Article Text

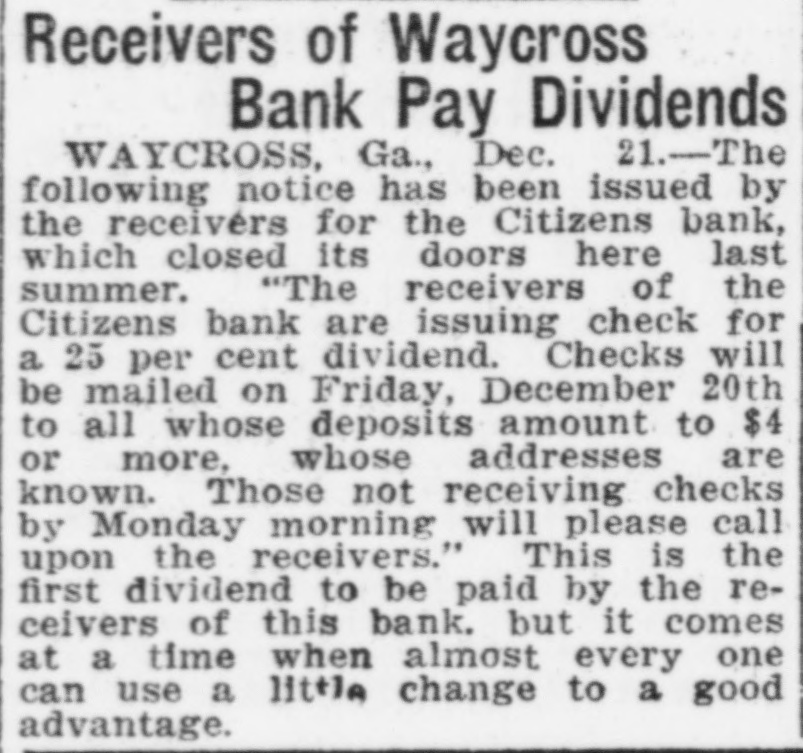

Receivers of Waycross Bank Pay Dividends WAYCROSS, Ga., Dec. 21.-The following notice has been issued by the receivers for the Citizens bank, which closed its doors here last summer. "The receivers of the Citizens bank are issuing check for a 25 per cent dividend. Checks will be mailed on Friday, December 20th to all whose deposits amount to $4 or more, whose addresses are known. Those not receiving checks by Monday morning will please call upon the receivers." This is the first dividend to be paid by the receivers of this bank. but it comes at a time when almost every one can use a little change to a good advantage.