Click image to open full size in new tab

Article Text

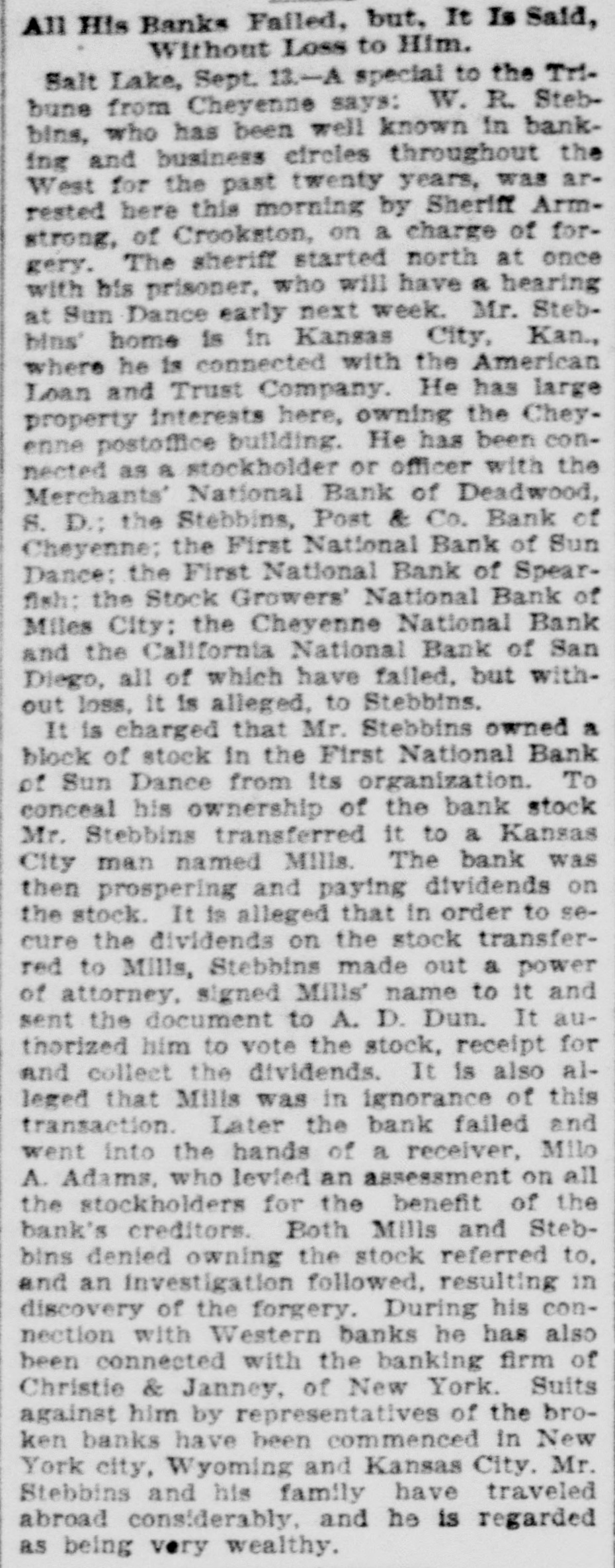

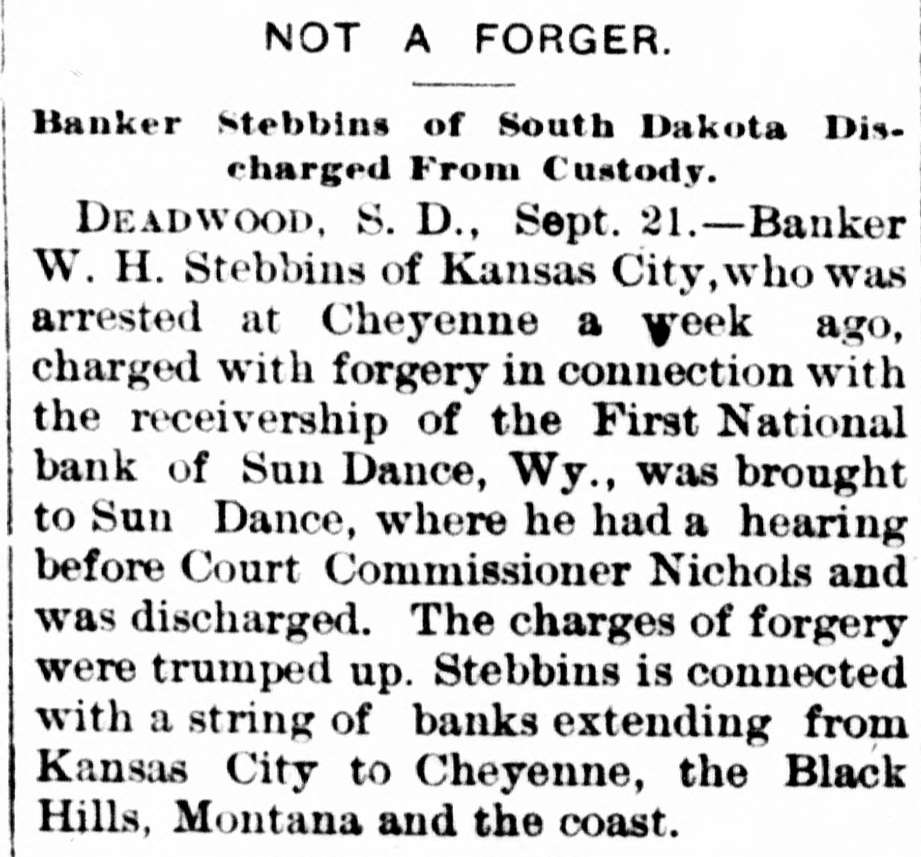

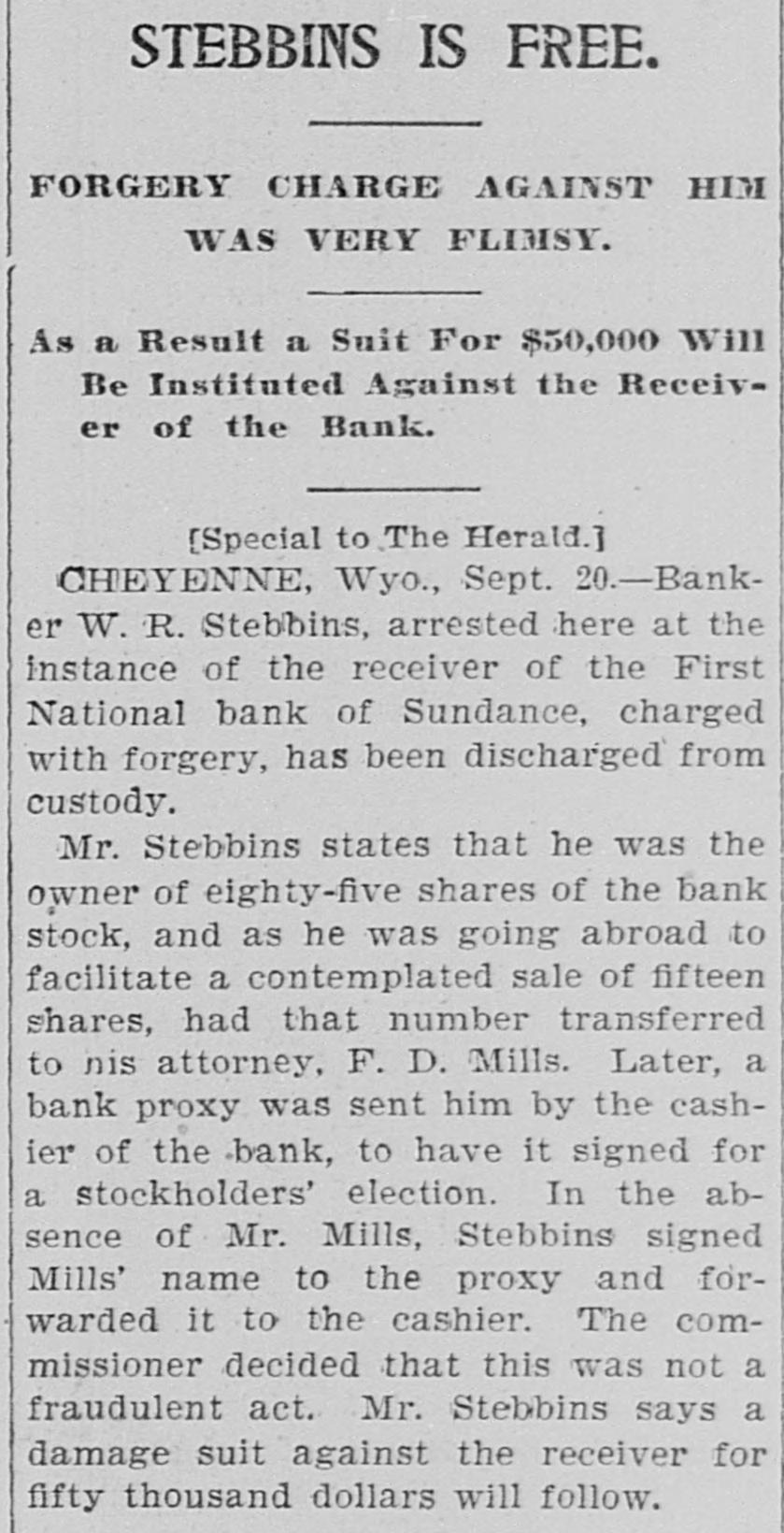

Western News Notes. The Eads, Colorado, creamery has suspended operation in order to enlarge its capacity. The new coal bank opened at Clear mont, Wyoming, is said to produce fine quality of lignite. The treasuries of different counties of Wyoming are reported as being in excellent condition. 0 M. H. Smith, banker at Sterling, has been convicted of receiving deposits after his bank was insolvent. Mrs. Driscoll and her son, who were arrested for murdering Mary Driscoll t at Sterling, have been discharged h The J. B. Wheeler Banking Comh of Colorado sush last July, has depany pended City, paid which all its positors. n Loveland, Colorado, parties are a toll road to to extend it to t propose building thence Estes Park Middle and and North Parks. Carbon, Wyoming, people desire to y purchase the townsite from the Union it Pacific Railroad Company, which now owns the land the town stands on. e E. L. Gilbert, for ten years agent of the Wells Fargo Express Company at c Albuquerque has been arrested charged 8 with embezzling $2,000 from the company is e The Saguache reservoir contract was let to W. E. Dodge of Leadville n for $27,259 and DOW active preparat tions are being made for pushing the I work. Lamar suffered from a fire on the o 23rd. The European hotel and other st buildings were destroyed. The loss e amounted to $7,500 with insurance of e $4,650. t Lincoln county, New Mexico, cattle and horse men have called a meeting S at Lincoln to organize for protection d against sheep herders' invasion from S Texas. f Lander, Wyoming, reports a rich e strike of gold in the Burr mine at r Lewiston. Forty tons of gold quartz has been taken out,yielding from $500 d to $5,000 ton. Four tough Chinamen went into the Methodist Chinese Sunday at Denver last e furious on two Trinity School made a onslaught they Sunday had and Chinamen against whom d grudge. The teachers participated and their lives were saved. f n Johnson county, Wyoming, oil lands are being rapidly entered by e Omaha parties. Last week ninetyy seven entries were recorded, conveyy ing 15,000 acres of oil land in that st county. Johnson county will some day be an immense oil field. is A large number of elk and several of deer and e of wolves, y last week. a by herds pack antelope, invaded The deep snows Bonanza, followed out n is up. were where drove Wyoming, feed them covered of the mountains, They so tame that people shot them down K by wholesale. 6The jury in the United States Court a at at ex-postmaster Cheyenne acquitted Cheyenne, William of Masi, the of of in funds which were rs in the at the postoffice charge Cheyenne having National embezzled bank deposited $1,335 rk time that institution suspended d Wages have been voluntarily raised g at the Ruby -Anthracite coal mine in Gunnison county, Colorado, from 60 I 75 cents ton. The miners are agree is or ably surprised. The company found that it pays better to employ experiW enced miners than to use cheaper la ay bor. p The lumbermen of Colorado, Wy ly is oming and New Mexico met in annual session in Denver on the 23rd. The he et morning was devoted to routine business. Officers were elected as follows: eR. W. English, president; Samuel d, Merrill of Cheyenne, vice president; R. W. Stewart, secretary and treas r urer. oie A colony from Eaton, Colorado, has npurchased potato land north of Chey. ed enne, Wyoming, of the Wyoming De ad velopment Company and will irrigate nd and plant extensively during the enn, suing season. to In the United States court at Chey al enne, Todd M. Pettigrew, of Sundance, Crook county, pleaded guilty to the n charge of embezzlement, and was send tenced to a term of five years in the penitentiary. Pettigrew was the cash is ier of the First National bank of Sun rs dance on the fourth of October last, he when that institution was closed by the bank examiner. The book: a This . national showed $19,000. that Pettigrew money he of owed had the expend works bank ed in buiding a system water as for the city with the expectation of rece alizing on the bonds which the city ch voted. The slump in the money mar on ket stopped all negotiations for the st the bonds, and Pettigrew was e, to skeet his Mr. h has the the sale Pettigrew unable of obligations. sympathy of community is his