Article Text

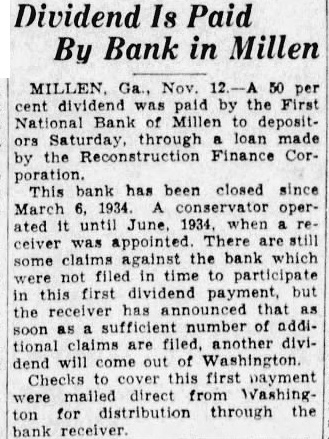

Dividend Is Paid By Bank in Millen MILLEN. Ga., Nov. 50 per dividend the Bank Millen depositors Saturday, through loan made the Reconstruction Finance Cor. poration This bank has been closed since March conservator operuntil when ceiver was appointed. There are still some claims the which first but has that the number addianother come out of Washington Checks cover this first payment mailed direct for distribution through the receiver