Article Text

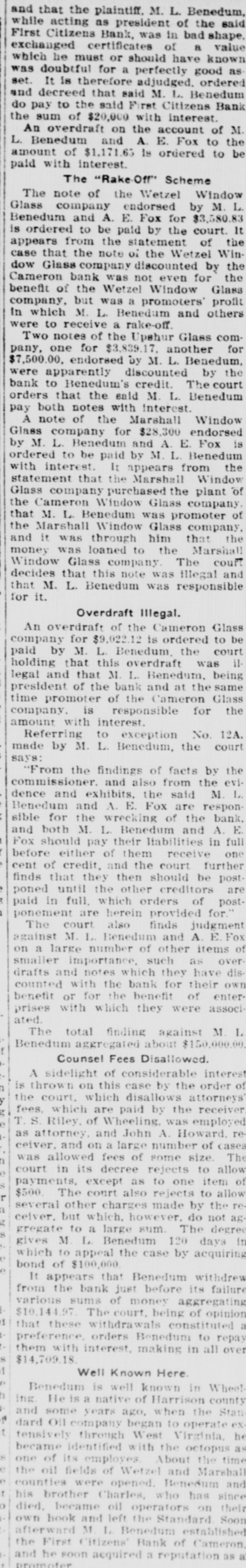

# BANK WRECKING CASE DECIDED and that the plaintiff, M. L. Benedum, while acting as president of the said First Citizens Bank, was in bad shape, exchanged certificates of a value which he must or should have known was doubtful for a perfectly good asset. It is therefore adjudged, ordered and decreed that said M. L. Benedum do pay to the said First Citizens Bank the sum of $20,000 with interest. An overdraft on the account of M. L. Benedum and A. E. Fox to the amount of $1,171.65 is ordered to be paid with interest. ## The "Rake-Off" Scheme The note of the Wetzel Window Glass company endorsed by M. L. Benedum and A. E. Fox for $3,580.83 is ordered to be paid by the court. It appears from the statement of the case that the note of the Wetzel Window Glass company discounted by the Cameron bank was not even for the benefit of the Wetzel Window Glass company, but was a promoters' profit In which M. L. Benedum and others were to receive a rake-off. Two notes of the Upshur Glass company, one for $3,839.17, another for $7,500.00, endorsed by M. L. Benedum, were apparently discounted by the bank to Benedum's credit. The court orders that the said M. L. Benedum pay both notes with Interest. A note of the Marshall Window Glass company for $28,300 endorsed by M. L. Benedum and A. E. Fox is ordered to be paid by M. L. Benedum with interest. It appears from the statement that the Marshall Window Glass company purchased the plant of the Cameron Window Glass company, that M. L. Benedum was promoter of the Marshall Window Glass company, and it was through him that the money was loaned to the Marshall Window Glass company. The court decides that this note was illegal and that M. L. Benedum was responsible for it. ## Overdraft Illegal. An overdraft of the Cameron Glass company for $9,022.12 is ordered to be paid by M. L. Benedum, the court holding that this overdraft was illegal and that M. L. Benedum, being president of the bank and at the same time promoter of the Cameron Glass company, is responsible for the amount with interest. Referring to exception No. 12A, made by M. L. Benedum, the court says: "From the findings of facts by the commissioner, and also from the evidence and exhibits, the said M. L. Benedum and A. E. Fox are responsible for the wrecking of the bank, and both M. L. Benedum and A. E. Fox should pay their liabilities in full before either of them receive one cent of credit, and the court further finds that they then should be postponed until the other creditors are paid in full, which orders of postponement are herein provided for." The court also finds judgment against M. L. Benedum and A. E. Fox on a large number of other items of smaller importance, such as overdrafts and notes which they have discounted with the bank for their own benefit or for the benefit of enterprises with which they were associated. The total finding against M. L. Benedum aggregated about $150,000.00 ## Counsel Fees Disallowed. A sidelight of considerable interest is thrown on this case by the order of the court, which disallows attorneys' fees, which are paid by the receiver. T. S. Riley, of Wheeling, was employed as attorney, and John A. Howard, receiver, and on a large number of cases was allowed fees of some size. The court in its decree rejects to allow payments, except as to one item of $500. The court also rejects to allow several other charges made by the receiver, but which, however, do not aggregate to a large sum. The degree gives M. L. Benedum 120 days in which to appeal the case by acquiring bond of $100,000. It appears that Benedum withdrew from the bank just before its failure various sums of money aggregating $10,144.97. The court, being of opinion that these withdrawals constituted a preference, orders Benedum to repay them with interest, making in all over $14,709.18. ## Well Known Here. Benedum is well known in Wheeling. He is a native of Harrison county and some years ago, when the Standard Oil company began to operate extensively through West Virginia, he became identified with the octopus as sone of its employes. About the time the oil fields of Wetzel and Marshall counties were opened, Benesum and this brother Charles, who has since died, became oil operators on their own hook and left the Standard. Soon afterward M. L. Benedum established the First Citizens' Bank of Cameron, and he soon acquired a reputation as a prom-