Click image to open full size in new tab

Article Text

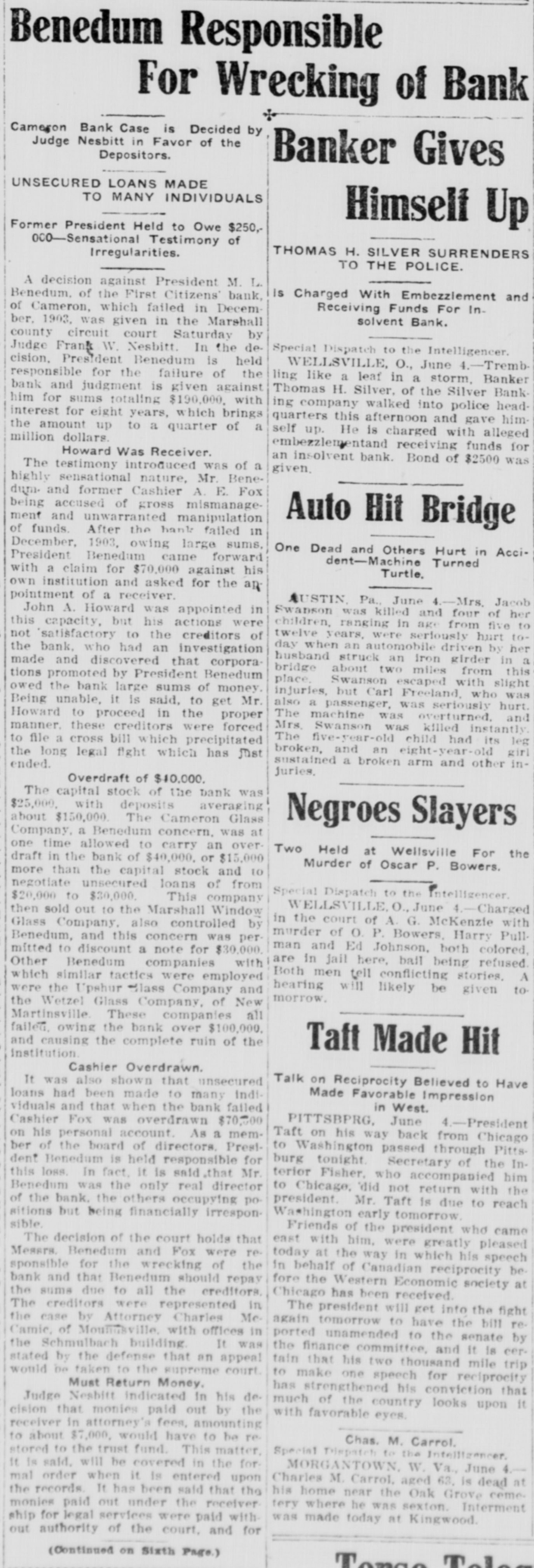

Benedum Responsible For Wrecking of Bank Cameron Bank Case is Decided by Judge Nesbitt in Favor of the Depositors. Banker Gives UNSECURED LOANS MADE TO MANY INDIVIDUALS Himself Up Former President Held to Owe $250,000-Sensational Testimony of Irregularities. THOMAS H. SILVER SURRENDERS TO THE POLICE. A decision against President M. L. Benedum. of the First Citizens' bank, is Charged With Embezzlement and of Cameron, which failed in DecemReceiving Funds For In. solvent Bank. ber. 1903. was given in the Marshall county circuit court Saturday by Judge Frank W. Nesbitt. In the deSpecial Dispatch to the Intelligencer. cision, President Benedum is held WELLSVILLE, O., June 4.-Trembresponsible for the failure of the ling like a leaf in a storm. Banker bank and judgment is given against Thomas H. Silver, of the Silver Bank him for sums totaling $190,000. with ing company walked into police headinterest for eight years, which brings quarters this afternoon and gave himthe amount up to a quarter of a self up. He is charged with alleged million dollars. embezzlementand receiving funds for Howard Was Receiver. an insolvent bank. Bond of $2500 was The testimony introduced was of a given. highly sensational nature, Mr. Benedum. and former Cashier A. E. Fox being accused of gross mismanagement and unwarranted manipulation Auto Hit Bridge of funds After the hank failed in December, 1903, owing large sums, One Dead and Others Hurt in AcciPresident Benedum came forward dent-Machine Turned with a claim for $70,000 against his Turtle. own institution and asked for the ap pointment of a receiver. AUSTIN, Pa., June -Mrs. Jacob John A. Howard was appointed in Swanson was killed and four of her this capacity, but his actions were children, ranging in age from five to not "satisfactory to the creditors of twelve years, were seriously hurt today when an automobile driven by her the bank. who had an investigation husband struck an iron girder in a made and discovered that corporabridge about two miles from this tions promoted by President Benedum Swanson escaped with owed the bank large sums of money. but Carl injuries, place Freeland, who slight was Being unable. it is said, to get Mr. also a passenger. was seriously hurt. Howard to proceed in the proper was and manner. these creditors were forced Mrs. The machine Swanson overturned was killed instantly The five-year-old child had its leg to file a cross bill which precipitated broken, and an eight-year-old girl the long legal fight which has Just sustained a broken arm and other inended. juries. Overdraft of $10,000. The capital stock of the bank was $25,000. with deposits averaging about $150,000. The Cameron Glass Negroes Slayers Company a Benedum concern, was at one time allowed to carry an overTwo Held at Wellsville For the draft in the bank of $40,000. or $15,000 Murder of Oscar P. Bowers. more than the capital stock and to negotiate unsecured loans of from Special Dispatch to the Intelligencer. $20,000 to $30,000. This company WELLSVILLE O., June Charged then sold out to the Marshall Window in the court of A. G. McKenzie with Glass Company also controlled by murder of O. P. Bowers, Harry PullBenedum, and this concern was per mitted to discount a note for $30,000. man and Ed Johnson. both colored. are in jail here, ball being refused Other Benedum companies with Both men tell conflicting stories. A which similar tactics were employed hearing will likely be given to were the Upshur Class Company and morrow the Wetzel Glass Company, of New Martinsville These companies all failed owing the bank over $100,000. and causing the complete ruin of the Taft Made Hit institution Cashier Overdrawn. It was also shown that unsecured Talk on Reciprocity Believed to Have loans had been made to many indiMade Favorable Impression viduals and that when the bank failed in West. Cashier Fox was overdrawn $70.00 PITTSBPRG, June 4.-President on his personal account As a memTaft on his way back from Chicago ber of the board of directors. Presito Washington passed through Pitts dent Benedum is held responsible for burg tonight Secretary of the Inthis loss. In fact. it is said .that Mr. terior Fisher, who accompanied him Benedum was the only real director to Chicago, did not return with the of the bank. the others occupying popresident Mr. Taft is due to reach sitions but being financially irresponWashington early tomorrow. sible. Friends of the president who came The decision of the court holds that east with him. were greatly pleased Messrs. Benedum and Fox were retoday at the way in which his speech sponsible for the wrecking of the in behalf of Canadian reciprocity be bank and that Benedum should repay fore the Western Economic society at the sums due to all the creditors Chicago has been received The creditors were represented in The president will get into the fight the case by Attorney Charles Mc again tomorrow to have the bill reCamic, of Mountabille, with offices in ported unamended to the senate by the Schmulbach building It was the finance committee and it is cerstated by the defense that an appeal tain that his two thousand mile trip would be taken to the supreme court to make one speech for reciprocity Must Return Money. has strengthened his conviction that Judge Nesbitt indicated in his demuch of the country looks upon it cision that monies paid out by the with favorable eyes. receiver in attorney's fees, amounting to about $7,000. would have to be reChas. M. Carrol. stored to the trust fund. This matter Special Dispatch to the Intelligencer it is said. will be covered in the for MORGANTOWN W. Va. June 4. mal order when it is entered upon Charles M. Carrol. aged 63. is dead at the records It has been said that the his home near the Oak Grove ceme. monies paid out under the receiver tery where he was sexton Interment ship for legal services were paid with was made today at Kingwood out authority of the court. and for (Continued on Sixth Page.) Tanga Take