Click image to open full size in new tab

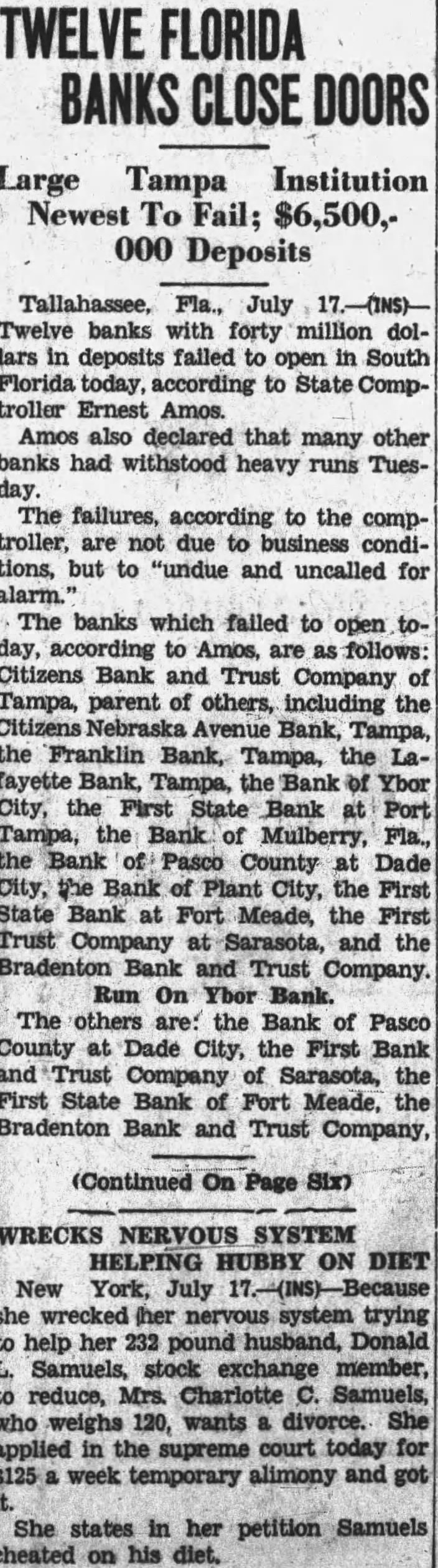

Article Text

WRECK TOLL, 12

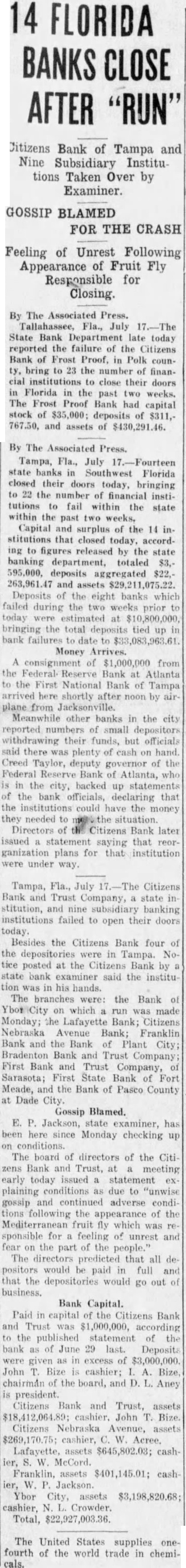

Moscow, July 18.-Soviet Russia last night severed all diplomatic relations with the Nanking government. This action was followed immediately by the concentration of armed forces of both nations along the Manchurian border with minor engagements being reported in some sections. The Soviet government made public its reply to the Chinese note, the latter having come in response to an ultimatum from Russia. In this note the Soviet Union said all means of reaching an amicable settlement had been exhausted. The Soviet note said that the Moscow government would reserve all the rights arising from the Peking-Mukden agreement of 1924. It declared that the Chinese reply to the Russian ultimatum was unsatisfactory in content and hypocritical in tone. The note further asserted all Soviet officials would be recalled from the Chinese Eastern railway, that all railway communications between Soviet territory and China would be suspended and that the diplomatic and consular representatives of the Nanking government would be ordered immediately to leave the Union of Soviet Socialist Republics. Countering the Chinese charge that Russia has been persecuting Chinese citizens in Soviet territory, the note said this was a hypocritical endeavor by China to justify its own outrages in the arrest of Russian citizens. The note asserted the Nationalist government knew well that Russia had had recourse to repressive measures only in the case of insignificant groups of spies, opium traders, white slavers, smugglers and other criminal Chinese.

KMOX Artist Is Missouri Farm Girl

St. Louis, July 18.-"And now we present Sunbonnet Sue, who will sing for you". How many times has this announcement brought joy to listeners of KMOX Farm Hour Programs. Sunbonnet Sue is a real farm girl, having been born and raised near Harrisonville, Missouri. Her name is Katherine McIntyre. She has been a member of KMOX staff at intervals covering several years. Last summer she studied violin in Paris, later going on to Florence where she devoted herself to the serious study of voice.

Perhaps she loves her violin more than anything else. It is certain that she has a very high standard of excellence and insists that every number she presents comes up to it. The Farm audience, without doubt, thoroughly appreciates her songs which she selects with a view to satisfying the longing often expressed in these days of jazz for the songs of long ago. Then when things get too serious Sunbonnet starts some fun by presenting one of her pianologues. Some times it is, "When the Summer Boarders Come." Sometimes "Spring Fever." Her store of interesting pianologues seems to have no end. Sunbonnet Sue is to be heard each day at noon over KMOX, as she provides the musical bits that are interspersed between the discussions of Farm Topics.

Cars of Fast Rock Island Train Through Colorado Bridge

Miss McIntyre is quite well known in this city having taught violin here.

Stratton, Colo., July 18.-Twelve persons were dead and a number injured when the crack Rock Island passenger train, No. 5, crashed through a bridge east of here early today. The known dead were passengers in one coach which was completely submerged in the swollen stream. The train, made up mostly of Pullmans from eastern and southern cities, carried a large number of passengers. Several of the cars went into the swollen creek when the bridge gave way beneath the engine, one of the cars being completely submerged. The coach was known to have been occupied by thirteen persons, twelve passengers and a colored porter. One of the passengers, badly bruised and cut, escaped from the car and swam to safety. The other occupants of the car were believed drowned. Many of the occupants of the other coaches were more or less injured. Physicians and nurses from all surrounding towns and cities were called to the scene of the disaster. Rail officials said the wreck could have been caused by two things, weakening of the bridge by excessive rains and swollen waters of the stream which it spanned or a broken rail on the bridge.

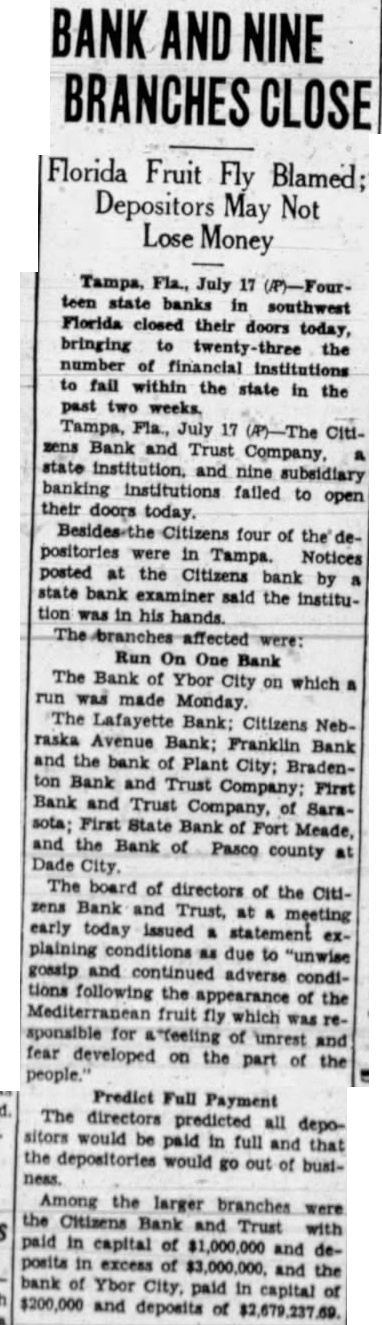

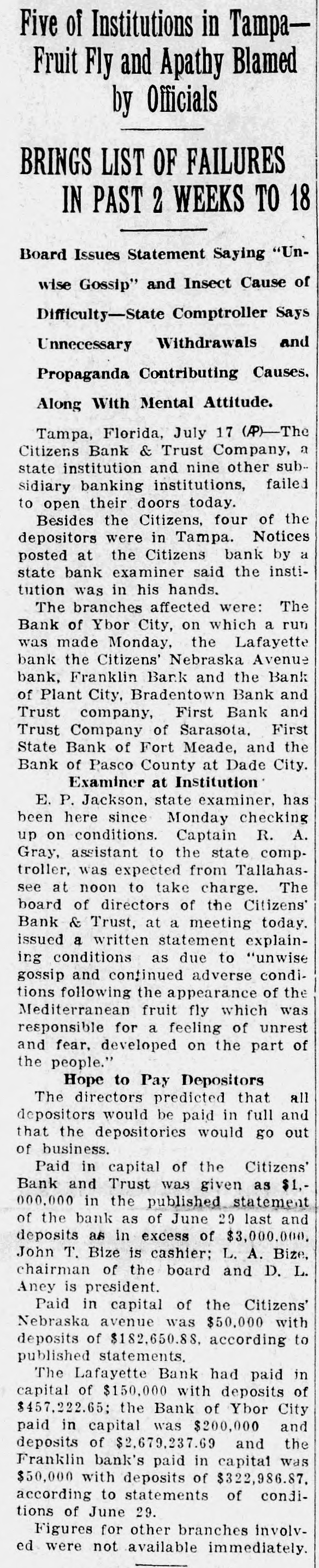

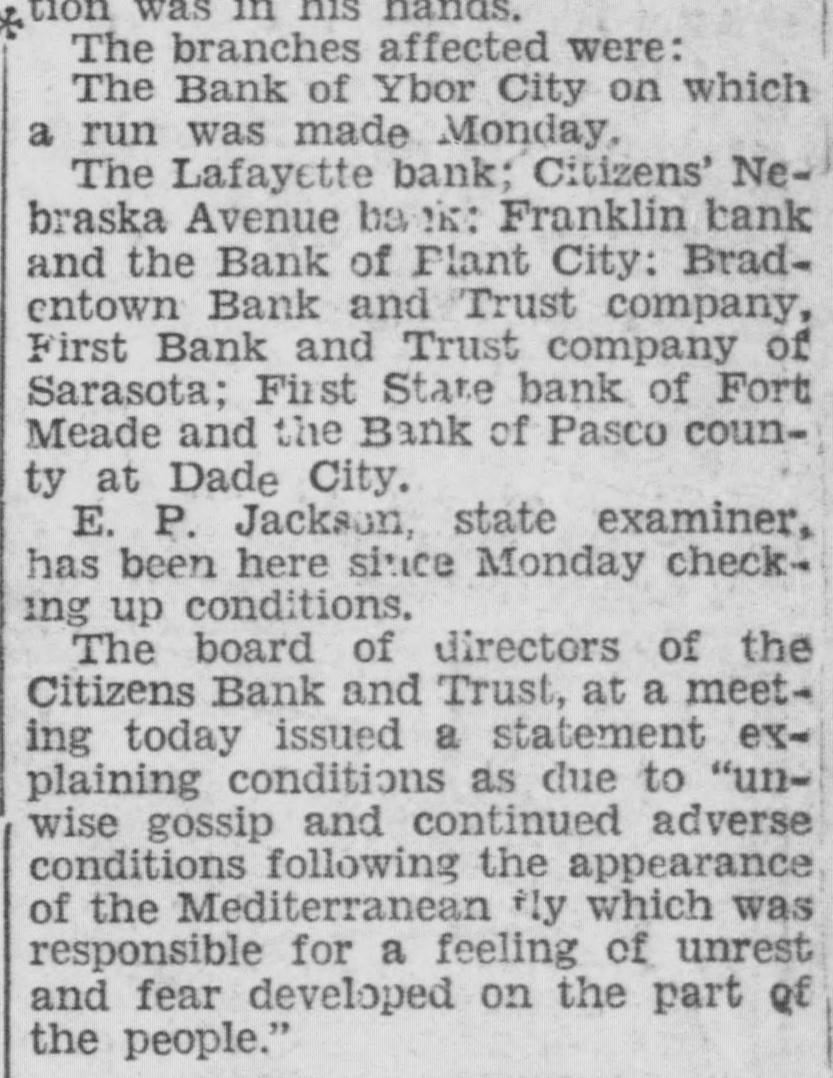

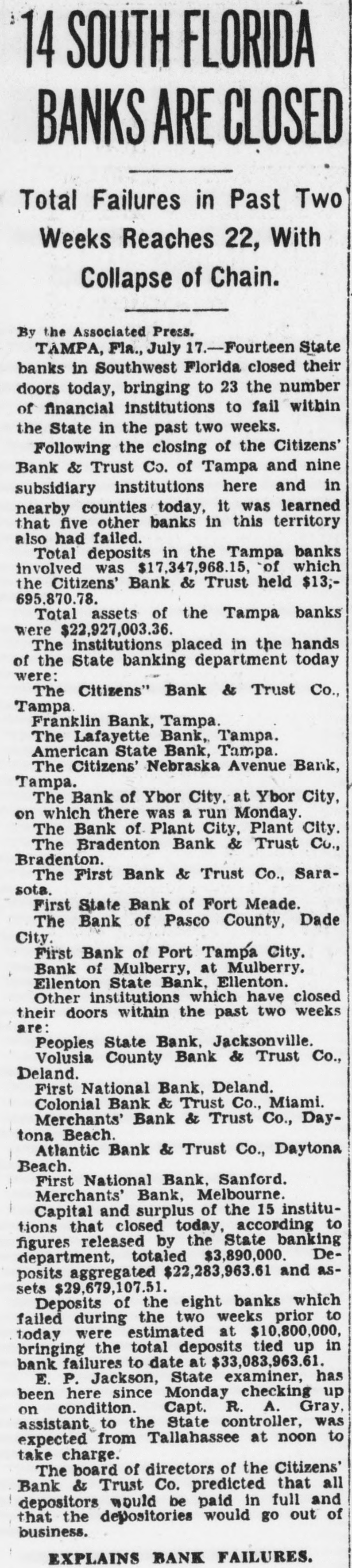

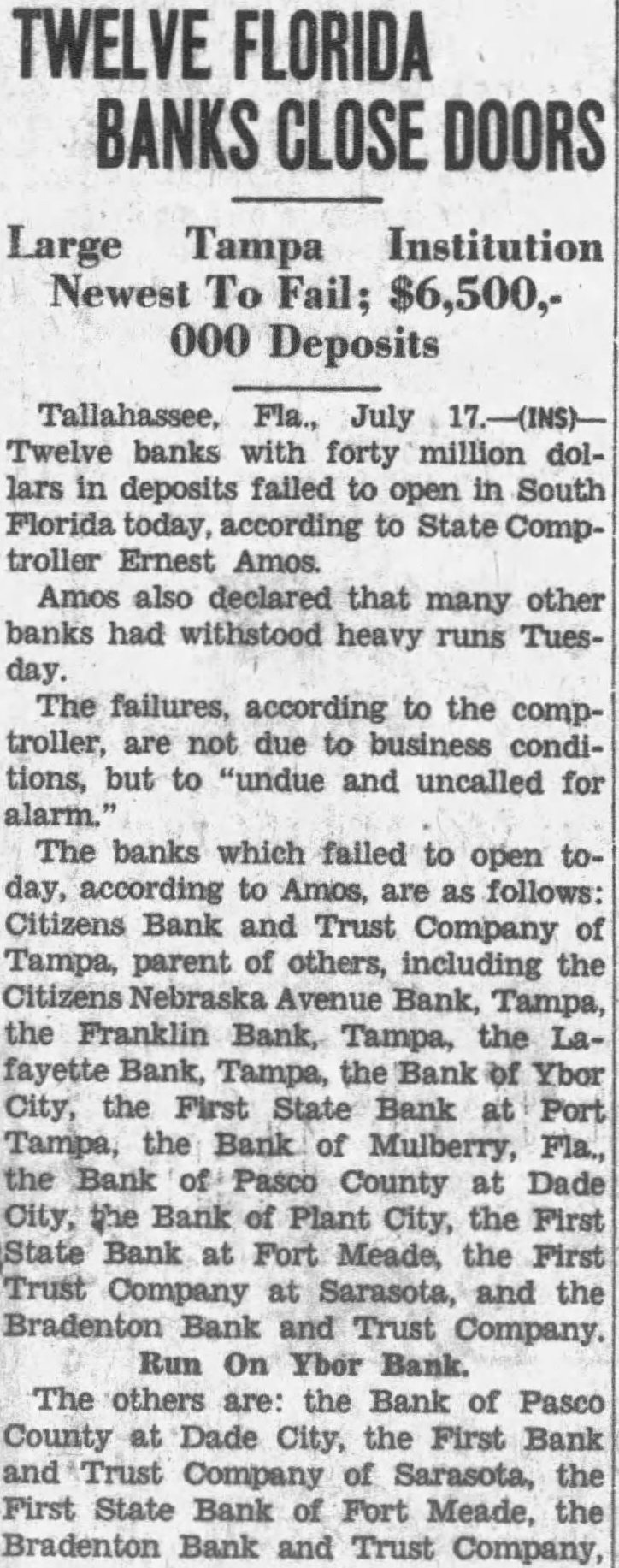

Gossip Causes Run on Banks

Tampa, Fla., July 17.-The Citizens Bank and Trust Company, a state institution, and nine subsidiary banking institutions, failed to open their doors today. Besides the Citizens, four of the depositories were in Tampa. Notices posted at the Citizens Bank by state bank examiner said the institution was in his hands. The branches affected were the Bank of Ybor City, on which a run was made Monday; the Lafayette Bank, Citizens Nebraska Avenue Bank, Franklin Bank and the Bank of Plant City, Bradenton Bank and Trust Company, First Bank and Trust Company of Sarasota, First State Bank of Fort Meade and the Bank of Pasco County at Dade City. E. P. Jackson, state examiner, has been here since Monday checking up on conditions. The board of directors of the Citizens Bank and Trust, at a meeting early today issued a statement explaining conditions as due to "unwise gossip and continued adverse conditions following the appearance of the Mediterranean fly, which was responsible for a feeling of unrest and fear developed on the part of the people." The directors predicted all depositors would be paid in full and that the depositories would go out of business. Paid-in capital of the Citizens Bank and Trust was 1 million dollars, according to the published statement of the bank as of June 29 last. Deposits were given as in excess of 13 million dollars. Paid-in capital of the Citizens Nebraska Avenue was $50,000, with deposits of $182,650.11, according to published statements. The Lafayette bank had paid-in capital of $150, 000, with deposits of $457,222.65; the Bank of Ybor City had paid-in capital of $200,000 and deposits of $2,679,237.69, and the Franklin bank's paid-in capital was $50,000, with deposits of $322,986.87, according to statements of conditions as of June 29. Figures for other branches involved were not available immediately. Total deposits in the Tampa banks involved were $17,347,968.15, of which the Citizens Bank and Trust held $13,695,870.78.

Your friends will read your name in the Democrat.