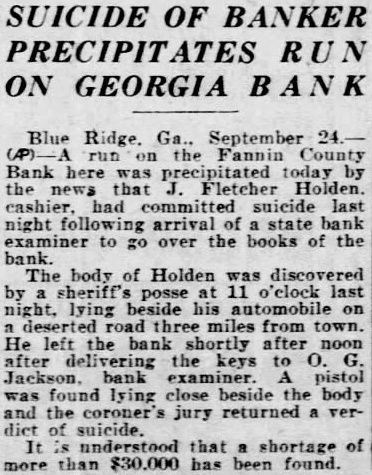

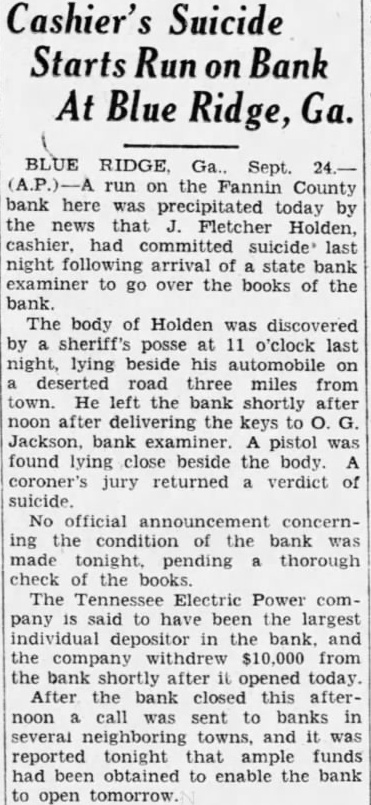

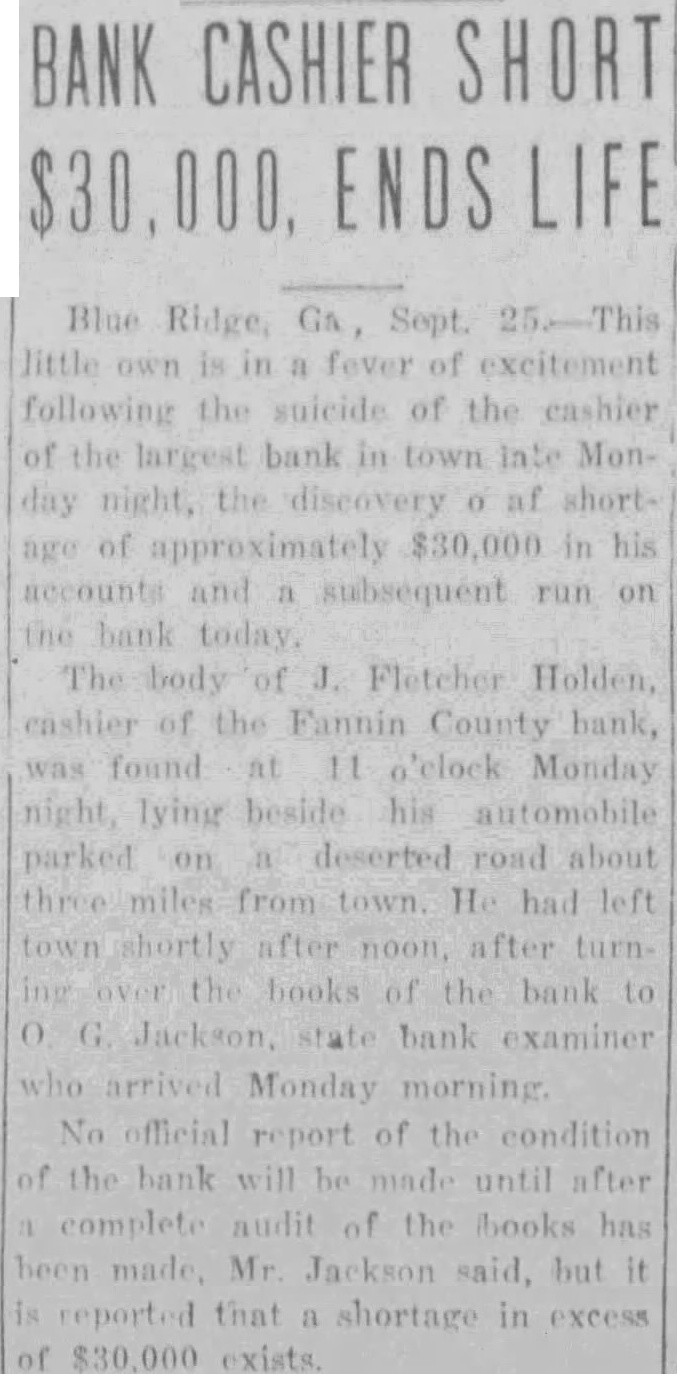

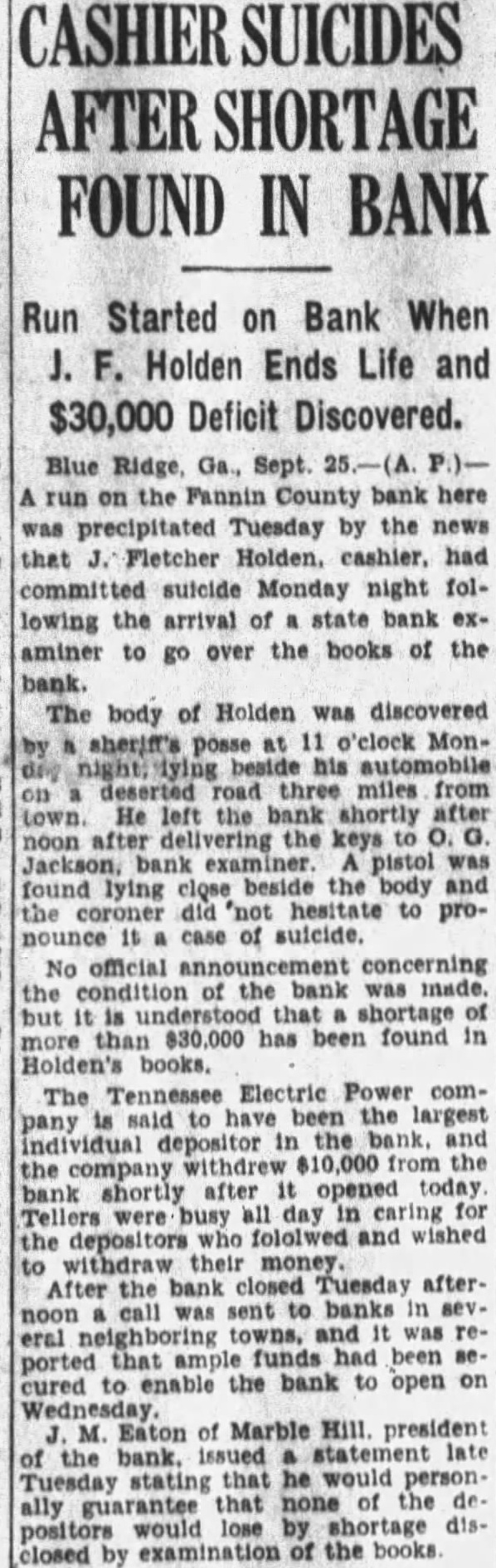

Article Text

SUICIDE OF BANKER PRECIPITATES RUN ON GEORGIA BANK Blue Ridge. Ga., September 24. the Fannin Bank today by that Fletcher Holden. cashier, committed suicide last night following arrival of state bank examiner to go over the books of the bank. The body of Holden was discovered by 11 o'clock last night, lying beside his automobile on deserted three miles from town. He left bank shortly after noon after delivering the keys to bank examiner. pistol was found lying close beside the body the coroner's jury returned verdiet of suicide. It understood that shortage of more than $30,000 has been found.