Click image to open full size in new tab

Article Text

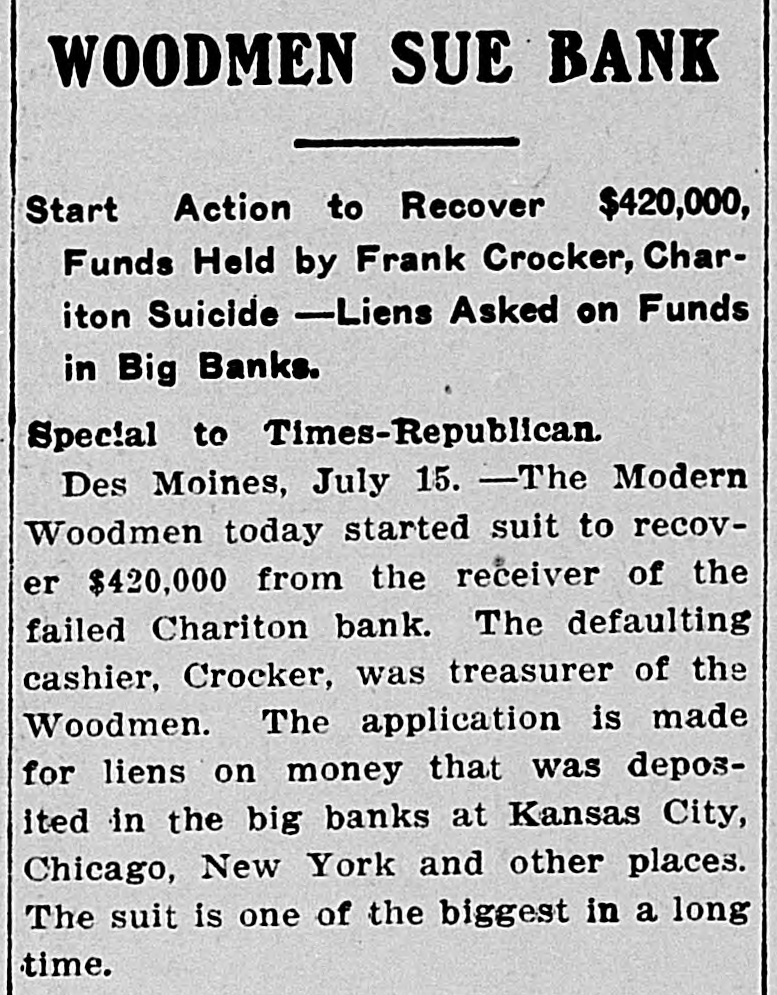

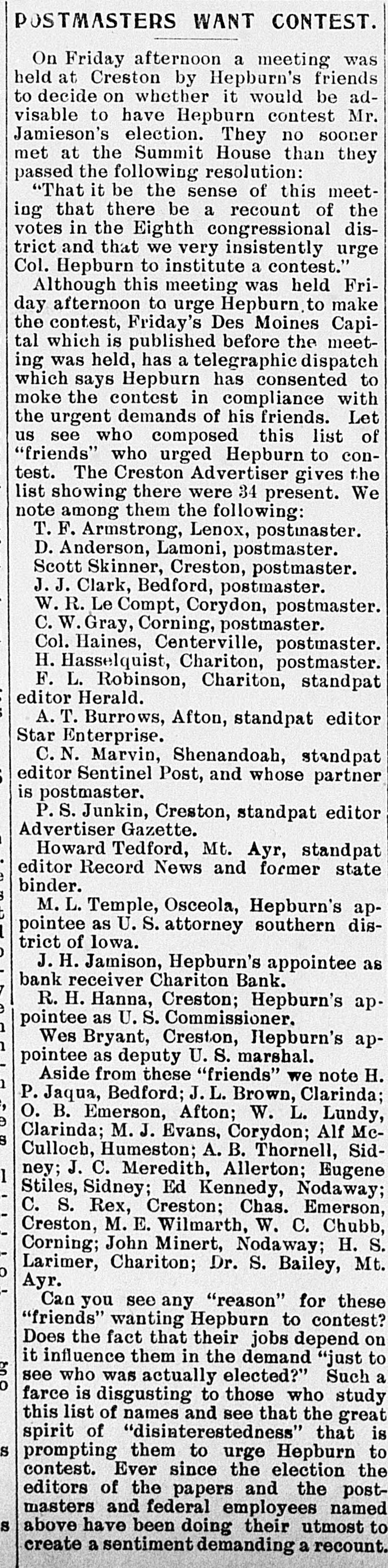

COUNTY ATTORNEYS MEET Small Attendance at Annual Session in Des Moines. INDIANAPOLIS MAN TSSAULTED While Fishing Along Coon River He is Fatally Stabbed-Jamison Resigns as Receiver of Chariton Bank. (From a Staff Correspondent.) DES MOINES, June 22.-(Special Telegram.)-The annual convention of the County Attorneys' association of Iowa began here today, with a very small attendance. Judge De Graff of the local court, who has been a member of the association several years, delivered an address of welcome, and the response was by County Attorney Egermeyer of Marshall county. President Seneca Cornell gave the annual address, but the remainder of the program was postponed until tomorrow, when the State Bar association will also convene. Megroes Assault Smith. Harry L. Smith of Indianapolis, Ind., was engaged in fishing along the Coon river in the western part of the city today when he was set upon by three negroes. In the melee which followed Smith was fatally stabbed. His assailants got away. Jamison Resigns. J. H. Jamison, receiver for the defunct Chariton bank, has resigned. G. C. Rakin of Washington has been appointed to succeed Jamison. A dividend of 5 per cent has been declared. Jamison will be nominated for judge, to succeed Towner, when the latter resigns to enter congress. Some Official Figures. The official canvass shows that only the state superintendency will go to the convention. David J. Palmer and Clifford Thorne, both of Washington, Ia., have been nominated for state railroad commissioner. Threatened injunction proceedings by Chris Ottesen of Humboldt against this canvass failed to materialize. When the executive council met, in order to forestall any controversy as to how to decide who was nominated, the council passed a resolution deciding the legal question as to the interpretation of the law, declaring that when the certificate is made out it will be based on 35 per cent of half the total vote and not 35 per cent of the entire vote. This wil shut out any argument on the question before the council. Congressional Vote. The vote in congressional districts was: First District-Brookhart, 4,406; Kennedy, 7,405; Kennedy's majority, 2,999. Democratic: Pollard, 3,554; Gillis, 1,625; Pollard's majority, 1,929. Second District-Charles Grilk, 5,704. Democratic: DeArmand, 3,345; Pepper, 3,404; Pepper's majority, 119. Fourth District-Haugen (republican), 11,927. Murphy (democratic), 3,708. Fifth District-Good (republican), 10,901; Huber (democratic), 2,641. Seventh District-Prouty, 14,122; Hull, 10,855; Prouty's official majority, 3,267. Democratic: Price, 1,483; O'Malley, 1,223; Price's majority, 260. Eighth District-Towner, 8,376; Darrah, 7,498; Towner's official majority, 878. Democratic: Stuart, 1,895; Booth, 1,418; Sankey, 985. Ninth District-Smith, 9,743; Byers, 8,138; Smith's majority, 1,605. Democratic: Cleveland, 2,606; Holsman, 980. Tenth District-Woods, 16,591; Mayne, 4,249; Woods' majority, 12,341. In the other districts there were no contests.