Article Text

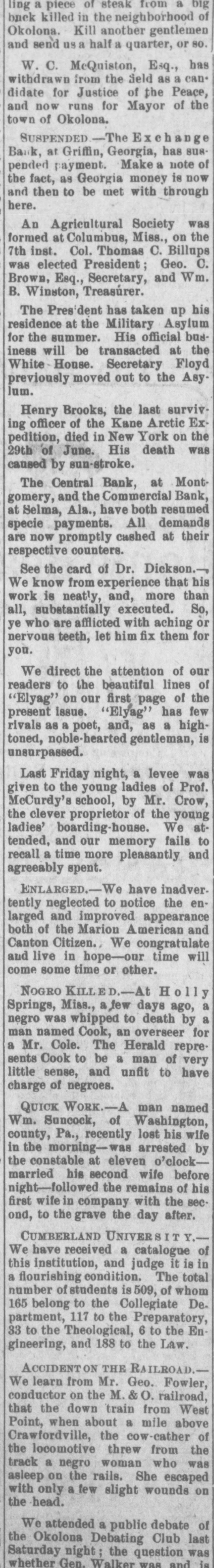

ling a piece of steak from a big back killed in the neighborhood of Okolona. Kill another gentlemen and send us a half a quarter, or so. W. C. McQuiston, Esq., has withdrawn from the Seld as a can* didate for Justice of the Peace, and now runs for Mayor of the town of Okolona. SUSPENDED Exchange Bank, at Griffin, Georgia, has suspended payment. Make a note of the fact, as Georgia money is now and then to be met with through here. An Agricultural Society was formed at Columbus, Miss., on the 7th inst. Col. Thomas C. Billups was elected President ; Geo. C. Brown, Esq., Secretary, and Wm. B. Winston, Treasurer. The President has taken up his residence at the Military Asylum for the summer. His official business will be transacted at the White House. Secretary Floyd previously moved out to the Asylum. Henry Brooks, the last surviving officer of the Kane Arctic Expedition, died in New York on the 29th of June. His death was caused by sun-stroke. The Central Bank, at Montgomery, and the Commercial Bank, at Selma, Ala., have both resumed specie payments. All demands are now promptly cashed at their respective counters. See the card of Dr. Dickson.We know from experience that his work is neatly, and, more than all, substantially executed. So, ye who are afflicted with aching or nervous teeth, let him fix them for you. We direct the attention of our readers to the beautiful lines of "Elyag" on our first page of the present issue. "Elyag" has few rivals as a poet, and, as a hightoned, noble-hearted gentleman, is unsurpassed. Last Friday night, a levee was given to the young ladies of Prof. McCurdy's school, by Mr. Crow, the clever proprietor of the young ladies' boarding-house. We attended, and our memory fails to recall a time more pleasantly and agreeably spent. ENLARGED.-We have inadvertently neglected to notice the enlarged and improved appearance both of the Marion American and Canton Citizen. We congratulate and live in hope-our time will come some time or other. NOGRO KILLED.-At H y Springs, Miss., a few days ago, a negro was whipped to death by a man named Cook, an overseer for a Mr. Cole. The Herald represents Cook to be a man of very little sense, and unfit to have charge of negroes. QUICK WORK.-A man named Wm. Suncock, of Washington, county, Pa., recently lost his wife in the morning-was arrested by the constable at eleven o'clockmarried his second wife before night-followed the remains of his first wife in company with the second, to the grave the day after. CUMBERLAND UNIVERS IT Y.We have received a catalogue of this institution, and judge it is in a flourishing condition. The total number of students is 509, of whom 165 belong to the Collegiate De. partment, 117 to the Preparatory, 33 to the Theological, 6 to the Engineering, and 188 to the Law. ACCIDENT ON THE RAILROAD.We learn from Mr. Geo. Fowler, conductor on the M. & O. railroad, that the down train from West Point, when about a mile above Crawfordville, the cow-cather of the locomotive threw from the track a negro woman who was asleep on the rails. She escaped with only a few slight wounds on the head. We attended a public debate of the Okolona Debating Club last Saturday night; the question was whether Gen. Walker was and is