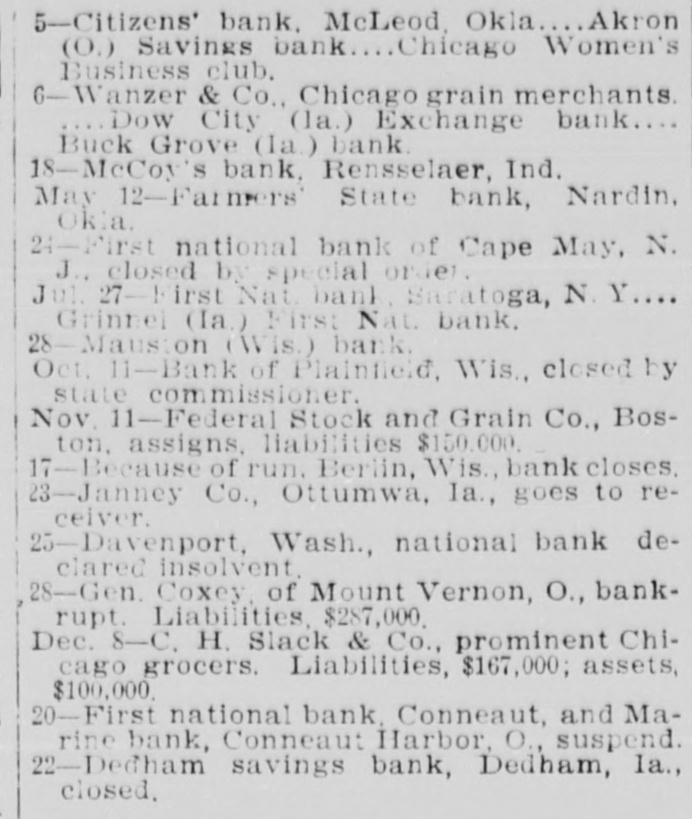

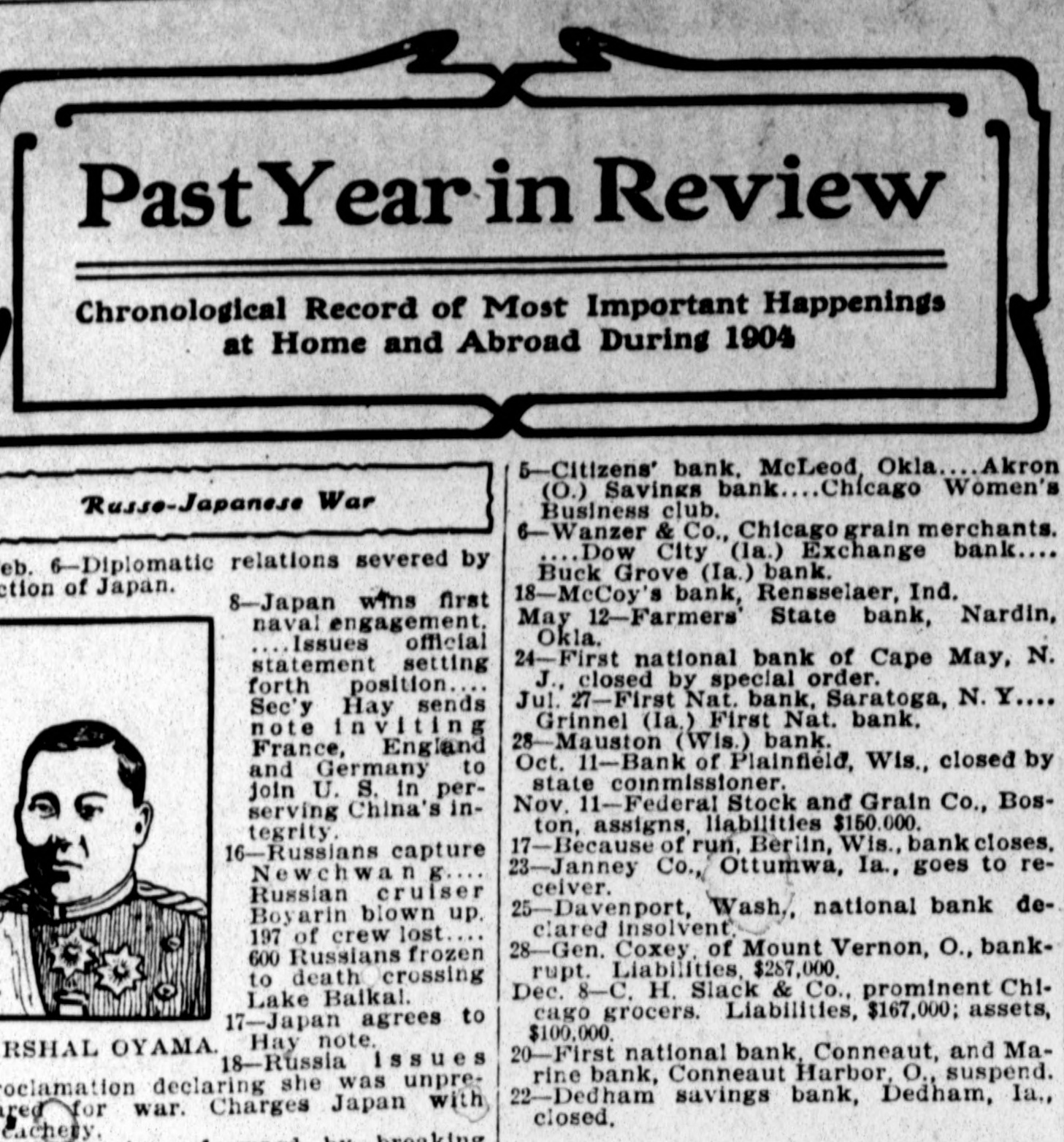

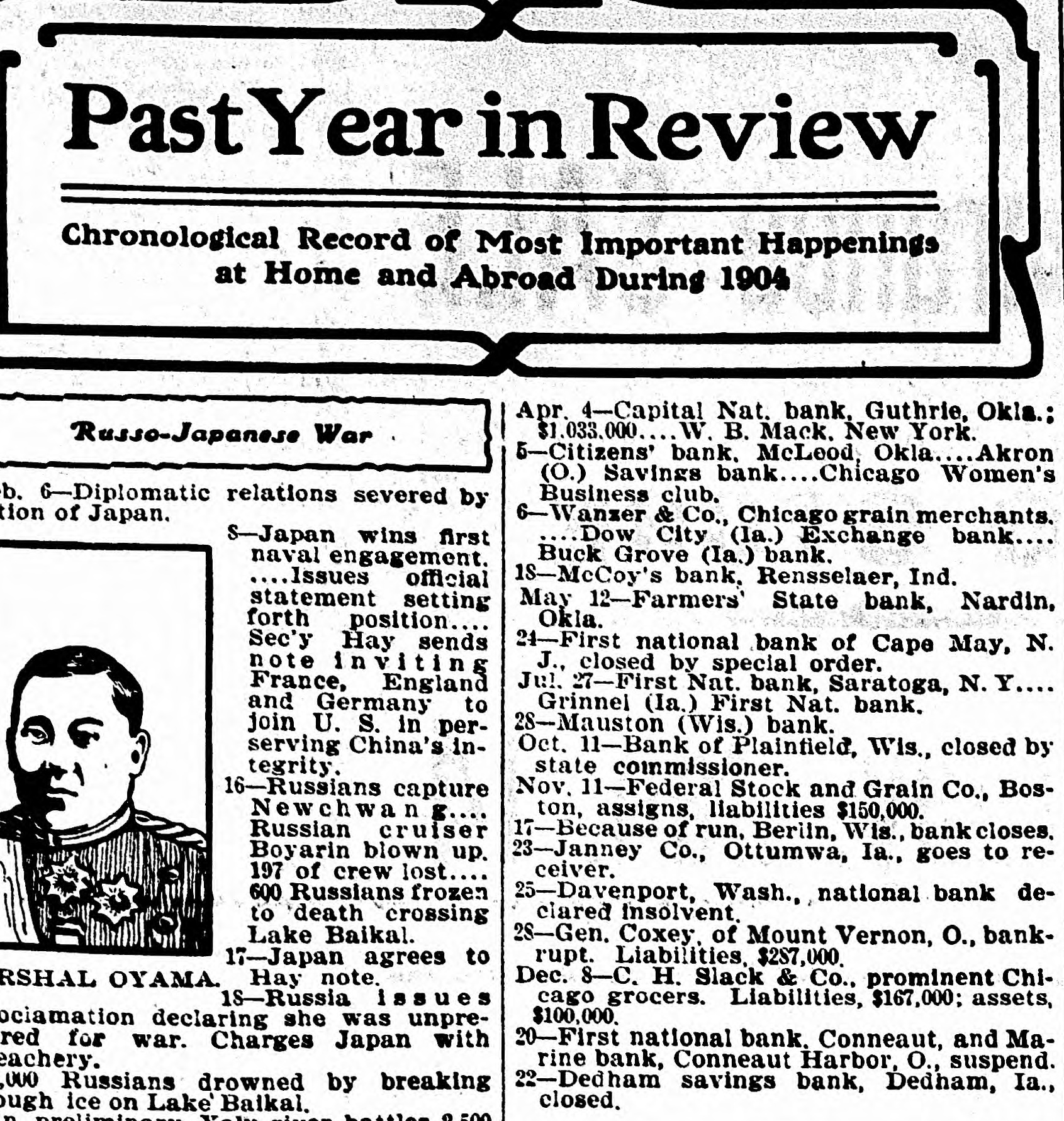

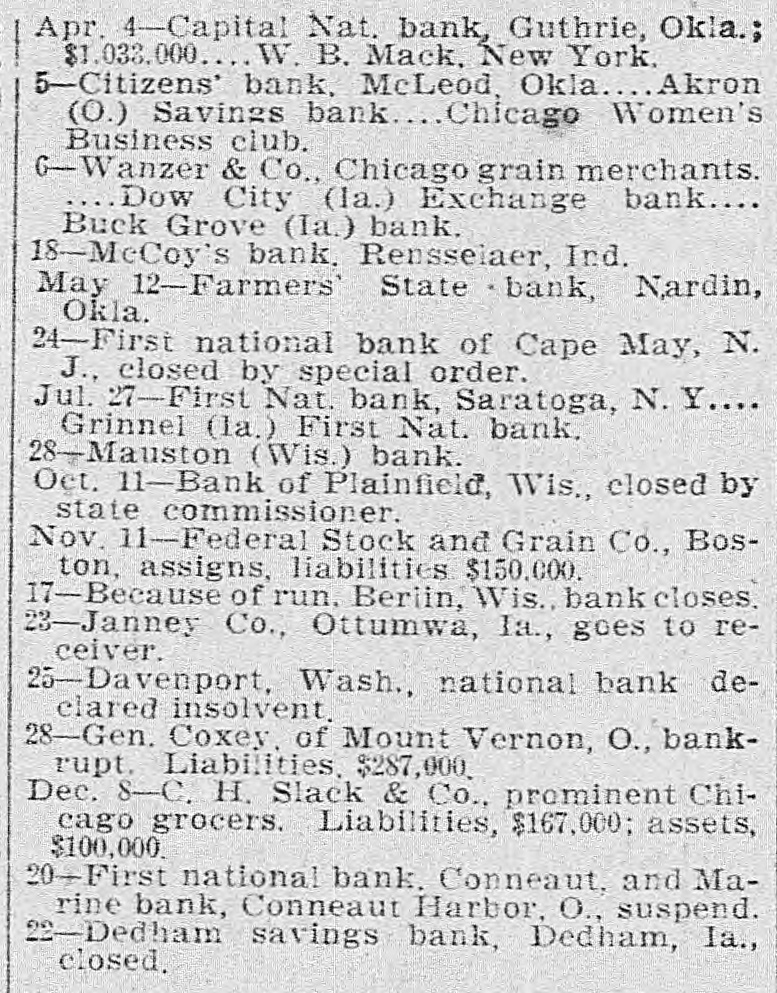

TEN BANKERS SUICIDE IOWA'S RECORD YEAR WITH FORTY FAILURES AND $12,000,000 LOSS. Many of Them Caused by Drop in Cattie Prices-Faced by Rula and Dishonor, Half a Score of Officials Committed Suicide. Some of the Iowa Banks That Failed. Buck Grove-H. S. Green's private bank. Dow City-H. S. Green's private bank. Grinnell-Citizens' National Bank. Waverly-German-American Loan and Trust Company. Pisgah-Bank of Pisgah, private. Curlew-Bank of Curlew. private. Little Sloux-Little Sloux Bank, private. Gaza -Bank of Gaza, private. Tiffin Corn Exchange Bank, private. Emerson-Farmers' Bank, private. Sheldon-Sheldon State Bank. Germania-State Bank. Ireton-Bank of Ireton, private. Colfax-Bank of Colfax, private. Royal-Bank of Royal, private. Ireton-F. H. McKeever's bank, private. Providence-O. E. Miller's Bank, prsvate. Linn Grove-H. W. Main's Bank, private. St. Charles-Citizens' Bank, private. Victor-Iowa County Bank. private. Mount Ayr-Citizens' Bank, private. Stgourney-Sigourney Savings Bank. Holstein-E. McCuteheon's Bank. Corning-Corning Savings Bank. Pella-People's Savings Bank. Coin-Bank of Coin. Garden Grove-Farmers' Bank, private. Maquoketa-Exchange Bank, private. Pleasanton-Royal-Richardson Bank. private. Dixon-Bank of Dixon, private. New Liberty-New Liberty Savings Birmingham-E. D. Skinner's private Bank. Imogene-Citizens' Bank, private. bank. Olin-Bank of Olin, private. Des Moines Special to N. Y. World. An unprecedented record of disaster among Iowa banks will be disclosed by a report now being prepared at the State Auditor's office for 1904. Culminating last week with the closing of the savings bank in Dedham this is the startling record: Ten bank cashiers dead by suicide. Forty banks wrecked and their surplus squandered. Twelve millions of dollars lost to depositors. In two instances bank officers have absconded with funds, thus accounting for the failure, but the remarkable number of failures due to similar circumstances has aroused the curiosity of the whole State to ascertain the cause. These are the suicides of the year due to bank failures, so far as the State officials know: H. C. Spencer and his son, cashier. and assistant cashier of the Grinnell National Bank. George D. Wood, cashier of the Bank of Colfax, Ia. Charles Wood, cashier of the Citizens Bank of St. Charles. F. L. LaRue, cashier of the Corning State Bank. G. D. Utterback, cashier of the Sigourney Savings Bank. H. W. Main, cashier of the Linn Grove Bank. Cashier of the Lone Tree Bank. Two other suicides early in the year, whose names are not recalled by the attaches of the State Auditor's office. Tragedy Follows Tragedy. It is only within the past few days that the State has become aware of the magnitude of the disaster and the tragedies attending them, many of the failures having been kept quiet. Not until the two suicides in quick succession at Lone Tree and Linn! Grove, and the failure of the Sheldon State Bank, with losses amounting to many thousands, created a State-wide sensation was general attention attracted to the seriour condition of affairs. The failure of the bank at Colfax, the National Bank at Storm Lake and the bank at Sigourney. with the suicide of the cashier, added to the sensation. The sulcide of Cashier Utterback of the Sigourney Bank, was followed by the discovery of extensive forgeries which he had perpetrated to cover up a shortage which had been running for