Article Text

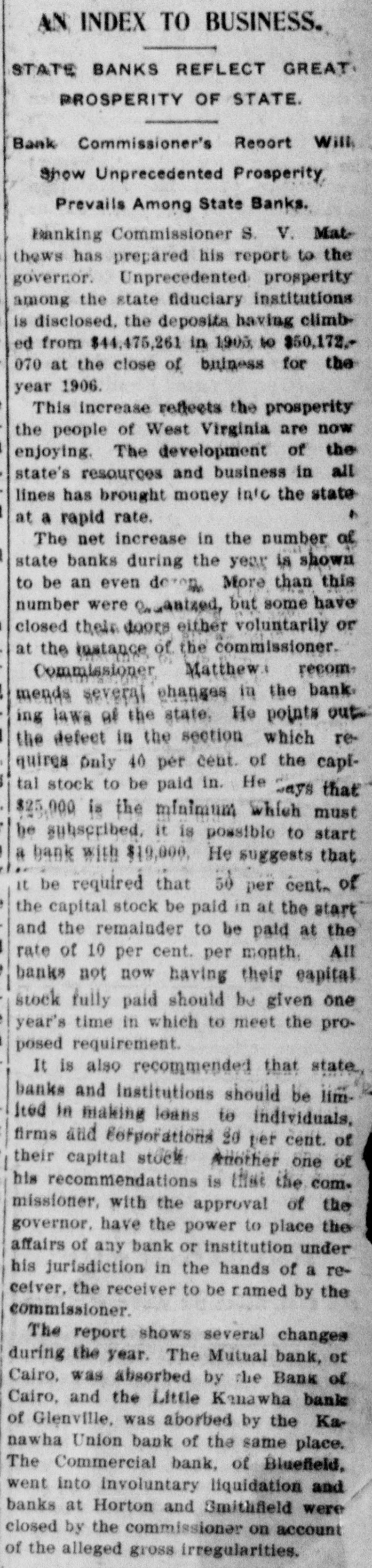

AN INDEX TO BUSINESS. STATE BANKS REFLECT GREAT PROSPERITY OF STATE. Bank Commissioner's Report Will Show Unprecedented Prosperity Prevails Among State Banks. Banking Commissioner S. V. Matthews has prepared his report to the governor. Unprecedented prosperity among the state fiduciary institutions is disclosed, the deposits having climbed from $44,475,261 in 1903 to $50,172.070 at the close of bulness for the year 1906. This increase reflects the prosperity the people of West Virginia are now enjoying. The development of the state's resources and business in all lines has brought money Into the state 4 at a rapid rate. The net increase in the number of state banks during the year is shown to be an even dezen More than this number were anized, but some have closed their doors either voluntarily or at the instance of the commissioner. Commissioner Matthew: recommends several changes in the bank. ing lawa of the state, He points out the defect in the section which requires Only 40 per cent. of the capital stock to be paid in. He ays that $25,000 is the minimum which must be subscribed, it is possible to start a bank with $19,000, He suggests that it be required that 50 per cent. of the capital stock be paid in at the start and the remainder to be paid at the rate of 10 per cent. per month. All banks not now having their capital stock fully paid should be given one year's time in which to meet the proposed requirement. It is also recommended that state banks and Institutions should be limlted in making loans to individuals, firms and Corporations 20 per cent. of their capital stock Another one of his recommendations is that the commissioner, with the approval of the governor. have the power to place the affairs of any bank or institution under his jurisdiction in the hands of a receiver, the receiver to be ramed by the commissioner. The report shows several changes during the year. The Mutual bank, or Cairo, was absorbed by the Bank of Cairo, and the Little Kanawha bank of Glenville, was aborbed by the Kanawha Union bank of the same place. The Commercial bank, of Bluefield, went into involuntary liquidation and banks at Horton and Smithfield were closed by the commissioner on account of the alleged gross irregularities.