Article Text

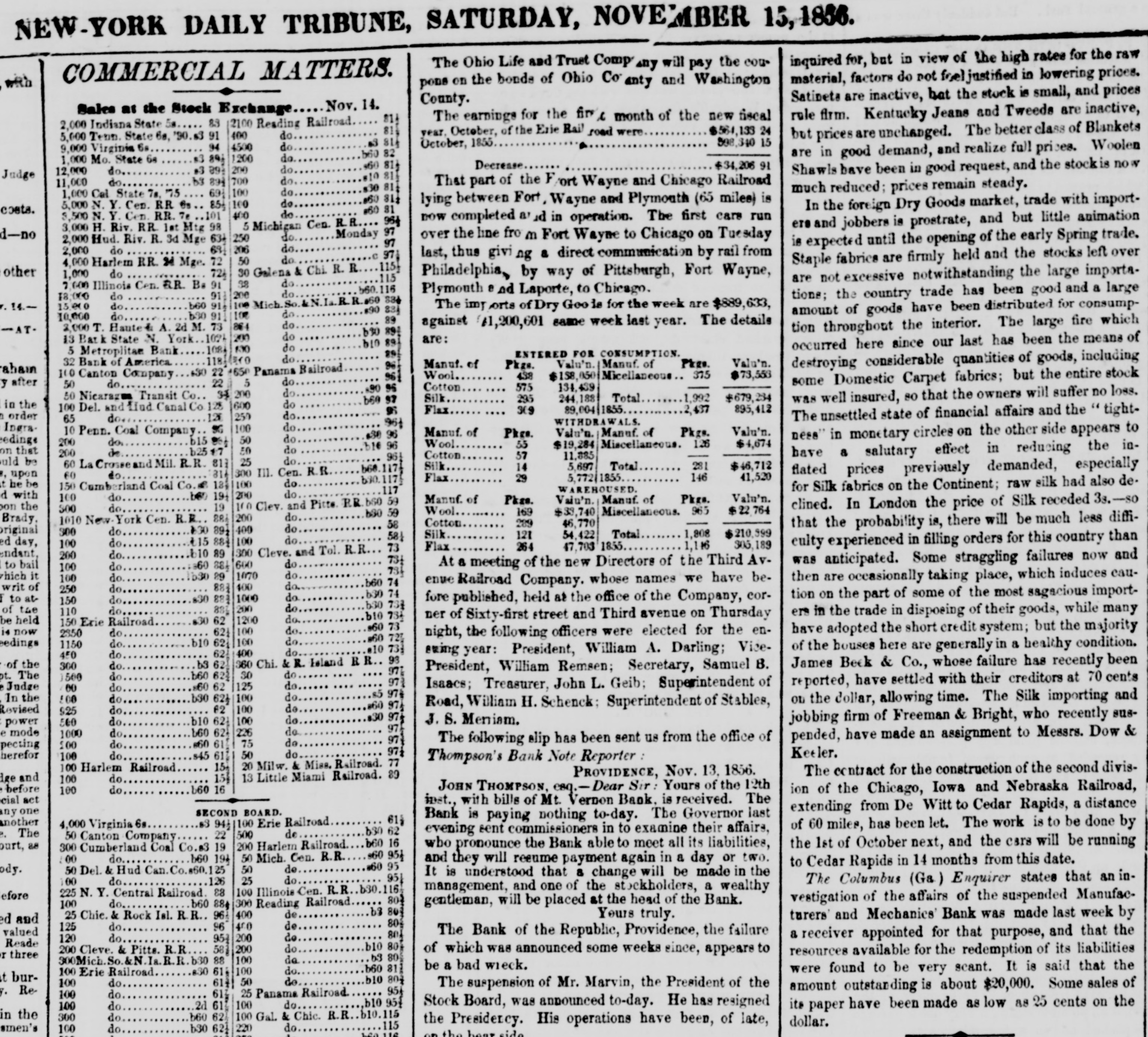

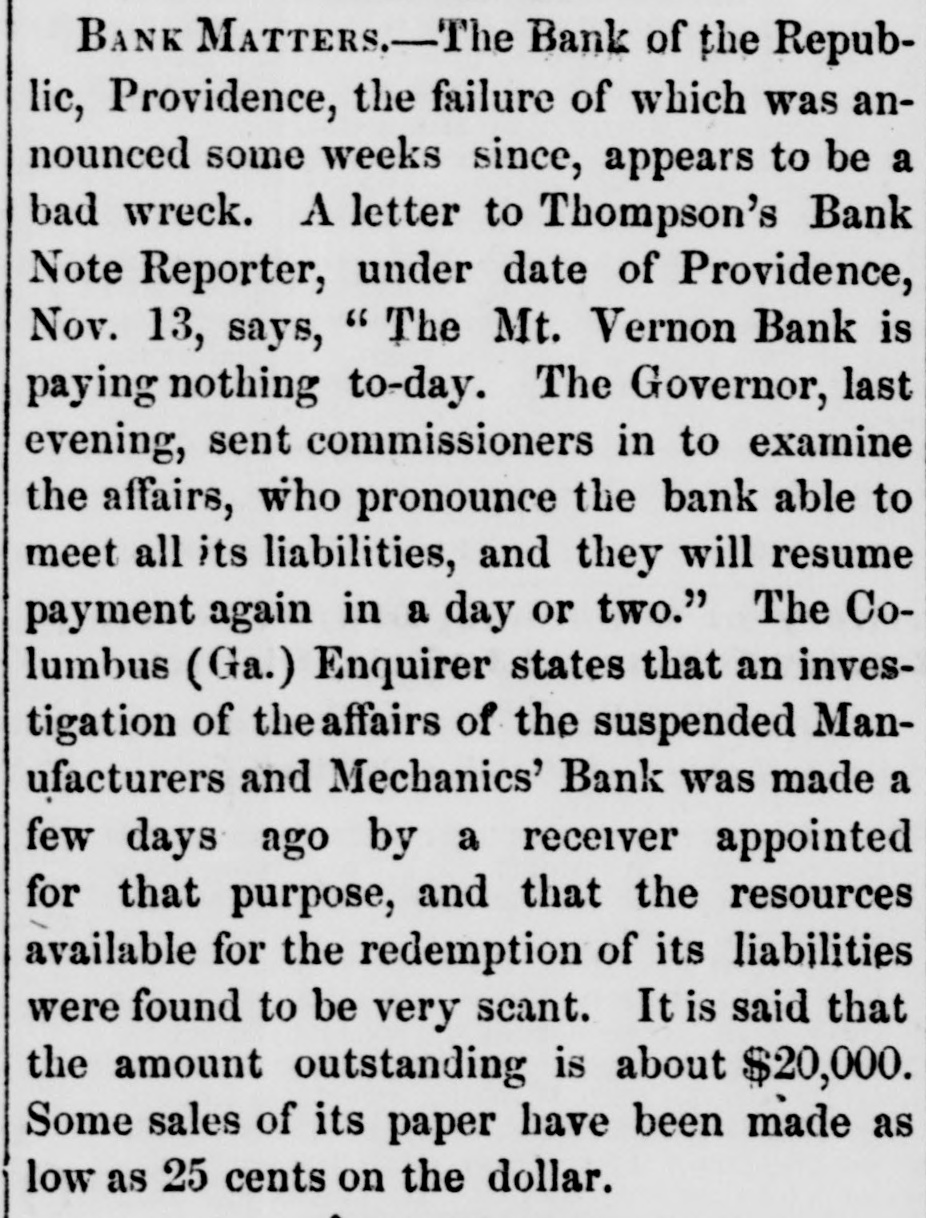

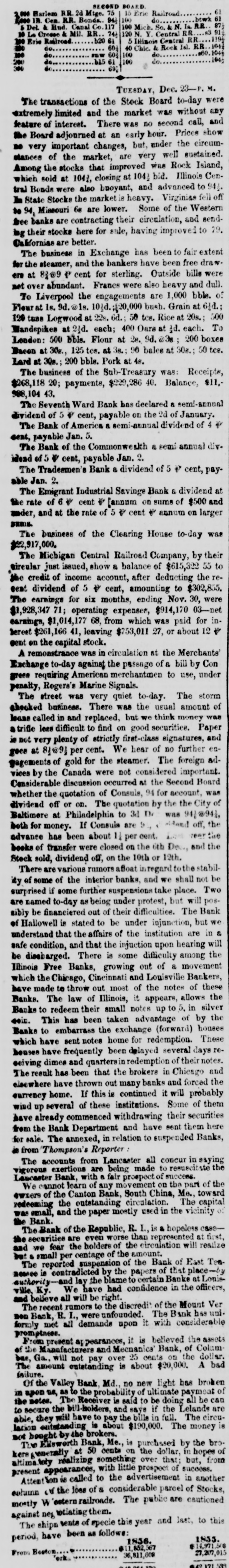

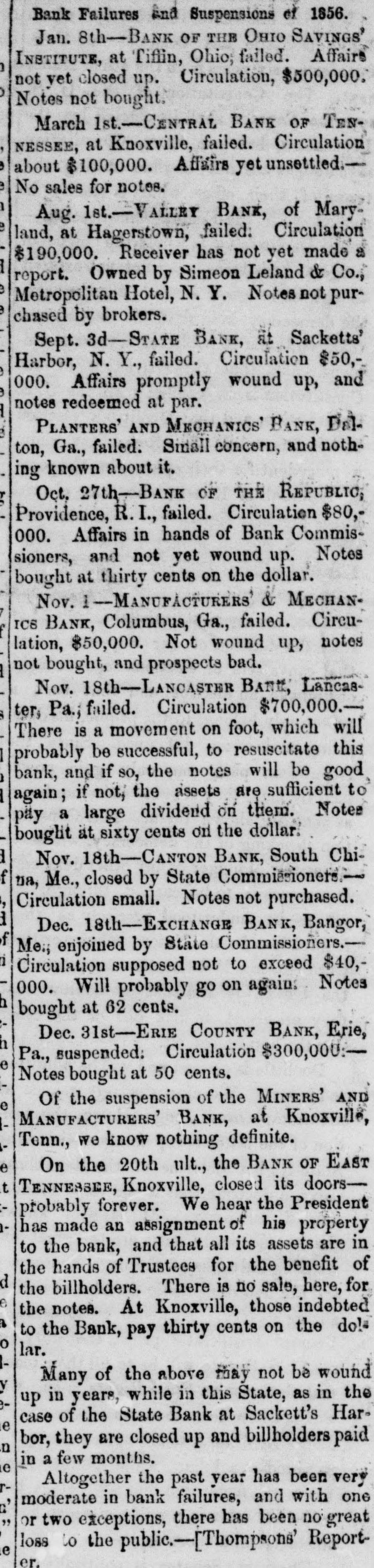

NEW-YORK DAILY TRIBUNE, SATURDAY, NOVEMBER 15,1856. inquired for, but in view of the high rates for the raw The Ohio Life and Trust Comp any will pay the couCOMMERCIAL MATTERS. material, factors do not foel justified in lowering prices. with pons on the bonds of Ohio Co anty and Washington Satinets are inactive, hat the stock is small, and prices County. Nov. 14. Sales at the Stock Exchange rule firm. Kentucky Jeans and Tweeds are inactive, 811 The earnings for the first month of the new fiscal 83 2100 Reading Railroad 2,000 Indiana State 5a 81, $564,133 24 year, October, of the Erie Rail road were do 400 5,000 Tenn. State 6a, 91 but prices are unchanged. The better class of Blankets 53 814 598,340 15 October, 1855 do 94 4500 9,000 Virginia 6s b60 82 are in good demand, and realize full prices. Woolen do 891 1200 1,000 Mo. State 6s s60 814 Decrease $34,206 91 do 200 $389 do Shawls have been in good request, and the stockis now 12,000 Judge #10 81 do 700 by 891 do 11,000 That part of the F/ort Wayne and Chicago Railroad s30 814 much reduced; prices remain steady. do 69 100 1,000 Cal State 7a, 75 #60 81% lying between Fort, Wayne and Plymouth (65 miles) is do 100 85+ 5,000 N. Y. Cen. RR Os In the foreign Dry Goods market, trade with importcosts. #60 81 do 400 3,500 N. Y. Cen. RR. 7a 101 now completed a d in operation. The first care run 964 ers and jobbers is prostrate, and but little animation 5 Michigan Cen. R.R. 3,000 H. Riv. RR. 1st Mtg 98 97 Monday do 250 over the line fro m Fort Wayne to Chicago on Tuesday 2,000 Hud. Riv. R. 3d Mge 63+ 97 is expected until the opening of the early Spring trade. do 206 do 69, 2,000 971 last, thus givi ng a direct communication by rail from do 50 Staple fabrics are firmly held and the stocks left over 4,000 Harlem RR. 2d Mge. 72 1151 other 30 Galena & Chi. R. R. do 72/2 1,000 Philadelphia, by way of Pittsburgh, Fort Wayne, 115 are not excessive notwithstanding the large importado 38 7,000 Illinois Cen. RR. Bs 91 Plymouth e nd Laporte, to Chicago. do 200 911 do tions; the country trade has been good and a large 18,000 #60 881 So Mich 100 do b60 91, 15,000 14The imp orts of Dry Goo for the week are $889,633, #90 831 amount of goods have been distributed for consumpdo 100 b30 91 do 10,000 89 do against $1,200,601 same week last year. The details 864 2,000 T. Haute & A. 2d M. 73 tion throughout the interior. The large fire which b30 891 do 200 are: 13 Bark State N. York 1021 b10 89 occurred here since our last has been the means of do 530 1084 5 Metroplitan Bank 89 ENTERED FOR CONSUMPTION. do 110 118 32 Bank of America Valu'n. Manuf. of Pkgs. Valu'n. Manuf. of 96 Pkgs. destroying considerable quantities of goods, including raham 1650 Panama Bailroad 22 630 Wool 100 Canton Company Micellaneous 375 438 $73,553 96 $158,050 do some Domestic Carpet fubries; but the entire stock after 5 22 do 50 Cotton 575 134,439 80 % do 200 50 Nicarage Transit Co 33 Silk Total $679,234 1,992 295 was well insured, so that the owners will suffer no loss. 244,188 b60 97 in do the 600 100 Del. and flud Canal Co 125 1855 Flax 309 895,412 96 89,004 2,437 order do 250 The unsettled state of financial affairs and the tight12 do 65 WITHDR 961 do Ingra100 SG Valu'n. 10 Penn. Coal Company Manuf. of Manuf. of Valu'n. Pkgs. Pkgs. s30 96 ness" in monetary circles on the other side appears to do 50 edinge do, 200 615 of 126 Wool 55 Miscellaneous. $4,674 $19,284 b10 96 do that 50 b2517 de 200 have a salutary effect in reducing the inCotton 57 11,885 961 do be 25 60 La Crosse and Mil. R.R. 811 281 Silk Total $46,712 14 5,697 b68.1171 flated prices previously demanded, especially 300 III. Cen. R.R. 811 upon 60 do 1855 146 Flax 29 41,520 5,7721 do he be 100 150 Cumberland Coal Co. 18$ for Silk fabrics on the Continent; raw silk had also deWAREHOUSED. 117 do with do beo 194 100 Valu'n. Pkgs. Manuf. of Manuf. of Valu'n Pkgs. clined. In London the price of Silk receded 3s.-so the 200 100 Clev. and Pitte 59 19 do 300 965 Wool $22,764 Miscellaneous. 169 $38,740 b30 59 do 200 Brady, 1010 New York Cen. R.R. 881 Cotton 289 46,770 58 that the probability is, there will be much less diffido 400 1630 89, original do 300 210,599 Total Silk 1,808 121 54,422 581 do 100 15 881 do day, 100 eulty experienced in filling orders for this country than 305,189 1855 Flax 264 1,116 73 47,703 300 Cleve. and Tol. R.R endant, b10 89 do 200 731 was anticipated. Some straggling failures now and do to bail 600 At a meeting of the new Directors of the Third Ava60 881 do 100 734 do it hich 1070 lbso 89 do 100 then are occasionally taking place, which induces caub60 74 enue Railroad Company. whose names we have bedo 400 of writ 881 do 250 630 74 tion on the part of some of the most sagacious importdo atto 1000 s30 884 do fore published, held at the office of the Company, cor150 b30 73% do 200 of tae do 881 110 ers in the trade in disposing of their goods, while many bio 734 ner of Sixty-first street and Third avenue on Thursday do 1200 held s30 62 150 Erie Railroad s60 73 do 100 now have adopted the short credit system; but the majority do 621 2850 night, the following officers were elected for the ens60 723 do 100 do b10 621 1150 eedings of the houses here are generally in a healthy condition. #10 73: do suing year: President, William A. Darling; Vice400 62 do 450 98 the 360 Chi. & R. Island R R of b3 62 James Beck & Co., whose failure has recently been do 300 President, William Remsen; Secretary, Samuel B. 97% do 30 The b60 62 do 1500 97 reported, have settled with their creditors at 70 cents do Judge 6062 125 Isaacs; Treasurer, John L. Geib; Superintendent of do /00 s5 97% do the In 100 do 100 b30 621 on the dollar, allowing time. The Silk importing and #60 97, Road, William H. Schenck; Superintendent of Stables, de 62 Revised 100 do 925 s30 971 do jobbing firm of Freeman & Bright, who recently sus100 b10 621 3. S. Merriam. do 560 power 97 do mode 226 b60 62 do 1000 pended, have made an assignment to Messrs. Dow & 97 The following slip has been sent us from the office of de 75 s60 61 do 100 pecting 971 Keeler. do herefor 50 s45 61 do 100 Thompson's Bank Note Reporter 20 Milw. & Miss. Railroad. 77 15, 100 Harlem Railroad The contract for the construction of the second divisPROVIDENCE, Nov. 13, 1856. and do 13 Little Miami Railroad. 89 154 100 JOHN THOMPSON, esq.- Dear Sir: Yours of the 12th before b60 16 do 100 ion of the Chicago, Iowa and Nebraska Railroad, act inst., with bills of Mt. Vernon Bank. is received. The extending from De Witt to Cedar Rapids, a distance one SECOND BOARD. Bank is paying nothing to-day. The Governor last 611 mother 100 Erie Railroad s8 4,000 Virginia 6s 942 of 60 miles, has been let. The work is to be done by b30 62 evening sent commissioners in to examine their affairs, The de 500 22 50 Canton Company b60 16 as who pronounce the Bank able to meet all its liabilities, the 1st of October next, and the cars will be running 200 Harlem Railroad 300 Cumberland Coal Co.a3 19 s60 951 50 Mich. Cen. R.R. do. b60 194 :00 and they will resume payment again in a day or two. to Cedar Rapids in 14 months from this date. a60 95 de 50 50 Del. & Hud Can $60.125 It is understood that a change will be made in the 951 do 25 126 do The Columbus (Ga) Enquirer states that an in100 management, and one of the stockholders, a wealthy 100 Illinois Cen. R.R b30 116 225 N. Y. Central Railroad 88 804 vestigation of the affairs of the suspended Manufacgentleman, will be placed at the head of the Bank. do. 300 Reading Railroad 100 b60 88, b8 80 de 400 turers' and Mechanics' Bank was made last week by 25 Chie. & Rock Isl. R.R. 96 Yours truly. and 80 de 400 96 do 125 valued The Bank of the Republic, Providence, the failure 801 a receiver appointed for that purpose, and that the de 200 do 120 951 Reade b10 801 do 200 200 Cleve. & Pitts. R.R 581 of which was announced some weeks since, appears to resources available for the redemption of its liabilities three b3 80 de 100 300Mich So Ia b30 88 be a bad wieck. b60 81 were found to be very scant. It is said that the do 100 s30 611 100 Erie Railroad burb10 804 50 de 614 do 100 The suspension of Mr. Marvin, the President of the amount outstanding is about $20,000. Some sales of Re954 61 25 Panama Railroad. do 100 b10 954 Stock Board, was announced to-day. He has resigned do 100 2d 61 do 100 its paper have been made as low as 25 cents on the 115 in the 100 Gal. & Chic. R.R. 300 b60 62 do dollar. the Presidency. His operations have been, of late, 115 do b30 62 do 220 100 on the hear side beo 116