Article Text

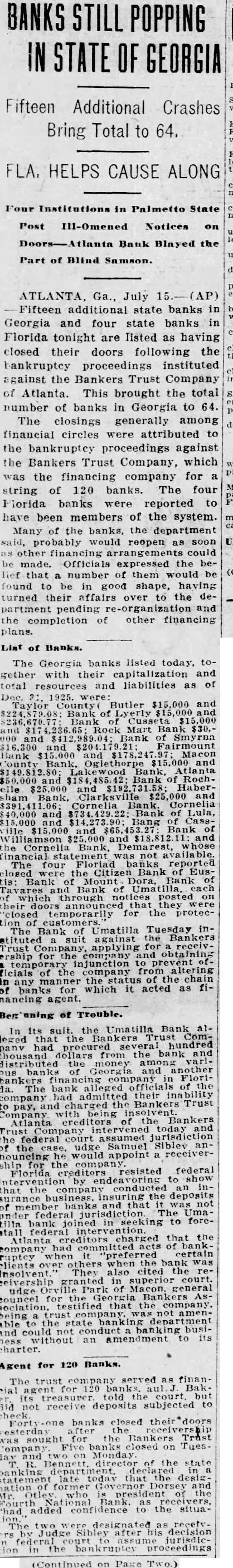

BANKS STILL POPPING IN STATE OF GEORGIA Fifteen Additional Crashes Bring Total to 64. FLA, HELPS CAUSE ALONG Four Institutions in Palmetto State Post III-Omened Notices on Bank Blayed the Part of Blind Samson. ATLANTA, Ga., July (AP) Fifteen additional state banks in Georgia and four state banks in Florida tonight are Tisted as having closed their doors following the bankruptcy proceedings instituted against Bankers Trust Company of Atlanta. This brought the total number of banks in Georgia to 64. The closings generally among financial circles were attributed to the bankruptcy proceedings against the Bankers Trust Company, which was the financing company for a string of 120 banks. The four Florida banks were reported to have been members of the system. Many of the banks, the department probably would reopen as soon other financing arrangements could made. Officials the belief that number of them would be found be good shape, having turned their affairs over to the department pending re-organization and the completion of other financing plans. List Banks. The Georgia banks listed today. tocapitalization and total resources and liabilities as County Butler $15,000 and Bank Cusseta Mart and of $16,300 Bank Macon Atlanta Bank of Roch$25,000 and HaberCornelia Bank. and of Lula, Bang and Cornelia Bank, Demarest, statement was four Floriad reported The the Citizen Bank EusBank Mount Dora, Bank Bank through notices posted they their temporarily protecUmatilla Tuesday inThe Bank against the Bankers suit Trust for obtaining injunction ficials of the company any which it acted as financing agent. oning of Trouble. In its suit. the Umatilla Bank leged the hundred from the bank distributed the money among Georgia another FloriThe alleged company had their Bankers Trust being Atlanta creditors of the the federal Siblev Samuel nouncing would udge appoint receiverresisted federal creditors show that the the deposits that federal The Uma- foretilla joined that the Atlanta company committed when the bank was They also cited the in superior court. the that company. trust amenwithout an amendment its Agent for 120 Banks. for 120 told banks. court. but not receive deposits subjected to banks closed Trust closed on TuesBennett of the state that former added confidence to the situaJudge his decision (Continued on Page Two.)