Article Text

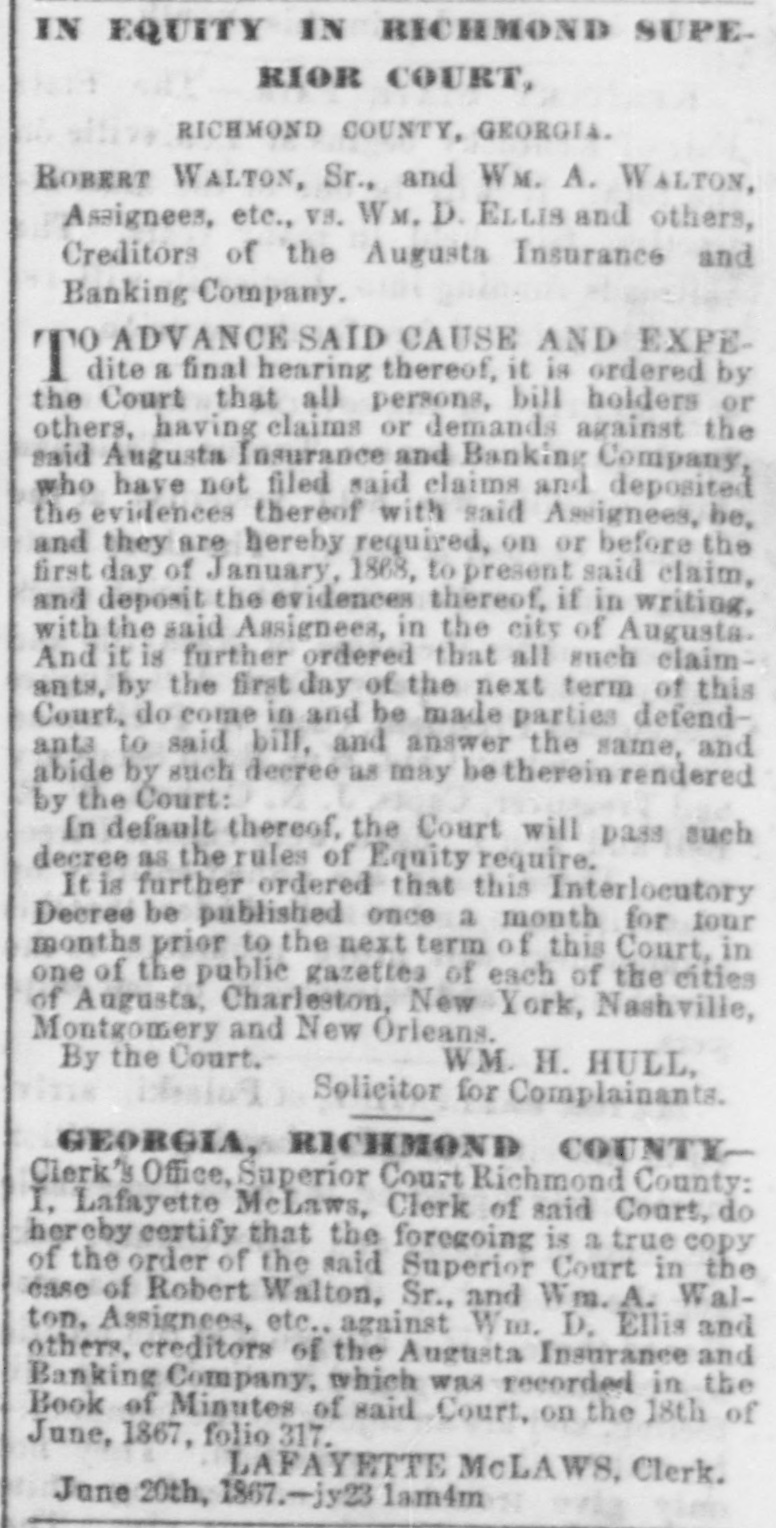

IN EQUITY IN RICHMOND SUPERIOR COURT, RICHMOND COUNTY, GEORGIA. ROBERT WALTON, Sr., and WM. A. WALTON, Assignees, etc., VS. WM. D. ELLIS and others, Creditors of the Augusta Insurance and Banking Company. ADVANCE SAID CAUSE AND EXPETOAN a final hearing thereof, it is ordered by the Court that all persons, bill holders or others, having claims or demands against the said Augusta Insurance and Banking Company, who have not filed said claims and deposited the evidences thereof with said Assignees, be, and they are hereby required, on or before the first day of January, 1868, to present said claim, and deposit the evidences thereof, if in writing. with the said Assignees, in the city of Augusta. And it is further ordered that all such claimants, by the first day of the next term of this Court, do come in and be made parties defendants to said bill, and answer the same, and abide by such decree as may be therein rendered by the Court: In default thereof, the Court will pass such decree as the rules of Equity require. It is further ordered that this Interlocutory Decree be published once a month for four months prior to the next term of this Court, in one of the public gazettes of each of the cities of Augusta, Charleston, New York, Nashville, Montgomery and New Orleans. By the Court. WM. H. HULL, Solicitor for Complainants. GEORGIA, RICHMOND COUNTYClerk's Office, Superior Court Richmond County: I, Lafayette McLaws, Clerk of said Court, do hereby certify that the foregoing is a true copy of the order of the said Superior Court in the éase of Robert Walton, Sr., and Wm. A. Walton, Assignees, etc against Wm. D. Ellis and others, creditors of the Augusta Insurance and Banking Company, which was recorded in the Book of Minutes of said Court, on the 18th of June, 1867, folio 317. LAFAYETTE McLAWS, Clerk. June 20th, 1867.-jy23 1am4m