Click image to open full size in new tab

Article Text

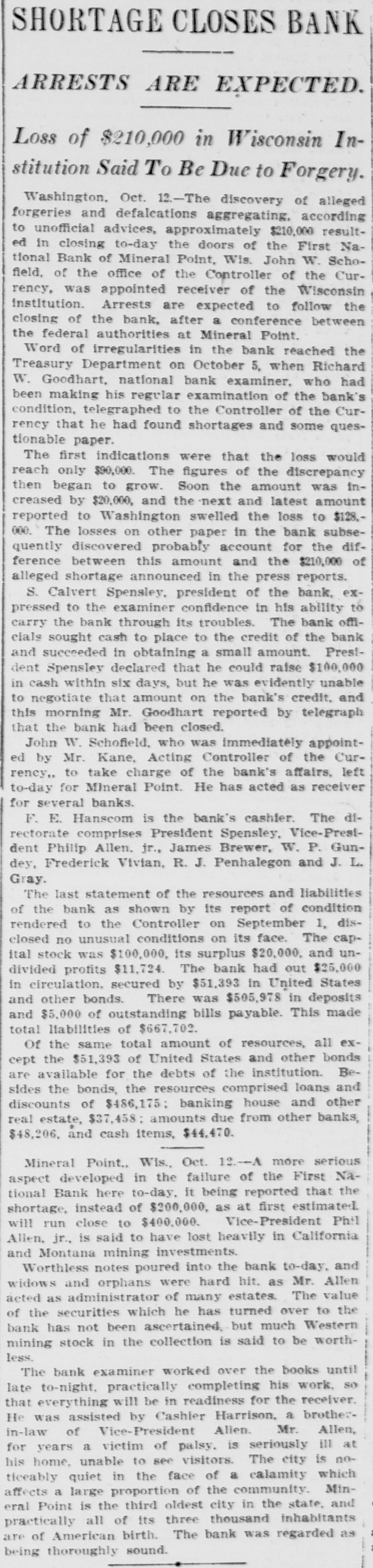

SHORTAGE CLOSES BANK ARRESTS ARE EXPECTED. Loss of $210,000 in Wisconsin Institution Said To Be Due to Forgery. Washington, Oct. 12.-The discovery of alleged forgeries and defalcations aggregating, according to unofficial advices, approximately $210,000 resulted in closing to-day the doors of the First National Bank of Mineral Point, Wis. John W. Schofield, of the office of the Controller of the Currency, was appointed receiver of the Wisconsin institution. Arrests are expected to follow the closing of the bank, after a conference between the federal authorities at Mineral Point. Word of irregularities in the bank reached the Treasury Department on October 5, when Richard W. Goodhart, national bank examiner, who had been making his regular examination of the bank's condition, telegraphed to the Controller of the Currency that he had found shortages and some questionable paper. The first indications were that the loss would reach only $90,000. The figures of the discrepancy then began to grow. Soon the amount was increased by $20,000, and the next and latest amount reported to Washington swelled the loss to $128,000. The losses on other paper in the bank subsequently discovered probably account for the difference between this amount and the $210,000 of alleged shortage announced in the press reports. S. Calvert Spensley, president of the bank, expressed to the examiner confidence in his ability to carry the bank through its troubles. The bank officials sought cash to place to the credit of the bank and succeeded in obtaining a small amount. Prestdent Spensley declared that he could raise $100,000 in cash within six days, but he was evidently unable to negotiate that amount on the bank's credit, and this morning Mr. Goodhart reported by telegraph that the bank had been closed. John W. Schofield, who was immediately appointed by Mr. Kane, Acting Controller of the Currency,, to take charge of the bank's affairs, left to-day for Mineral Point. He has acted as receiver for several banks. F. E. Hanscom is the bank's cashier. The directorate comprises President Spensley, Vice-Prestdent Philip Allen. jr., James Brewer, W. P. Gundey, Frederick Vivian, R. J. Penhalegon and J. L. Gray. The last statement of the resources and liabilities of the bank as shown by its report of condition rendered to the Controller on September 1, disclosed no unusual conditions on its face. The capital stock was $100,000, its surplus $20,000, and undivided profits $11,724. The bank had out $25,000 in circulation. secured by $51,393 in United States and other bonds. There was $505,978 in deposits and $5,000 of outstanding bills payable. This made total liabilities of $667,702. Of the same total amount of resources, all except the $51,393 of United States and other bonds are available for the debts of the institution. Besides the bonds, the resources comprised loans and discounts of $486,175 : banking house and other real estate, $37,458: amounts due from other banks, $48,206. and cash items, $44,470. Mineral Point., Wis., Oct. 12.-A more serious aspect developed in the failure of the First National Bank here to-day, it being reported that the shortage, instead of $200,000, as at first estimated. will run close to $400,000. Vice-President Phil Allen, jr., is said to have lost heavily in California and Montana mining investments. Worthless notes poured into the bank to-day, and widows and orphans were hard hit. as Mr. Allen acted as administrator of many estates. The value of the securities which he has turned over to the bank has not been ascertained, but much Western mining stock in the collection is said to be worthless. The bank examiner worked over the books until late to-night, practically completing his work, so that everything will be in readiness for the receiver. He was assisted by Cashier Harrison, a brotherin-law of Vice-President Allen. Mr. Allen, for years a victim of palsy, is seriously ill at his home, unable to see visitors. The city is noticeably quiet in the face of a calamity which affects a large proportion of the community. Mineral Point is the third oldest city in the state, and practically all of its three thousand inhabitants are of American birth. The bank was regarded as being thoroughly sound.