Click image to open full size in new tab

Article Text

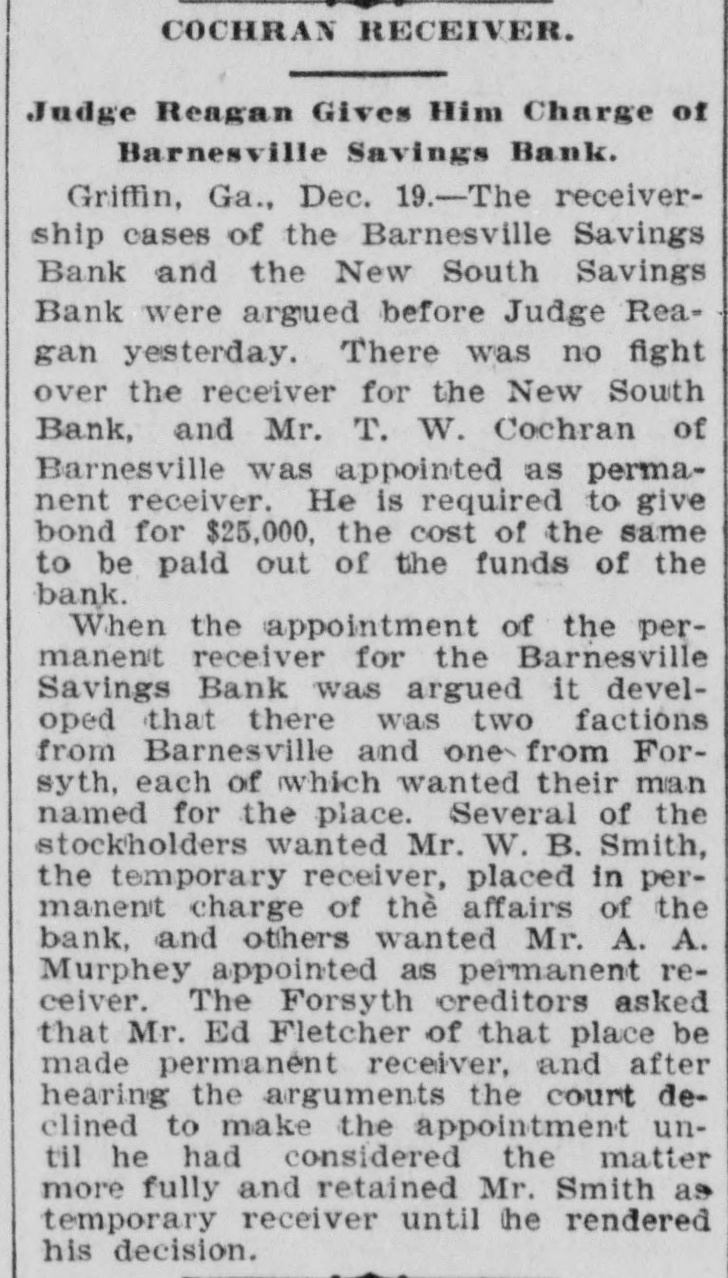

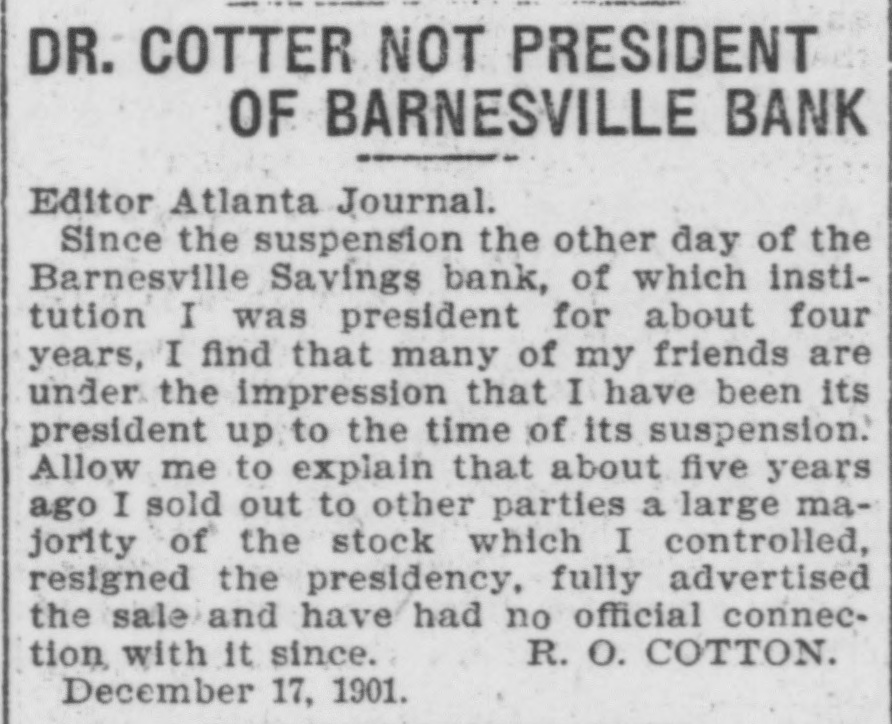

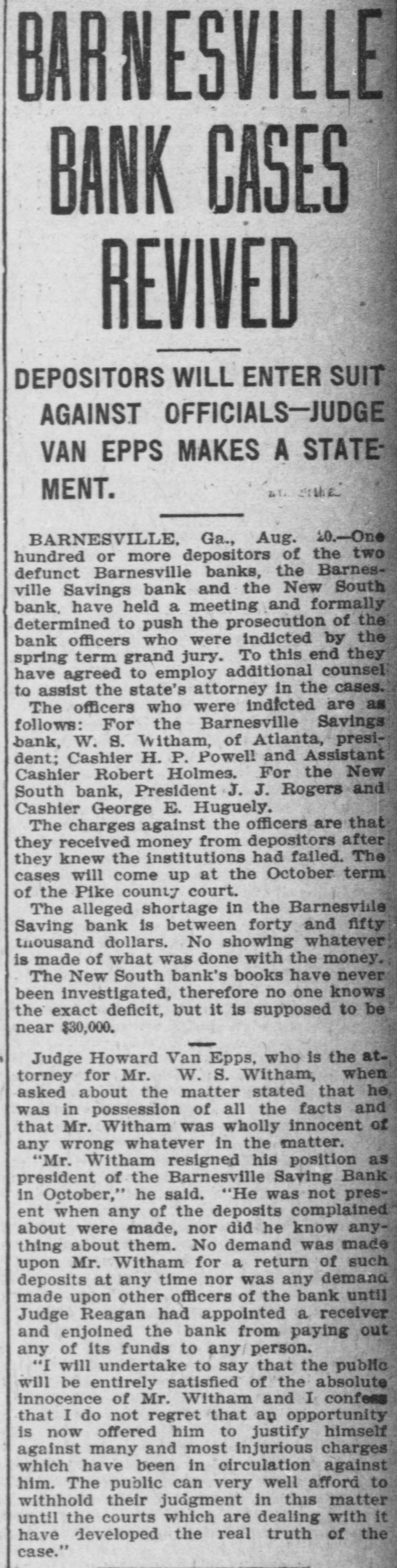

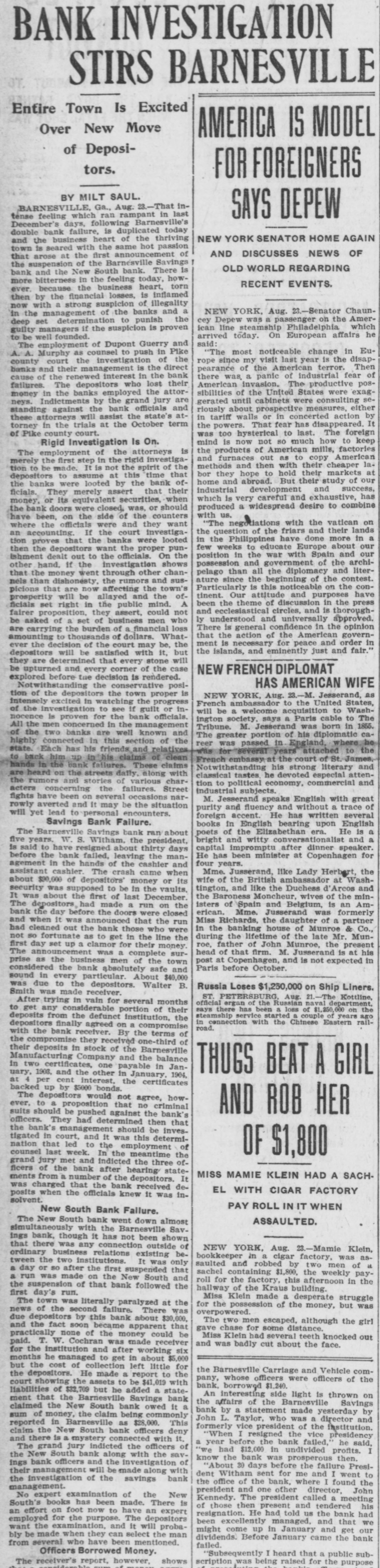

BANK INVESTIGATION STIRS BARNESVILLE Entire Town Is Excited Over New Move AMERICA IS MODEL of Depositors. FOR FOREIGNERS BY MILT SAUL. BARNESVILLE, Ga., Aug. 23.-That inSAYS DEPEW tense feeling which ran rampant in last December's days, following Barnesville's double bank failure, is duplicated today NEW YORK SENATOR HOME AGAIN and the business heart of the thriving town is seared with the same hot passion AND DISCUSSES NEWS OF that arose at the first announcement of the suspension of the Barnesville Savings OLD WORLD REGARDING bank and the New South bank. There is more bitterness in the feeling today, howRECENT EVENTS. ever. because the business heart, torn then by the financial losses, is inflamed now with a strong suspicion of illegality NEW YORK, Aug. 23.-Senator Chaunin the management of the banks and a cey Depew was a passenger on the Amerdeep set determination to punish the ican line steamship Philadelphia which guilty managers if the suspicion is proven arrived today. On European affairs he be well to founded. said: The employment of Dupont Guerry and "The most noticeable change in EuA.A. Murphy as counsel to push in Pike rope since my visit last year is the disapcounty court the investigation of the banks and their management is the direct pearance of the American terror. Then there was, a panic of industrial fear of cause of the renewed interest in the bank American invasion. The productive posfailures. The depositors who lost their sibilities of the United States were exagmoney in the banks employed the attorneys. Indictments by the grand jury are gerated until cabinets were consulting seriously about prospective measures, either standing against the bank officials and in tariff walls or in concerted action by these attorneys will assist the state's atthe powers. That fear has disappeared. It torney in the trials at the October term of Pike county court. was too hysterical to last. The foreign mind is now not so much how to keep Rigid Investigation Is On. the products of American mills, factories The employment of the attorneys is and furnaces out as to copy American merely the first step in the rigid investigamethods and then with their cheaper lation to be made. It is not the spirit of the bor they hope to hold their markets at depositors to assume at this time that home and abroad. But their study of our the banks were looted by the bank ofindustrial development and success, ficials. They merely assert that their which is very careful and exhaustive, has money, or its equivalent securities, when produced a widespread desire to combine the bank doors were closed, was, or should with us. have been, on the side of the counters "The tiations with the vatican on where the officials were and they want the question of the friars and their lands an accounting. If the court investigain the Philippines have done more in a tion proves that the banks were looted few weeks to educate Europe about our then the depositors want the proper punposition in the war with Spain and our Ishment dealt out to the officials. On the possession and government of the archiother hand. if the investigation shows pelago than all the diplomacy and literthat the money went through other chanature since the beginning of the contest. nels than dishonesty, the rumors and susParticularly is this noticeable on the conpicions that are now affecting the town's tinent. Our attitude and purposes have prosperity will be allayed and the ofbeen the theme of discussion in the press ficials set right in the public mind. A and ecclesiastical circles, and is thoroughfairer proposition, they assert, could not ly understood and universally approved. be asked of a set of business men who There is general confidence in the opinion are carrying the burden of a financial loss that the action of the American governamounting to thousands of dollars. Whatment is necessary for peace and order in ever the decision of the court may be, the the Islands, and eminently just and fair. depositors will be satisfied with it, but they are determined that every stone will be upturned and every corner of the case NEW FRENCH DIPLOMAT explored before tue decision is rendered. HAS AMERICAN WIFE Notwithstanding the conservative position of the depositors the town proper is NEW YORK, Aug. 23.-M. Jesserand, as intensely excited in watching the progress French ambassador to the United States, of the investigation to see If guilt or inwill be a welcome acquisition to Washnocence is proven for the bank officials. ington society, says a Paris cable to The All the men concerned in the management Tribune. M. Jesserand was born in 1855. of the two banks are well known and The greater portion of his diplomatic cahighly connected in this section of the reer was passed in England, where he state. Each has his friends and relatives. was for several years attached to the to back him claims of clean French embassy at the court of St. James. hands in the bank failures. These claims his strong literary and are heard on the streets daily, along with classical tastes. he devoted especial attenthe rumors and stories of various chartion to political economy, commercial and acters concerning the failures. Street Industrial subjects. fights have been on several occasions narM. Jesserand speaks English with great rowly averted and It may be the situation purity and fluency and without a trace of will yet lead to personal encounters. foreign accent. He has written several Savings Bank Failure. books in English bearing upon English The Barnesville Savings bank ran about poets of the Elizabethan era. He is a bright and witty conversationalist and a five years. W. S. Witham. the president, capital impromptu after dinner speaker. is said to have resigned about thirty days He has been minister at Copenhagen for before the bank failed, leaving the manfour years. agement in the hands of the cashier and Mme. Jusserand, like Lady Herbert, the assistant cashier. The crash came when wife of the British ambassador at Washabout $90,000 of depositors' money or its tington, and like the Duchess d'Arcos and security was supposed to be in the vaults, the Baroness Moncheur, wives of the minIt was about the first of last December. isters of Spain and Belgium, is an AmThe depositors had made a run on the erican. Mme. Jusserand was formerly bank the day before the doors were closed Miss Richards, the daughter of a partner and when it was announced that the run in the banking house of Munroe & Co., had cleaned out the bank those who were during the lifetime of the late Mr. Munnot so fortunate as to get in the line the roe, father of John Munroe, the present first day set up a clamor for their money. head of that firm. M. Jusserand is at his The was a complete surpost at Copenhagen, and is not expected in prise as the business men of the town Paris before October. considered the bank absolutely safe and sound in every particular. About $40,000 was due to the depositors. Walter B. Russia Loses $1,250,000 on Ship Liners. Smith was made receiver. ST. PETERSBURG, Aug. 21.-The Kottline, After trying in vain for several months ergan of the Russian naval department, says there has been loss of $1,250, 000 on the to get any considerable portion of their steamship service started a couple years ago deposits from the defunct institution, the depositors finally agreed on a compromise road. in connection with the Chinese Eastern railwith the bank receiver. By the terms of the compromise they received one-third of their deposits in stock of the Barnesville Manufacturing Company and the balance in two certificates, one payable in JanTHUGS BEAT A GIRL uary, 1903, and the other in January, 1904, at per cent interest, the certificates backed up by $5000 bonds. The depositors would not agree, however. to a proposition that no criminal AND ROB HER suits should be pushed against the bank's officers. They had determined then that the bank's management should be investigated in court, and it was this determination that led to the employment of counsel last week. In the meantime the OF $1,800 grand jury met and indicted the three officers of the bank after hearing stateMISS MAMIE KLEIN HAD A SACHments from a number of the depositors. It was charged that the bank received deEL WITH CIGAR FACTORY posits when the officials knew It was insolvent. PAY ROLL IN IT WHEN New South Bank Failure. The New South bank went down almost ASSAULTED. simultaneously with the Barnesville Savings bank, though it has not been shown that there was any connection outside of NEW YORK, Aug. 23.-Mamie Klein, ordinary business relations existing bebookkeeper in a cigar factory, was astween the two institutions. It was only saulted and robbed by two men of a a day or so after the first suspended that sachel containing $1,800, the weekly paya run was made on the New South and roll for the factory, this afternoon in the the suspension of that bank followed the hallway of the Kraus building. first day's run. Miss Klein made a desperate struggle The town was literally paralyzed at the for the possession of the money, but was news of the second failure. There was overpowered. due depositors by this bank about $30,000, The two men escaped, although the girl and the fact soon became apparent that gave chase for some distance. practically none of the money could be Miss Klein had several teeth knocked out paid. T. W. Cochran was made receiver and was badly cut about the face. for the institution and after working six months he managed to get in about $5,000 but the cost of collection left little for the Barnesville Carriage and Vehicle comthe depositors. He made a report to the pany, whose officers were officers of the court showing the assets to be $41,019 with bank, borrowed $1,240. liabilities of $32,709 but he added a stateAn interesting side light is thrown on ment that the Barnesville Savings bank the affairs of the Barnesville Savings claimed the New South bank owed it a bank by a statement made yesterday by sum of money, the claim being commonly John L. Taylor, who was a director and reported in Barnesville as $28,000. This formerly vice president of the institution. claim the New South bank officers deny "When resigned the vice presidency and there is mystery connected with it. a year before the bank failed, he said, The grand jury indicted the officers of "We had $12,000 in undivided profits. I the New South bank along with the savknow the bank was prosperous then ings bank officers and the investigation of "About 30 days before the failure Presitheir management will be made along with dent Witham sent for me and I went to the investigation of the savings bank the office of the bank, where found the management. president and one other director, John No expert examination of the New Kennedy. The president called a meeting South's books has been made. There is of those then present and tendered his an effort on foot now to have an expert resignation. He had told us the bank had employed for the purpose. The depositors been excellently managed, and that we want the examination, and it will probamight come up in January and get our bly be made when they can select the man dividends. Before January came the bank from several who have been mentioned. failed. Officers Borrowed Money. "Subsequently I heard that a public subThe receiver's report, however, shows scription was being raised for the purpose