Article Text

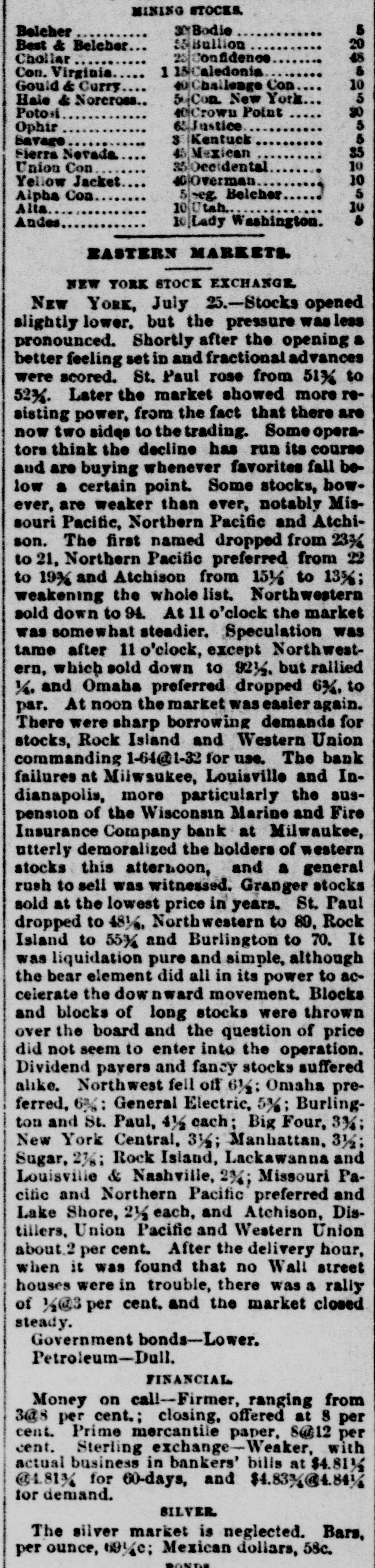

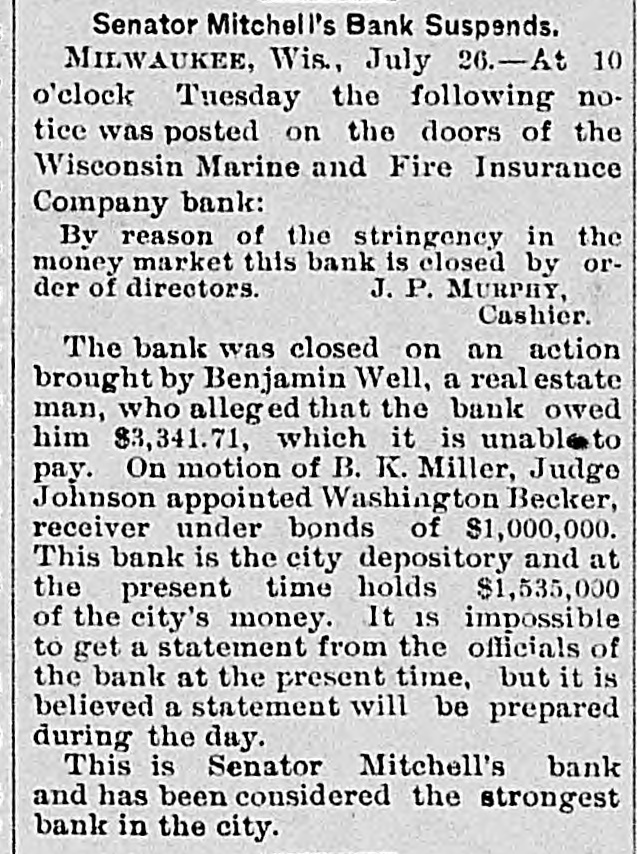

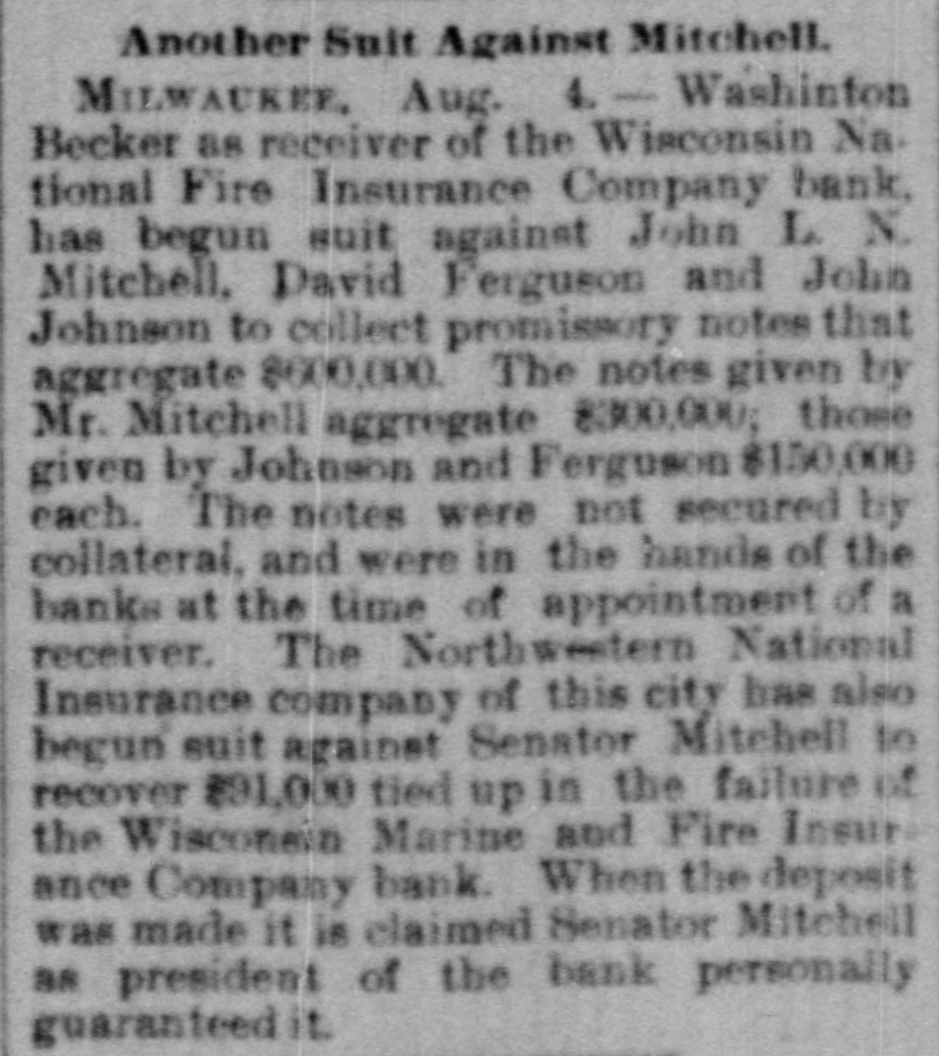

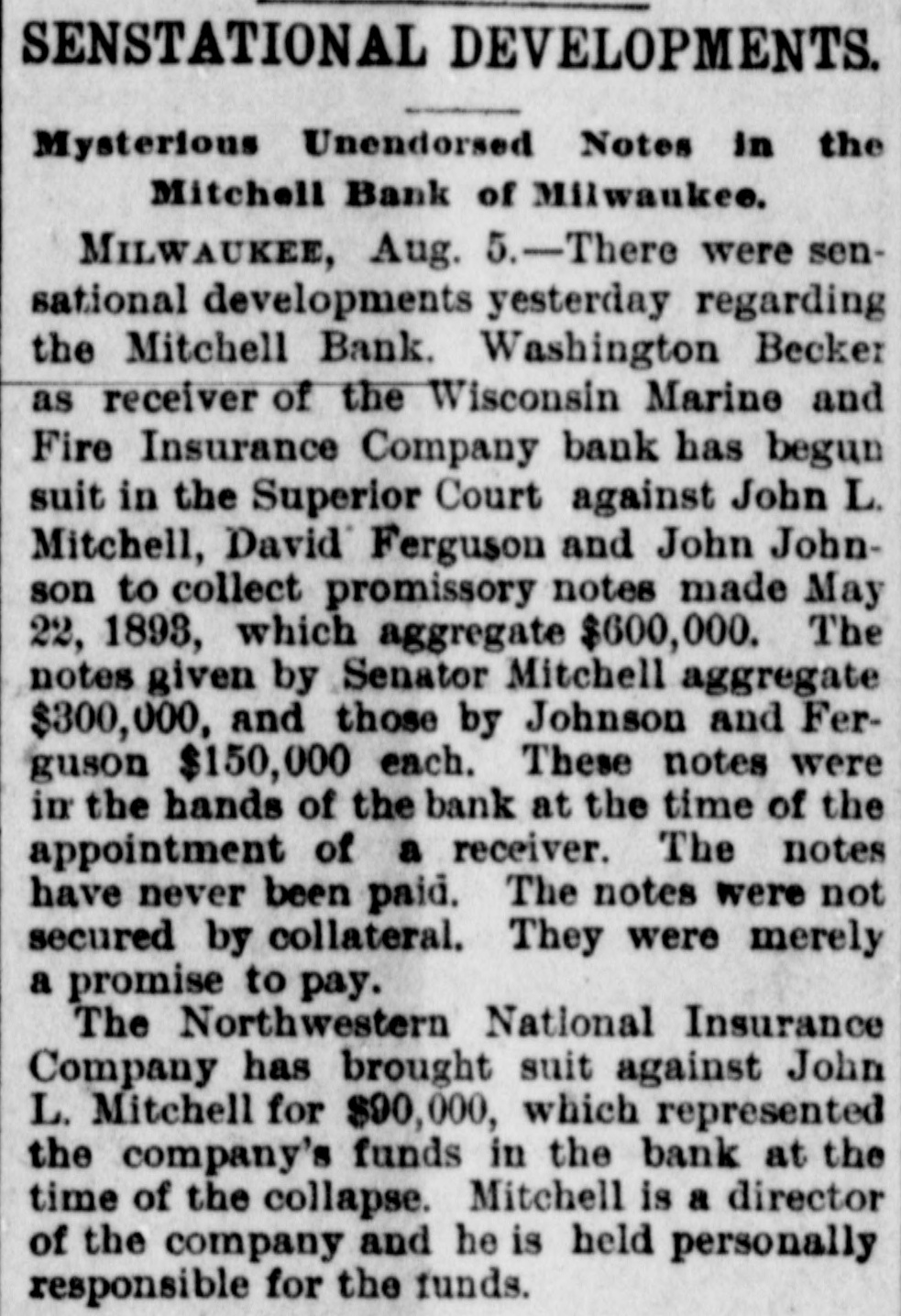

MINING STOCKS. 5 Bodie Belcher 20 55 Bullion Best & Belcher 25 48 Confidence Choller & 15 Caledonia 1 Con. Virginia 10 40 Challenge Con Gould & Curry 5 Con. New York 5 Hale & Noreross 30 Crown Point 40 Potoli 5 65 Justice Ophir 5 Kentuck 3 Savage 35 Mexican 45 Sierra Nevada 10 35 Decidental Union Con Overman 10 40 Yellow Jacket 5 5 eg. Belcher Alpha Con Utah 10 10 Alta 5 10 Andes Lady Washington. EASTERN MARKETS. NEW YORK STOCK EXCHANGE. NEW YORK, July 25.-Stocks opened slightly lower. but the pressure was less pronounced. Shortly after the opening a better feeling set in and fractional advances were scored. St. Paul rose from 51% to 523/4. Later the market showed more resisting power, from the fact that there are now two sides to the trading. Some operators think the decline has run its course and are buying whenever favorites fall below a certain point. Some stocks, however, are weaker than ever, notably Missouri Pacific, Northern Pacific and Atchison. The first named dropped from 233/2 to 21, Northern Pacific preferred from 22 to 19% and Atchison from 15½ to 13%; weakening the whole list. Northwestern sold down to 94. At 11 o'clock the market was somewhat steadier. Speculation was tame after 11 o'clock, except Northwestern, which sold down to 92½. but rallied 1/4. and Omaha proferred dropped 6%, to par. At noon the market was easier again. There were sharp borrowing demands for stocks, Rock Island and Western Union commanding 1-64@1-32 for use. The bank failures at Milwsukee, Louisville and Indianapolis, more particularly the suspension of the Wisconsin Marine and Fire Insurance Company bank at Milwaukee, utterly demoralized the holders of western stocks this atternoon, and a general rush to sell was witnessed. Granger stocks sold at the lowest price in years. St. Paul dropped to 48½ Northwestern to 89, Rock Island to 55% and Burlington to 70. It was liquidation pure and simple, although the bear element did all in its power to accelerate the dow nward movement. Blocks and blocks of long stocks were thrown over the board and the question of price did not seem to enter into the operation. Dividend payers and fancy stocks suffered alike. Northwest fell off 6½: Omaha preferred, 6%: General Electric, 5%; Burlington and St. Paul, 4½ each; Big Four, 33/4; New York Central, 3½; Manhattan, 3½; Sugar, 2½; Rock Island, Lackawanna and Louisville & Nashville, 2%; Missouri Pacitic and Northern Pacific preferred and Lake Shore, 2½ each, and Atchison, Distillers, Union Pacific and Western Union about.2 per cent. After the delivery hour, when it was found that no Wall street houses were in trouble, there was a rally of 1/2@3 per cent. and the market closed steady. Government bonds-Lower. Petroleum-Dull. FINANCIAL Money on call-Firmer, ranging from 3@8 per cent.; closing, offered at 8 per cent. Prime mercantile paper, S@12 per cent. Sterling exchange-Weaker, with actual business in bankers' bills at $4.811/2 @4.81% for 60-days, and $4.83%@4.84% for demand. SILVER. The silver market is neglected. Bars, per ounce, 691/20; Mexican dollars, 58c. BONDS