Article Text

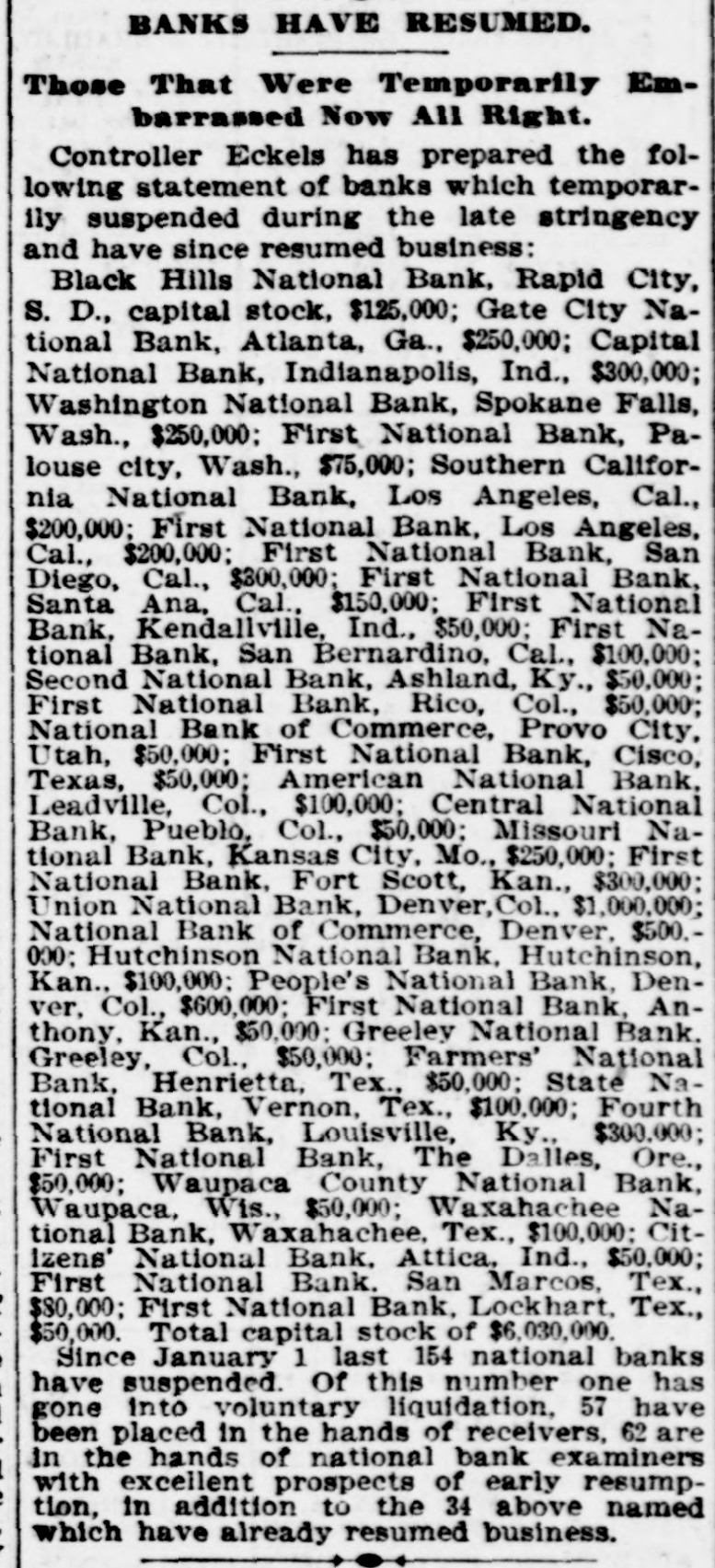

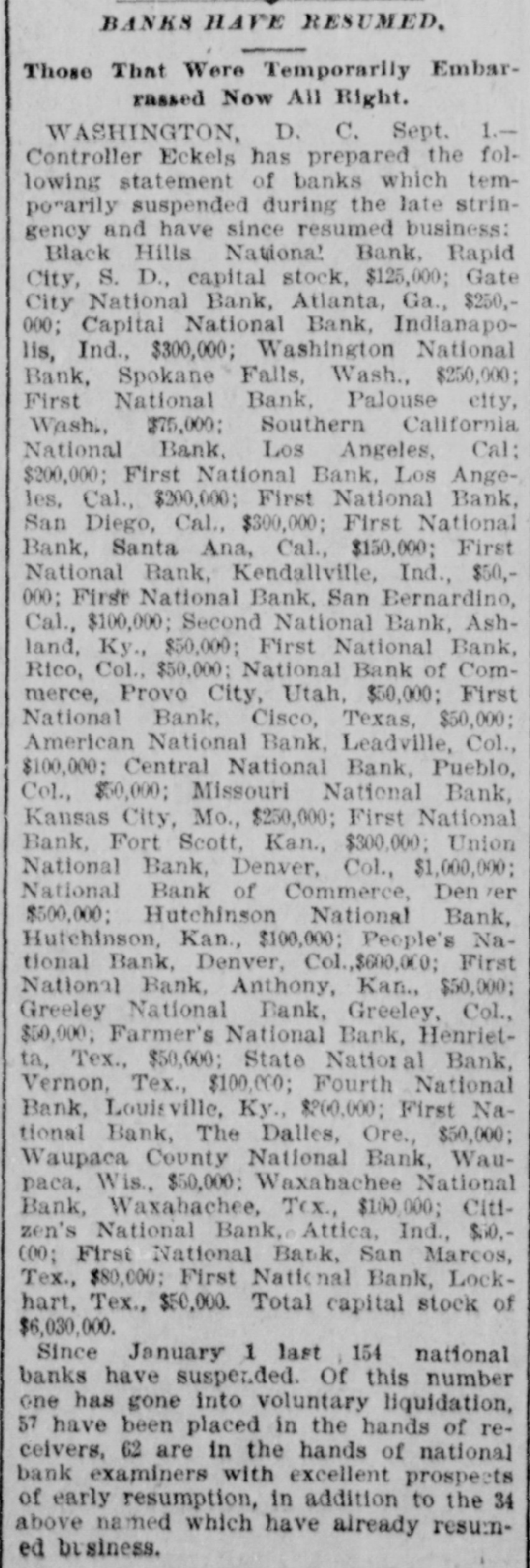

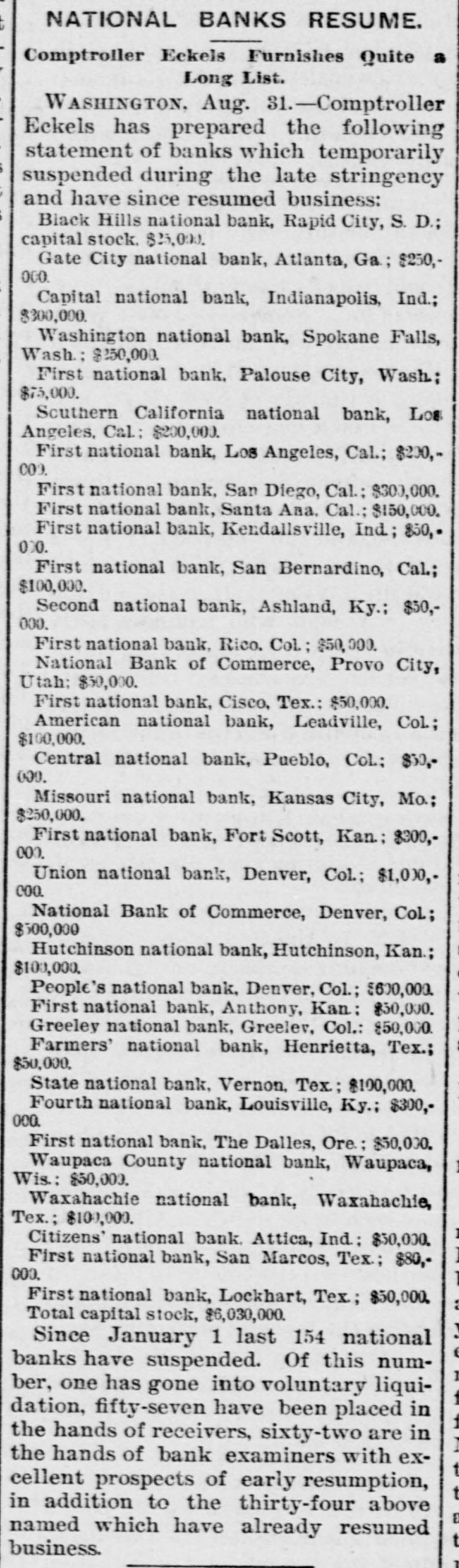

TELEGRAPHIC BREVITIES. The mail stage running between San Renito and the Hernandez Valley, Cal., was robbed Monday afternoon by three armed men. The fight in the Goshen, Ind., opera house last evening between LaBlanche and Dwyer for a purse of $500, resulted in LaBlanche knocking out his opponent in the fifth round. Thomas M. King, second vice-president of the Baltimore and Ohio Rai]way Company has been chosen president of the Pittsburg and Western. The road is now owned by the Baltimore and Ohio. In the silver convention in Chicago to-day ex-Senator Hill, of Colorado, in presenting the report of the committee on resolutions, said "The gold standard countries were in an abyss of industrial misery never experienced in a century as a result of their present condition of prices, while the silver standard countries were comparatively prosperous. The amount of money now locked up and hidden away was more than double all the gold in the country. The silver men would acquiesce in any international arrangement that promised to restore bi-metallic conditions to what they were before 1873." He criticised the men who were incapable of being anything beyond the confines of Wall street. A demand would be made for uncontrovertable paper money that could not be resisted. Among the failures reported to-day are the Denver, Col., Safe Deposit and Trust Company ; the Toronto, Ohio, Banking Company ; the First National Bank of Nampa, Idaho. the First National Bank of Birmingham, Ala. the El Paso, Tex., National Bank, and the Waupaca County, Wis., National Bank. This morning Jesse Crook. ex-superintendent of the Jeffersonville, Ind., Street Car Company, deliberately jumped into the Ohio river with suicidal intent, and was drowned. He was 46 years old and leaves a wife and daughter. Despondency prompted the act. Ex-Vice President Levi P. Morton's immense new barn at Rhinebeck, N.Y.. chicken houses and outbuildings, together with 100 head of Guersney and all farm horses were destroyed by fire this morning. Loss over $100,000. Three burglars overpowered two watchmen and did a neat job on a safe in the office of the Chicago newspaper union lastnight. They secured $15,000 worth of notes and commercial paper and $100 cash. Adam Smith & Co., wholesale liquor dealers, of Chicago, assigned this morning. Liabilities $125,000.