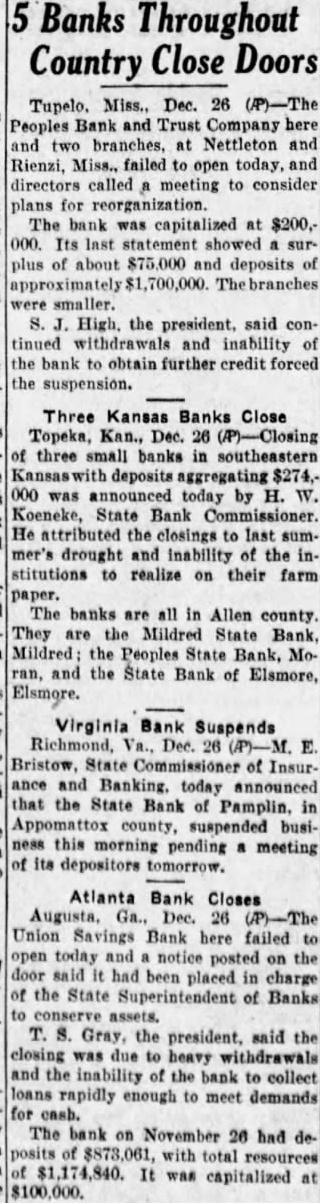

Article Text

Banks Throughout Close Doors Country Miss., Dec. 26 Peoples Bank Trust Company and branches, Nettleton Rienzi, Miss.. failed open directors called meeting to consider plans for The capitalized 000. Its last plus of about and deposits the president, said tinued withdrawals inability the bank obtain further credit forced the suspension. Three Kansas Close Topeka, Kan., Dec. three small banks in southeastern deposits was announced today by Koeneke, State Bank Commissioner. He attributed closings to last mer's drought and inability of the stitutions realize on their farm paper. banks are all in Allen county. They Mildred State Mildred the Peoples State Bank, Moran, the State Bank Elsmore, Elsmore. Virginia Suspends Dec. Bristow, State Commissioner of and today that the State Bank of Pamplin, this pending meeting its depositors Atlanta Bank Closes 26 Union Savings Bank here failed and on the had been placed charge the State Superintendent of Banks