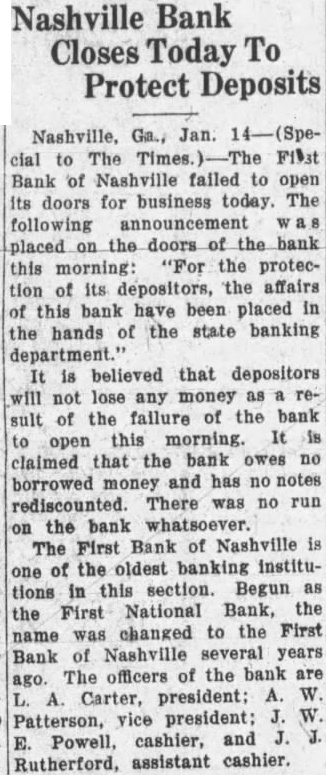

Article Text

Nashville Bank Closes Today To Protect Deposits Nashville, Ga., Jan. cial to The First Bank of Nashville failed to open its doors for business today. The following announcement placed on the doors of the bank this morning: "For the protection of its depositors, the affairs of this bank have been placed in the hands of the state banking It is believed that depositors will not lose any money as sult of the failure of the bank to open this morning. It claimed that the bank owes no borrowed money and has no notes rediscounted. There was no run the bank whatsoever. The First Bank of Nashville one of the oldest banking institutions in this section. Begun National Bank, the the First name was changed to the First Bank of Nashville several years ago. The officers of the bank are Carter, president: A. W. Patterson, vice Powell, cashier, and assistant cashier. Rutherford,