Article Text

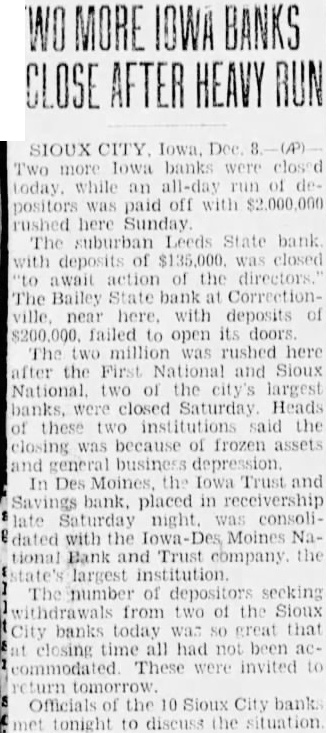

MORE BANKS CLOSE AFTER HEAVY Two more Iowa banks were closed today. while an all-day run of depositors was paid off with $2,000,000 rushed here Sunday The suburban Leeds State bank with deposits of $135,000 was closed to await action of the directors The Bailey State bank at Correctionville near here. with deposits of $200.000. failed to open its doors The two million was rushed here after the First National and Sioux National two of the city's largest banks, were closed Saturday Heads of these two institutions said the closing was because of frozen assets and general business depression. In Des Moines, the Iowa Trust and Savings bank. placed in receivership late Saturday night was consolidated with the Iowa Moines National Bank and Trust company the state's largest institution. The number of depositors secking withdrawals from two of the Sioux City banks today was so great that closing time all had not been accommodated These were invited to return tomorrow Officials the 10 Sioux City bank tonight to discuss the situation