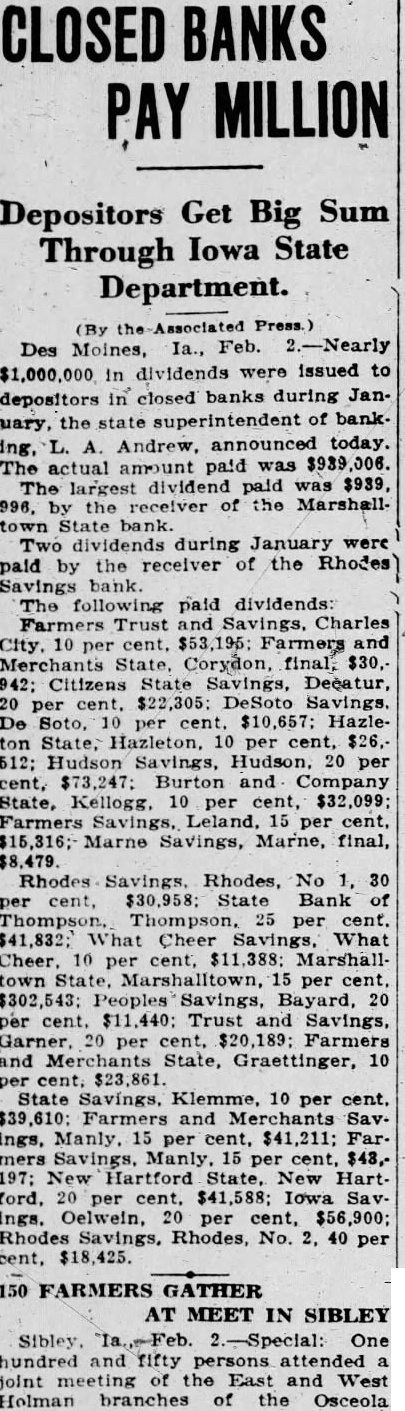

Article Text

BANKS PAY MILLION Depositors Get Big Sum Through Iowa State Department. (By Des Moines, Feb. in dividends were issued to depositors closed banks during January, the state superintendent of bank. Andrew, announced today. actual amount paid was The dividend paid was $939, 996, the of the MarshallState bank. Two dividends during January were paid the receiver of the Rhodes Savings bank following paid dividends: Farmers Trust and Savings, Charles City, cent, $53,195; Farmers Merchants State, Corydon, final, $30,942; Citizens State Savings, Decatur, De Soto, cent. HazleState, Hazleton, 10 per cent, Hudson Savings, Hudson, 20 per cent, $73,247: Burton and Company State, Kellogg. 10 per cent, $32,099; Farmers Savings, Leland, 15 per cent, $15,316;- Marne Savings, Marne, final, $8,479. Rhodes Savings, Rhodes, No cent, State Bank of 25 per cent. $41,832; Cheer What Cheer, 10 per cent, $11,388: Marshalltown per 20 per cent. Trust Savings, per cent, Farmers Merchants State, Graettinger, 10 $23,861. State Savings, Klemme, 10 per cent. and Merchants Savings, Manly. 15 per cent, $41,211; Manly. per cent, $43,New Hartford State, New Hartford, $41,588; Iowa Savings. Oelwein, 20 per cent, $56,900; Rhodes Savings, Rhodes, No. per cent, $18,425. 150 FARMERS GATHER AT MEET IN SIBLEY 2.-Special: One hundred and fifty persons attended the East and West Holman branches of the Osceola