Article Text

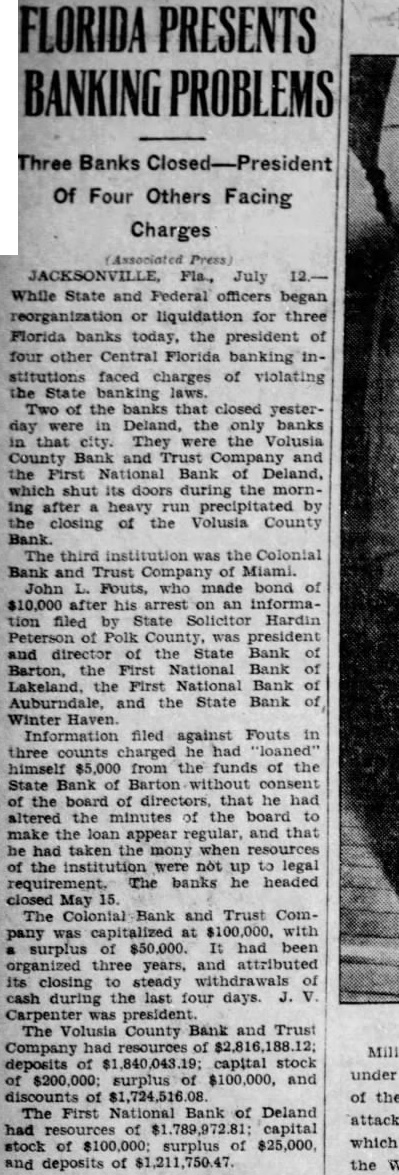

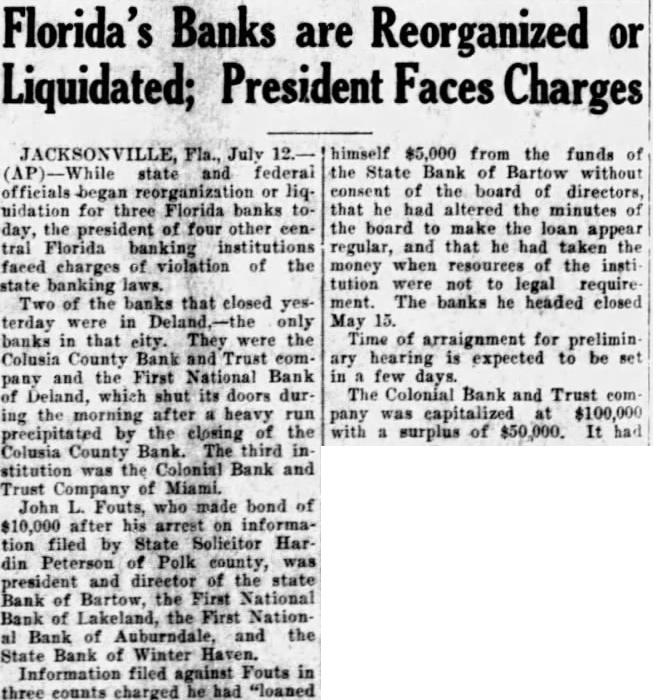

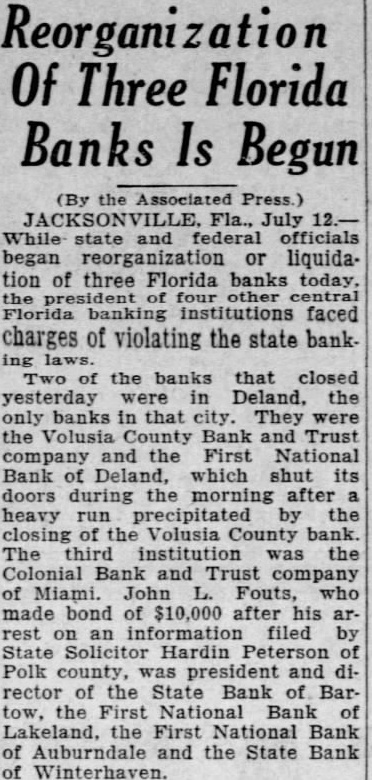

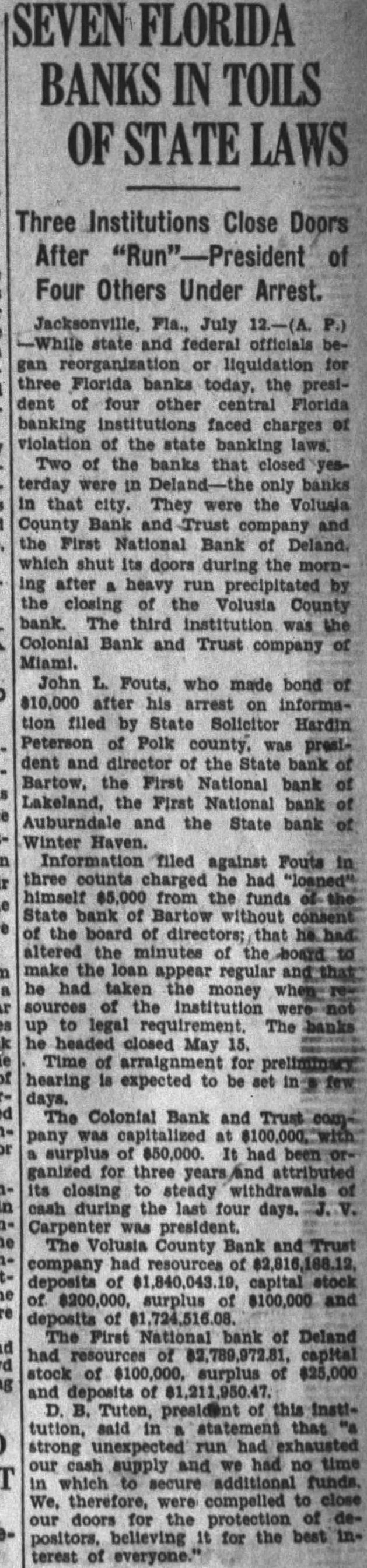

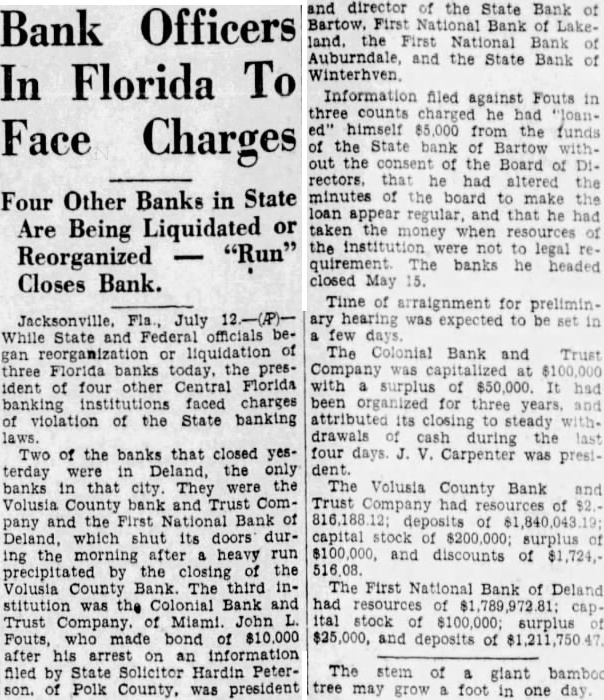

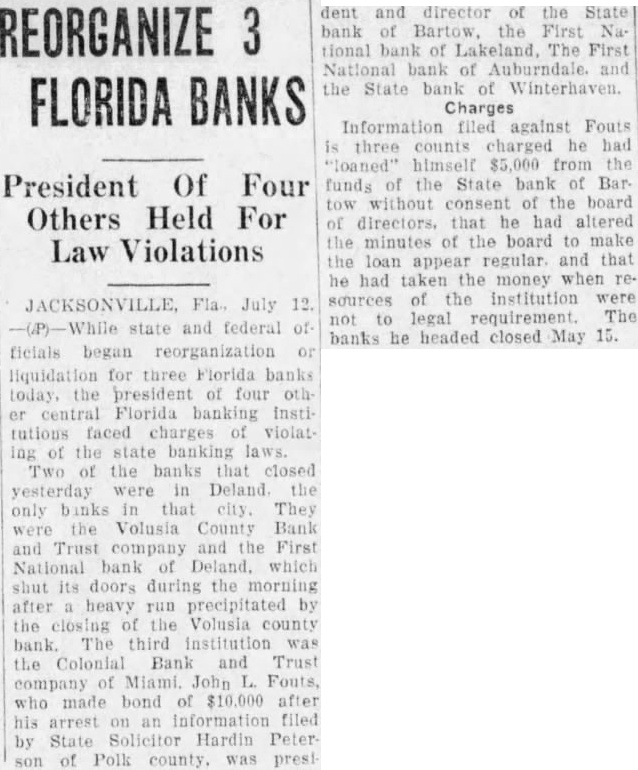

FLORIDA PRESENTS BANKING PROBLEMS Three Banks Closed-President Of Four Others Facing Charges JACKSONVILLE, Fla, July While State and Federal officers began reorganization or liquidation for three Florida banks today, the president of four other Central Florida banking stitutions faced charges of violating the State banking laws. Two of the banks that closed yesterday were in Deland, the only banks in that city. They were the Volusia County Bank and Trust Company and the First National Bank of Deland, which shut its doors during the morning after heavy run precipitated by closing of the Volusia County Bank. The third institution was the Colonial Bank and Trust Company of Miami. John L. Fouts, who made bond of $10,000 after his arrest on an information filed by State Solicitor Hardin Peterson of Polk County, was president and director of the State Bank Barton, the First National Bank of Lakeland, the First National Bank Auburndale, and the State Bank of Winter Haven. Information filed against Fouts in three counts charged he had "loaned" himself $5,000 from the funds of the State Bank of Barton without consent of the board of directors, that he had altered the minutes of the board to make the loan appear regular, and that he had taken the mony when of the institution were not up to legal requirement. The banks he headed closed May 15. The Colonial Bank and Trust Company was capitalized at $100,000. with surplus of $50,000. It had been organized three years, and attributed its closing to steady withdrawals cash during the last four days. J. was president The Volusia County Bank and Trust Company had resources of deposits of capital stock of $200,000; surplus of $100,000, and discounts of $1,724,516.08. The First National Bank of Deland had resources of capital stock of $100,000; surplus of $25,000, and deposits of $1,211,750.47.