Click image to open full size in new tab

Article Text

The News Condensed.

Important Intelligence From All Parts.

DOMESTIC.

THE North Dakota Milling association of Grand Forks, owning and operating twelve flouring mills in North Dakota and northern Minnesota, made an assignment with liabilities of $400,000 and assets of $700,000.

THE Universal Peace union in session at Philadelphia adopted resolutions that the 18th day of April be regarded as an annual Peace day for Americans.

THE remains of James W. Scott, late proprietor of the Chicago Times-Herald, were buried in Graceland cemetery.

By the failure of the Eureka Land company at Selma, Ind., many farmers will lose everything they have.

THE National Manufacturing and Jewelry Importing company of Chicago failed for $100,000.

THE government mint at Carson City, Nev., has been abandoned.

THE American Mutual Fire Insurance association of Denver made an assignment with risks outstanding amounting to $216,000 and assets of $2,999.

THE exchanges at the leading clearing houses in the United States during the week ended on the 19th aggregated $918,274,551, against $953,741,379 the previous week. The increase, compared with the corresponding week in 1894, was 1.3.

WILLIAM CRAMER, about 30 years of age, shot and fatally wounded his divorced wife at Decatur, Ill., and then killed himself.

THROUGH undervaluation of imported goods at the port of New York it was said the government would lose over $100,000.

SIR BELIVERE, the champion St. Bernard and one of the most famous dogs in the world, owned by Capt. S. A. Pratt, and valued at $20,000, died at Little Rock, Ark.

SIXTY business houses at Ardmore, I. T., were destroyed by fire, the total loss being $600,000.

THERE were 241 business failures in the United States in the seven days ended on the 19th, against 207 the week previous and 219 in the corresponding time in 1894.

A CYCLONE swept away twenty houses at Matties Landing, Ala., and killed three persons.

FIRE in the building in Philadelphia occupied by the New York Biscuit company caused a loss of $300,000.

BALDWIN BROS. & Co., brokers at Boston, with branch offices in over fifty New England cities and in New York, suspended with liabilities of over $500,000.

PATRIOTS' day, the anniversary of the battle of Lexington, was generally observed throughout New England.

THORNTON PARKER (colored) was hanged at Westchester, Va., for assault on Mrs. Melton, and Frank Fuller (also colored) was hanged at New Orleans, La., for murdering Henrietta Gardner.

FIVE HUNDRED garmentworkers went on a strike at St. Louis against the sweating system.

JOHN B. THOMAS, late editor of the Mount Vernon (Ind.) Republican and a cripple, left Evansville to go round the world in a wheel chair in two years without a cent of money except what he earns on his way.

HARRY BLAKE, Patrick Harvey and William Hardpke were killed and John Conly and J. J. Hand were fatally injured by the collapse of hoisting machinery in the Chicago Ship Building company's yards at South Chicago.

THE Furnas county bank at Beaver City, Neb., closed its doors with liabilities of $27,000.

MRS. DELIA T. S. PARNELL, 80 years of age, mother of the late Charles Stuart Parnell, was murderously assaulted by highwaymen near Bordentown, N. J.

JUDGE EVERETT, of the superior court at Lafayette, Ind., in the case of Helen M. Gougar, decided that women were not entitled to the right of suffrage in Indiana.

THE National Union of Heavy Hardware Dealers began its annual meeting in Louisville, Ky.

THE percentages of the baseball clubs in the National league for the week ended on the 20th were: Boston, 1.000; Cincinnati, 1.090; Pittsburgh, .667; Chicago, .667; New York .500; Brooklyn, .500; Baltimore, .500; Philadelphia, .500; St. Louis, .333; Louisville, .333; Washington, .000; Cleveland, .000.

A TRAIN on the Philadelphia & Reading railroad, struck a wagon containing Mr. and Mrs. Henry Frank, aged 62 and 65 respectively, near Richland, Pa., and both were instantly killed.

THE Chicago Times-Herald and the Chicago Evening Post were purchased by Mr. H. H. Kohlsaat.

THE forty-second regular session of the Wisconsin legislature adjourned sine die.

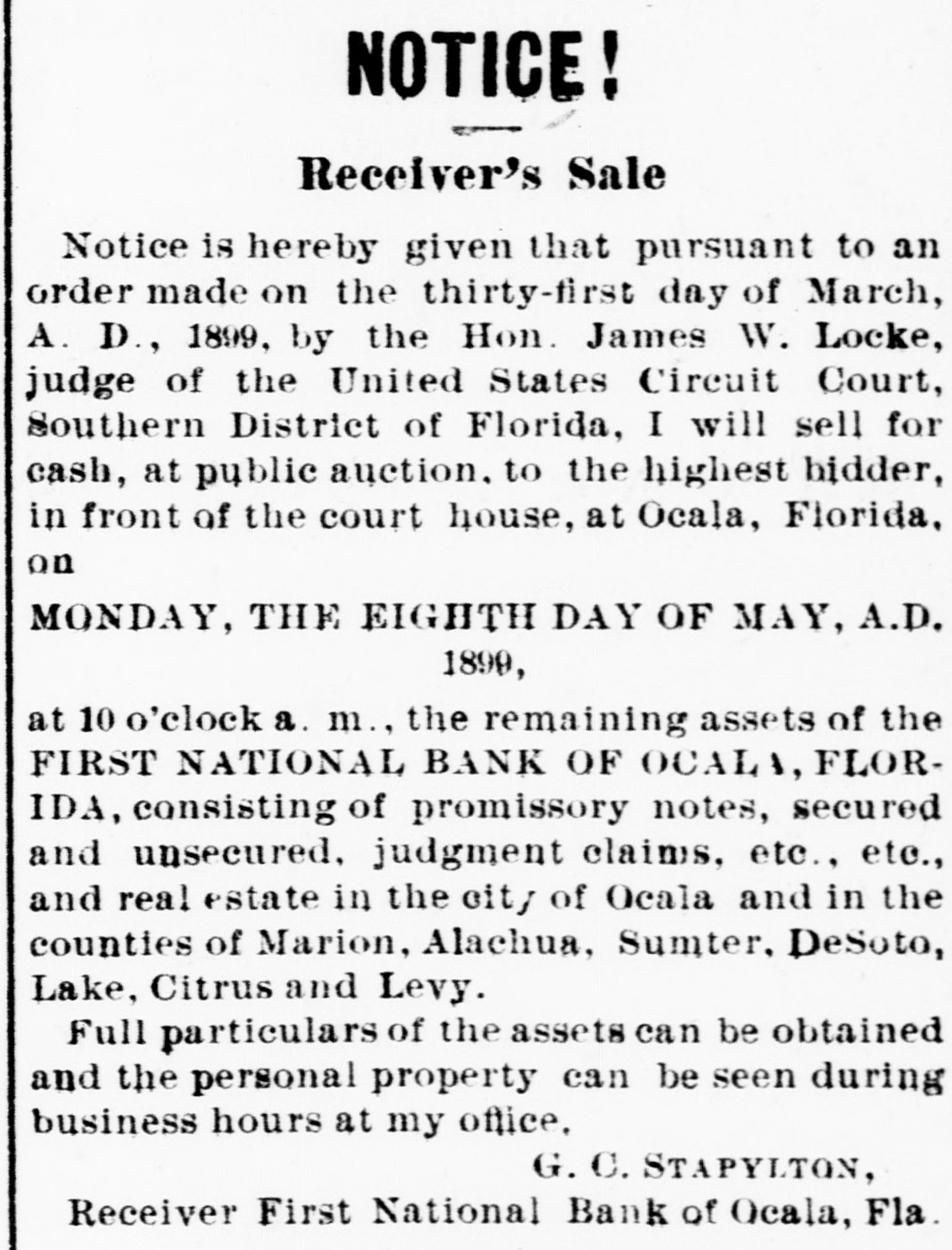

THE First national bank of Ocala, Fla., closed it doors.

LAKESIDE, a summer resort on Pewaukee lake, about twenty miles east of Milwaukee, was destroyed by fire.

DURING a storm at Fort Worth, Tex., a portion of the roof of the tabernacle gave way and fell on part of an audience of 10,000 listening to Evangelist Dwight Moody, fifty persons being injured

MATTHEW CALLOWAY, a negro who