Article Text

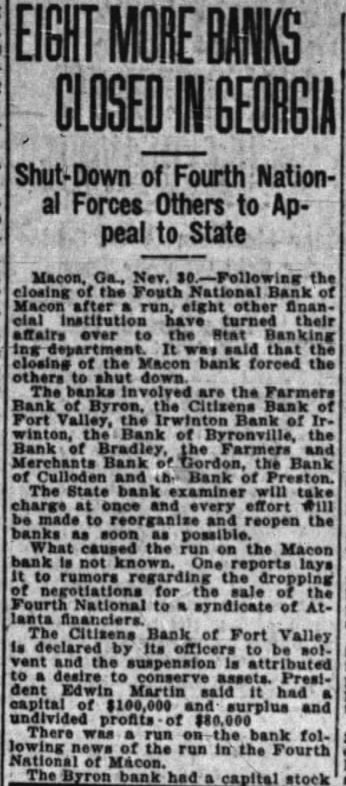

EIGHT GEORGIA BANKS CLOSED Institution Drags Small Ones Down United MACON, Nov. 28. Eight small Georgia banks were closed today result of failure bank, Macon, with listed reof more than With the exception the Citizens' bank, of Fort Valley, capitalized at other institutions, Bank of Byronville, Irwinton bank, Bank of Preston, Citizens' Bank company, of Culloden, Bank of Bradley, Farmers' Merchants' bank, of Gordon, Farmers' bank, of at from $15,000 to were closed aftheavy runs due to the scare that followed ing of the Macon bank. All the banks are located in the Georgia peach With Clyde J. Edwards in charge of an audit, and Claude Gilbert, named of the Fourth National plans under today to adjust affairs could be cared for. Exact cause of the run was concealed, altho circles said recent investments had turned out poorly.