Click image to open full size in new tab

Article Text

# BIGELOW DEFALCATION

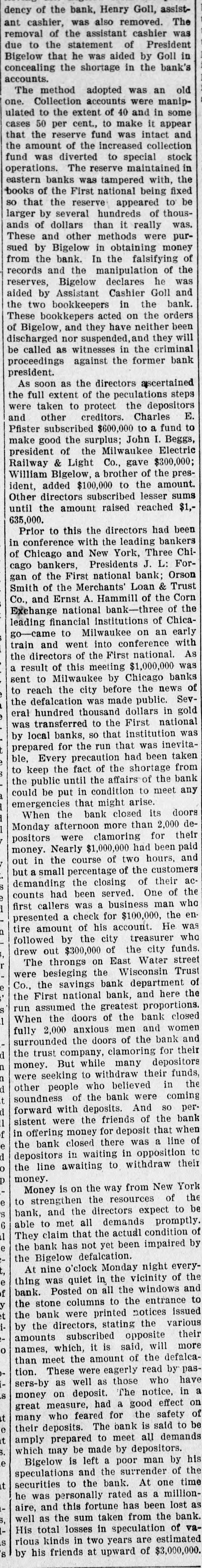

dency of the bank, Henry Goll, assistant cashier, was also removed. The removal of the assistant cashier was due to the statement of President Bigelow that he was aided by Goll in concealing the shortage in the bank's accounts.

The method adopted was an old one. Collection accounts were manipulated to the extent of 40 and in some cases 50 per cent., to make it appear that the reserve fund was intact and the amount of the increased collection fund was diverted to special stock operations. The reserve maintained in eastern banks was tampered with, the books of the First national being fixed so that the reserve appeared to be larger by several hundreds of thousands of dollars than it really was. These and other methods were pursued by Bigelow in obtaining money from the bank. In the falsifying of records and the manipulation of the reserves, Bigelow declares he was aided by Assistant Cashier Goll and the two bookkeepers in the bank. These bookkepers acted on the orders of Bigelow, and they have neither been discharged nor suspended, and they will be called as witnesses in the criminal proceedings against the former bank president.

As soon as the directors ascertained the full extent of the peculations steps were taken to protect the depositors and other creditors. Charles E. Pfister subscribed $600,000 to a fund to make good the surplus; John I. Beggs, president of the Milwaukee Electric Railway & Light Co., gave $300,000; William Bigelow, a brother of the president, added $100,000 to the amount. Other directors subscribed lesser sums until the amount raised reached $1,635,000.

Prior to this the directors had been in conference with the leading bankers of Chicago and New York, Three Chicago bankers, Presidents J. L: Forgan of the First national bank; Orson Smith of the Merchants' Loan & Trust Co., and Ernst A. Hammill of the Corn Exchange national bank-three of the leading financial institutions of Chicago-came to Milwaukee on an early train and went into conference with the directors of the First national. As a result of this meeting $1,000,000 was sent to Milwaukee by Chicago banks to reach the city before the news of the defalcation was made public. Several hundred thousand dollars in gold was transferred to the First national by local banks, so that institution was prepared for the run that was inevitable, Every precaution had been taken to keep the fact of the shortage from the public until the affairs of the bank could be put in condition to meet any emergencies that might arise.

When the bank closed its doors Monday afternoon more than 2,000 depositors were clamoring for their money. Nearly $1,000,000 had been paid out in the course of two hours, and but a small percentage of the customers demanding the closing of their accounts had been served. One of the first callers was a business man who presented a check for $100,000, the entire amount of his account. He was followed by the city treasurer who drew out $300,000 of the city funds.

The throngs on East Water street were besieging the Wisconsin Trust Co., the savings bank department of the First national bank, and here the run assumed the greatest proportions. When the doors of the bank closed fully 2,000 anxious men and women surrounded the doors of the bank and the trust company, clamoring for their money. But while many depositors were seeking to withdraw their funds, other people who believed in the soundness of the bank were coming forward with deposits. And so persistent were the friends of the bank in offering money for deposit that when the bank closed there was a line of depositors in waiting in opposition to the line awaiting to withdraw their money.

Money is on the way from New York to strengthen the resources of the bank, and the directors expect to be able to met all demands promptly. They claim that the actual condition of the bank has not yet been impaired by the Bigelow defalcation.

At nine o'clock Monday night everything was quiet in the vicinity of the bank. Posted on all the windows and the stone columns to the entrance to the bank were printed notices issued by the directors, stating the various amounts subscribed opposite their names, which, it is said, will more than meet the amount of the defalcation. These were eagerly read by passers-by as well as those who have money on deposit. The notice, in a great measure, had a good effect on many who feared for the safety of their deposits. The bank is said to be amply prepared to meet all demands which may be made by depositors.

Bigelow is left a poor man by his speculations and the surrender of the securities to the bank. At one time he was personally rated as a millionaire, and this fortune has been lost as well as the sum taken from the bank. His total losses in speculation of various kinds in two years are estimated by his friends at upward of $3,000,000.