Click image to open full size in new tab

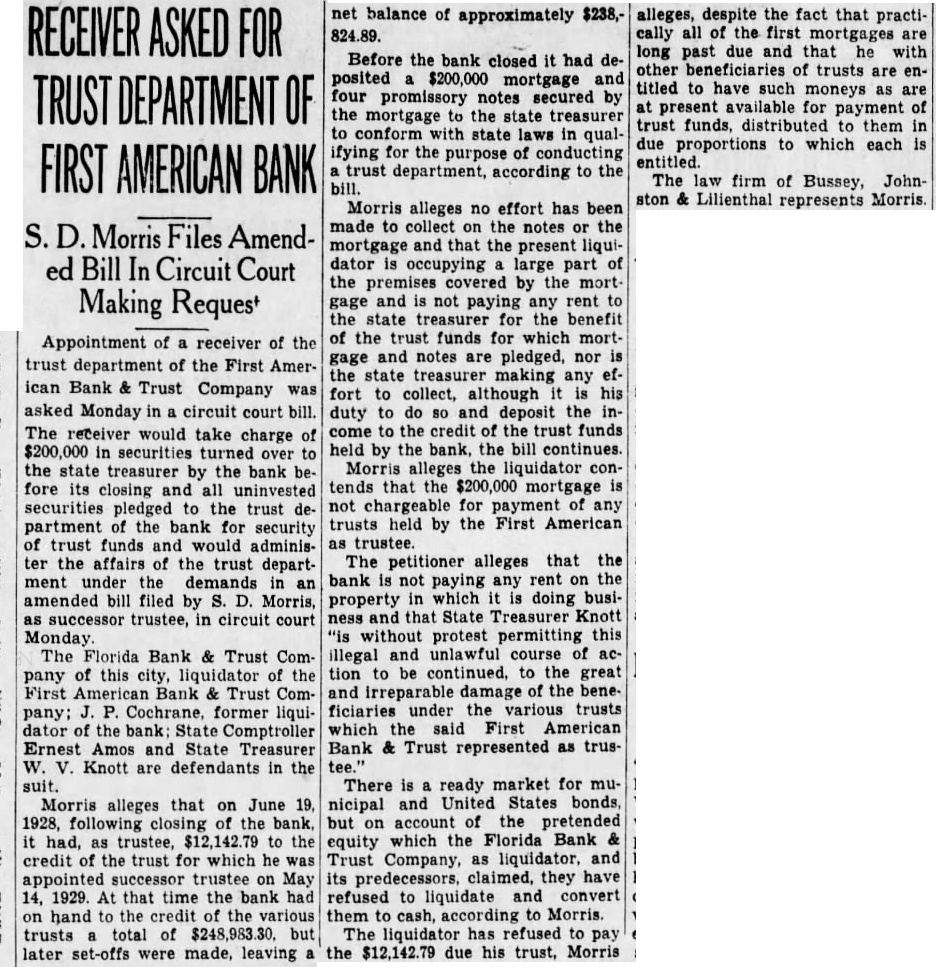

Article Text

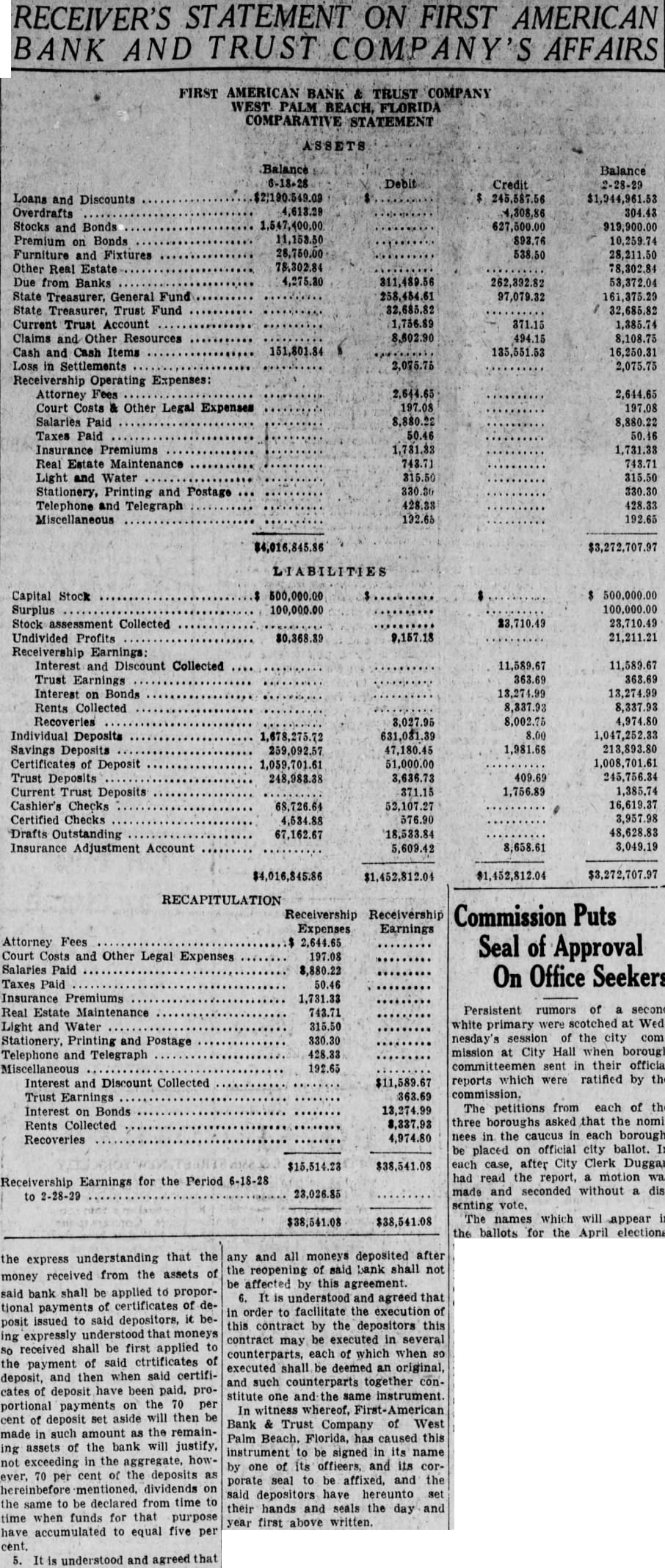

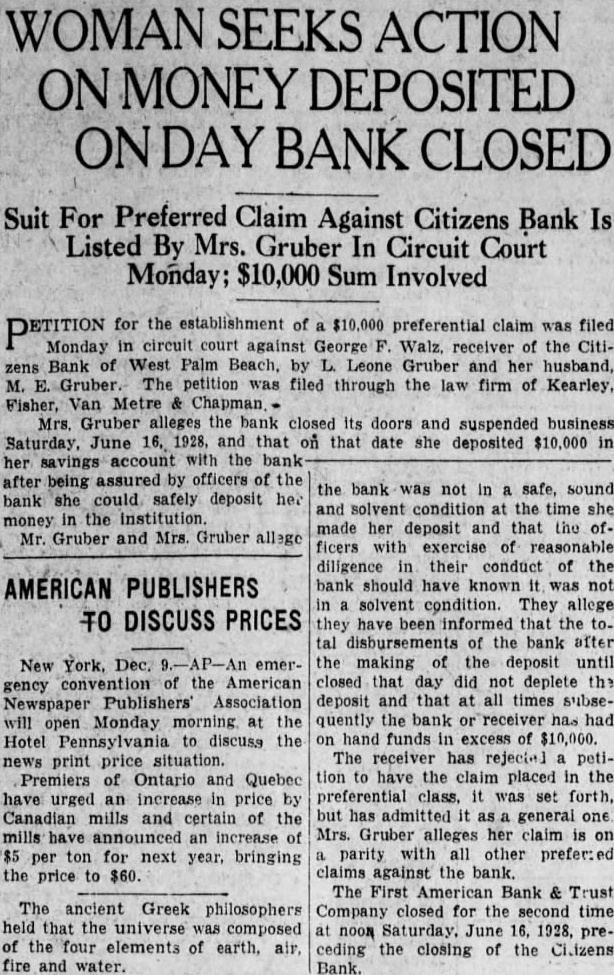

RECEIVER'S STATEMENT ON FIRST AMERICAN BANK AND TRUST COMPANY'S AFFAIRS the express understanding that the money received from the assets of said bank shall be applied to proportional payments of certificates of deposit issued to said depositors, it being expressly that so received shall be first applied to the payment of said ctrtificates of deposit, and then when said certificates of deposit have been paid. proportional payments on the 70 per cent of deposit set aside will then be made in such amount as the remaining assets of the bank will justify, not exceeding in the aggregate, however, 70 per cent of the deposits as hereinbefore mentioned. dividends on the same to be declared from time to time when funds for that purpose have accumulated to equal five per cent. 5. It understood and agreed that any and all moneys deposited after the reopening of said bank shall not be affected by this agreement. 6. It understood and agreed that in order to facilitate the execution of this contract by the depositors this contract may be executed in several counterparts, each of which when so executed shall be deemed an original, and such counterparts together constitute one and the same instrument. In witness whereof, First-American Bank & Trust Company of West Palm Beach. Florida, has caused this instrument to be signed in its name by one of its officers. and its corporate seal to be affixed, and the said depositors have hereunto set their hands and seals the day year first above written.

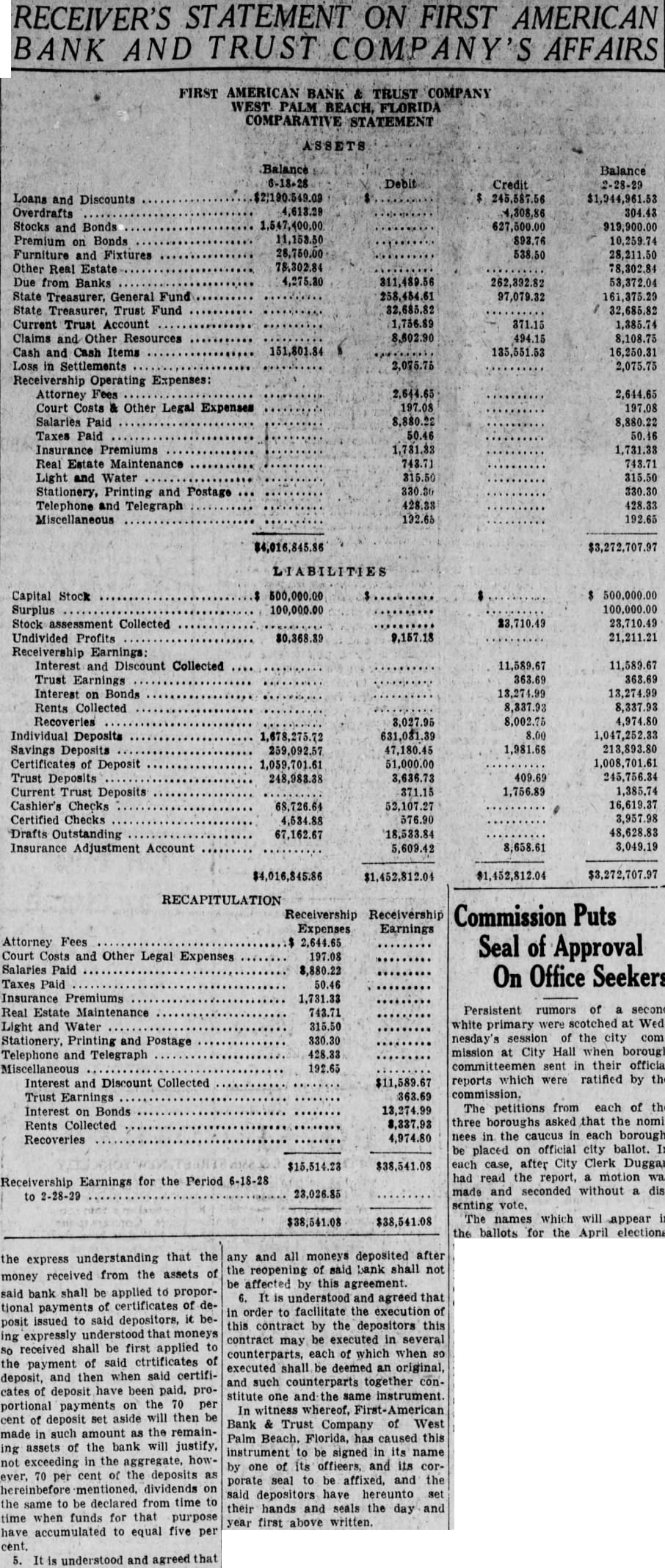

FIRST AMERICAN BANK & TRUST COMPANY WEST PALM BEACH, FLORIDA COMPARATIVE STATEMENT ASSETS Balance Balance Debit Credit 2-28-29 Loans and Discounts $2,190,549.09 245,587.56 Overdrafts 4,613.29 4,308.86 304.43 Stocks and Bonds 1,547,400.00 627,500.00 919,900.00 Premium on Bonds 893.76 10,259.74 Furniture and Fixtures 28,750.00 538.50 28,211.50 Other Real Estate 78,302.84 78,302.84 Due from Banks 311,489.56 262,392.82 53,372.04 State Treasurer, General Fund 97,079.32 State Treasurer, Trust Fund 32,685.82 32,685.82 Current Trust Account 1,736.89 371.15 1,385.74 Claims and Other Resources *********** 494.15 8,108.75 Cash and Cash Items 151,801.84 135,551.53 16,250.31 Loss in Settlements 2,075.75 Receivership Operating Expenses: Attorney Fees 2,644.65 2,644.65 Court Costs & Other Legal Expenses 197.08 197.08 Salaries Paid 8,880.22 8,880.22 Taxes Paid 50.46 50.16 Insurance Premiums 1,731.33 Real Estate Maintenance 743.71 Light and Water 315.50 315.50 Stationery, Printing and Postage 330.30 330.30 Telephone and Telegraph 428.33 428.33 Miscellaneous 192.65 $4,016,845.86 $3,272,707.97 LIABILITIES Capital Stock 500,000.00 $ $ 500,000.00 Surplus 100,000.00 Stock assessment Collected $3,710.49 23,710.49 Undivided Profits $0,368.39 21,211.21 Receivership Earnings: Interest and Discount Collected 11,589.67 11,589.67 Trust Earnings 363.69 363.69 Interest on Bonds 13,274.99 13,274.99 Rents Collected 8,837.93 8,337.93 Recoveries 8,002.75 4,974.80 Individual Deposits 1,678,275.72 8.00 1,047,252.33 Savings Deposits 259,092.57 47,180.45 213,893.80 Certificates of Deposit 1,059,701.61 51,000.00 1,008,701.61 Trust Deposits 248,988.38 3,636.73 409.69 245,756.34 Current Trust Deposits 371.15 1,756.89 1,385.74 Cashier's Checks 68,726.64 52,107.27 16,619.37 Certified Checks 576.90 3,957.98 Drafts Outstanding 67,162.67 18,533.84 48,628.83 Insurance Adjustment Account 5,609.42 8,658.61 3,049.19 $4,016,845.86 $1,452,812.04 $1,452,812.04 $3,272,707.97 RECAPITULATION Receivership Receivership Commission Puts Expenses Earnings Attorney Fees $ 2,644.65 Seal of Approval Court Costs and Other Legal Expenses 197.08 Salaries Paid 8,880.22 On Office Seekers Taxes Paid 50.46 Insurance Premiums 1,731.33 Persistent rumors of a second Real Estate Maintenance 743.71 ********* Light and Water 315.50 white primary were scotched at WedStationery Printing and Postage 330.30 nesday's session of the city com428.33 mission at City Hall when borough Telephone and Telegraph committeemen sent in their official Miscellaneous 192.65 $11,589.67 reports which were ratified by the Interest and Discount Collected Trust Earnings 363.69 The petitions from each of the Interest Bonds three boroughs asked that the nomiRents Collected 4,974.80 nees in the caucus in each borough, Recoveries be placed on official city ballot. In $15,514.23 $38,541.08 each case, after City Clerk Duggan had read the report, motion was Receivership Earnings for the Period 6-18-28 23,026.85 made and seconded without disto 2-28-29 senting vote. $38,541.08 The names which will appear in $38,541.08 the ballots for the April elections,