Article Text

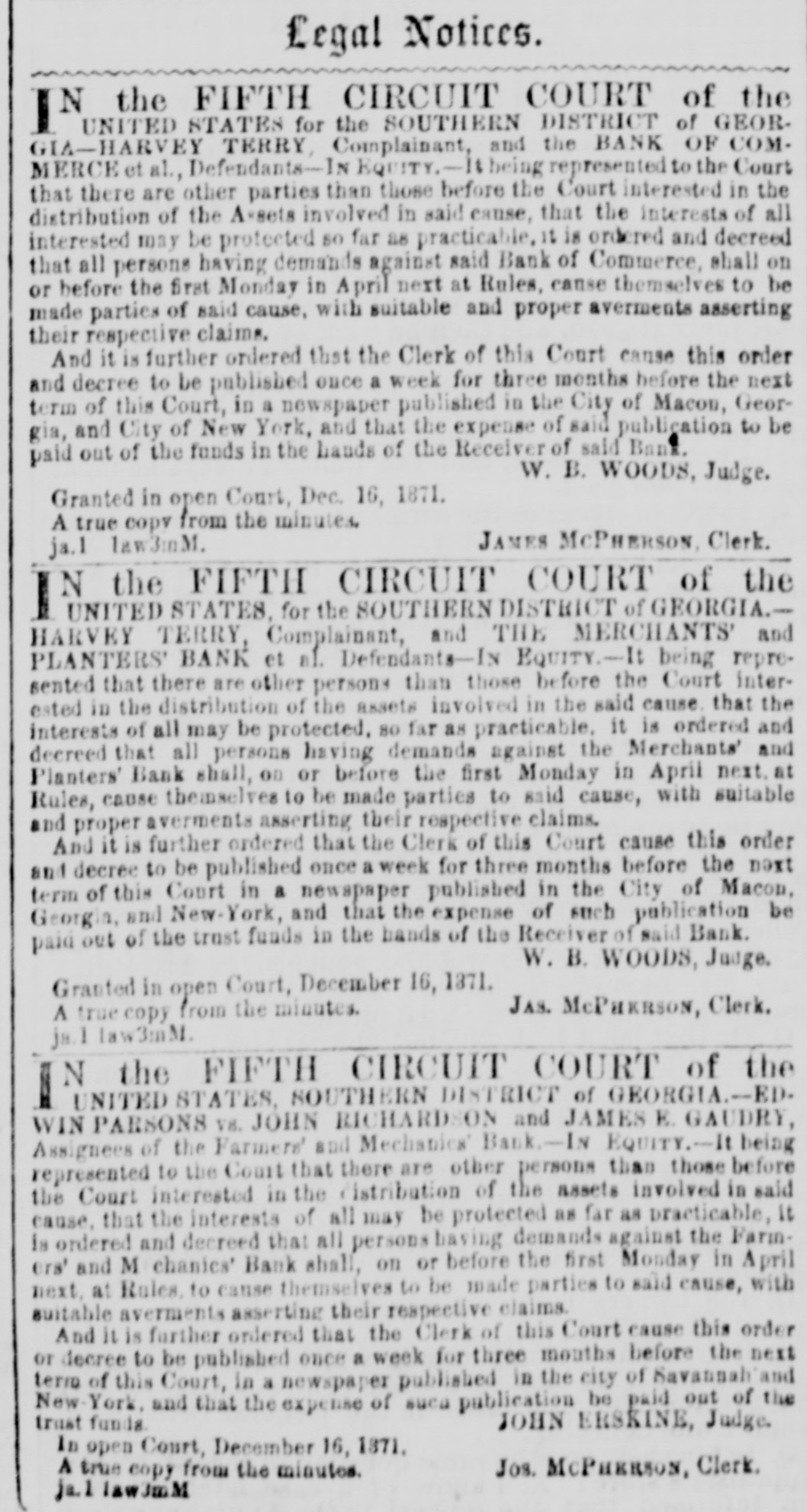

Co Whom it man Concern MATRIMONIAL.-A Christian Gentleman of high standing and position. a widower, over who does not find in his own circle a person congerial desires to correspond with a Christian Lady from 35 to 40, with a view to marriage. She must he of good family, appearance, and health, refi ed. intelligent. and int He tual; sincerely pious and amiable, to meet the same position and qualities in the advertis Any corre ondence which may ensue will be Id strictly and honorably confidential. Address, MARTIN LUTHER Box 849 N. Y. Post Office. Legal Notices. ADVERTISEMENT FOR LEGATEES.-ParA suant to a decree of the H b Court of Chancery in Ireland, made the cause of the Rev. PETER EDWARD O'FARRELLY and in THOMAS FITZPATRICK Plaintifs and TERESA TAYLOR the Rev. PATRIC K MACCABE. P. P., and Her Majesty's Attorney General for Ireland. Defendants instituted for the administration of the Estate of ROSE ELLEN FORD, late of Saul core avenue, Kingstown County Dublia, Ireland, formerly of Westland Row. Dablin. Ireland. who died on the 9th day of May, 1871. Mrs. JANE CAFFREY in the will of said deceased de cribed as of Albany, America (ifalive), and if dead the legal personal representatives of said Mrs. Jane a Trey, or are hereby required by her or their solicitors. on or before the 224 day of March 1872, to come in and prove her or their el in to the legacy of $100 by said beque. to the said Mrs. Jane Caffrey at the Chambers of the Right Bonorable the Master of the Rolls, Four Courts Inns, Qray, Dablin Ireland, or in default thereof she or they will be peremptorly excluded from the bene fit of said deeree. -Dated this 19th December 1871. B. W. WHITESTONE Chief Clerk WILLIAM ROCHE & SON, Solicitors for the Plaintiffs, 137 Stephen's Green West Dublin, Ireland. N the FIFTH CIRCUIT COURT of the UNITED STATES, for the SOUTHERN DISTRICT of GEORGIA.HARVEY TERRY, Complainant and THE MERCHANTS' and PLANTERS BANK et al. Defendants-Iv EQUITY.-It being represented that there are other persons than those before the Court inter ested in the distribution of the assets involved in the said cause, that the intereste of all may be protected so far as practicable. it is ordered and decreed that all persons having demands against the Merchants' and Piauters' Bank shall. on or before the first Monday in April next. at Rules, cause themselves to be made parties to said cause, with suitable and proper averments asserting their respective claims. And it is further ordered that the Clerk of this Court cause this order and decree to be published once a week for three months before the next term of this Court in a newspaper published in the City of Macon, Georgia, and New-1 York, and that the expense of such publication be paid out of the trust funs in the hands of the Receiver of said Bank. W. B. WOOD3, Judge Granted in open Court. December 16, 1871. JAB. McPHERSON, Clerk. A true copy from the minutes. ja.1 law3inM