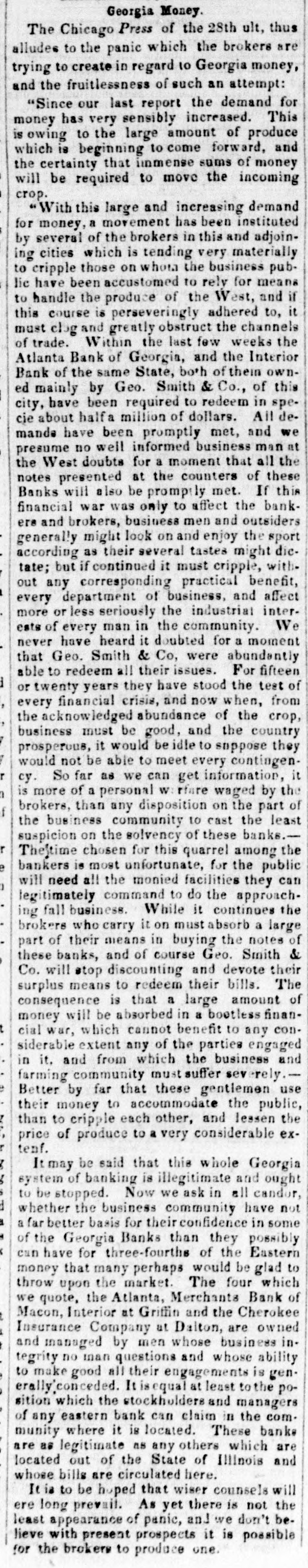

Article Text

Georgia Money. The Chicago Press of the 28th ult, thus alludes to the panic which the brokers are trying to create in regard to Georgia money, and the fruitlessness of such an attempt: "Since our last report the demand for money has very sensibly increased. This is owing to the large amount of produce which is beginning to come forward, and the certainty that immense sums of money will be required to move the incoming crop. "With this large and increasing demand for money, a movement has been instituted by several of the brokers in this and adjoining cities which is tending very materially to cripple those on whom the business public have been accustomed to rely for means to handle the produce of the West, and if this course is perseveringly adhered to, it must chg and greatly obstruct the channels of trade. Within the last few weeks the Atlanta Bank of Georgia, and the Interior Bank of the same State, both of them owned mainly by Geo. Smith & Co., of this city, have been required to redeem in specie about halfa million of dollars. All demande have been promptly met, and we presume no well informed business man at the West doubts for a moment that all the notes presented at the counters of these Banks will also be promptly met. If this financial war was only to affect the bankera and brokers, business men and outsiders generally might look on and enjoy the sport according as their several tastes might dietate; but if continued it must cripple, without any corresponding practical benefit, every department of business, and affect more or less seriously the industrial interests of every man in the community. We never have heard it doubted for a moment that Geo. Smith & Co, were abundantly able to redeem all their issues. For fifteen or twenty years they have stood the test of every financial crisis, and now when, from the acknowledged abundance of the crop, business must be good, and the country prosperous, it would be idle to suppose they would not be able to meet every contingency. So far as we can get information, it is more of a personal W: rfure waged by the brokers, than any disposition on the part of f the business community to cast the least suspicion on the solvency of these banks. The}time chosen for this quarrel among the bankers is most unfortunate, for the public will need all the monied facilities they can legitimately command to do the approaching fall business. While it continues the brokers who carry it on must absorb a large part of their means in buying the notes of these banks, and of course Geo. Smith & Co. will stop discounting and devote their surplus means to redeem their bills. The consequence is that a large amount of money will be absorbed in a bootless financial war, which cannot benefit to any considerable extent any of the parties engaged in it. and from which the business and farming community must suffer severely.Better by far that these gentlemen use their money to accommodate the public, than to cripple each other, and lessen the price of produce to a very considerable extenf. It may be said that this whole Georgia system of banking is illegitimate and ought to be stopped. Now we ask in all candor, whether the business community have not a far better basis for their confidence in some of the Georgia Banks than they possibly can have for three-fourths of the Eastern money that many perhaps would be glad to throw upon the market. The four which we quote, the Atlanta, Merchants Bank of Macon, Interior at Griffin and the Cherokee Insurance Company at Dalton, are owned and managed by men whose business integrity no man questions and whose ability to make good all their engagements is generally'conceded. It isequal at least tothe position which the stockholders and managers of any eastern bank can claim in the com. munity where it is located. These banks are as legitimate as any others which are located out of the State of Illinois and