Article Text

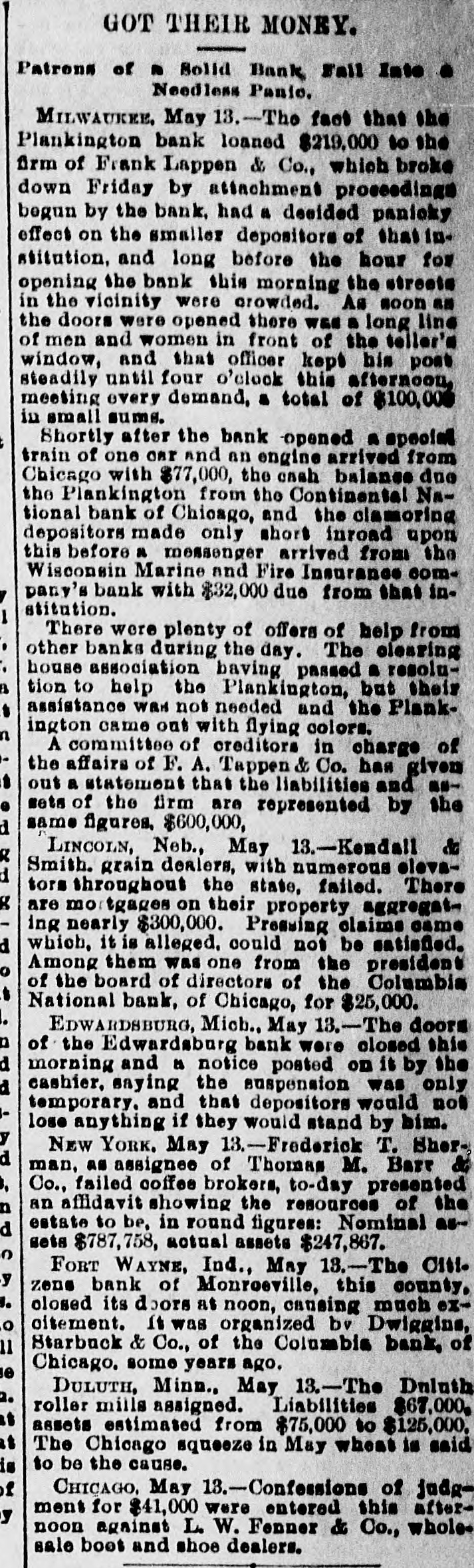

GOT THEIR MONEY. Patrons of n Solid Bank Fall Into . Needless Panic. MILWAUKEE. May 13. I The fact that the Plankington bank loaned $219,000 to the firm of Frank Lappen & Co., which broke down Friday by attachment proceedings begun by the bank, had a decided panicky effect on the smaller depositors of shatin. stitution, and long before the hour for opening the bank this morning the streets in the vicinity were crowded. As noon an the doors were opened there was a long line of men and women in front of the teller's window, and that officer kept him post steadily until four o'clock this afternoon, meeting every demand, a total of $100,000 in small sums. Shortly after the bank opened a special train of one ORT and an engine arrived from Chicago with $77,000, the enah balance due the Plankington from the Continental National bank of Chicago, and the clamoring depositors made only short inroad upon this before n messenger arrived from the Wisconsin Marine and Fire Insurance company's bank with $32,000 due from that institution. There were plenty of offers of help from other banks during the day. The clearing house association baving passed a resolua tion to help the Plankington, but their s assistance WAH not needed and the Plankington came out with flying colors. A committee of creditors in charge of the affairs of F. A. Tappen & Co. has given 1 out a statement that the liabilities and ase sets of the firm are represented by the same figures. $600,000, a LINCOLN, Neb., May 13.-Kendall & Smith. grain dealers, with numerous elevators throughout the state, failed. There are mortgages on their property aggregating nearly $300,000. Pressing claims came d which, it is alleged. could not be satisfied. o Among them was one from the president of the board of directors of the Columbia t National bank, of Chicago, for $25,000. EDWARDSBURG, Micb., May 13.-The doors n of the Edwardsburg bank were closed shis d morning and is notice posted on it by the d cashier. saying the suspension was only temporary. and that depositors would not lose anything if they would stand by him. y NEW YORK. May 13.-Frederick T. Sherd man, as assignee of Thomas M. Barr & , Co., failed coffee brokers, to-day presented n an affidavit showing the resources of the estate to be, in round figures: Nominal avd sets $787,758, actual assets $247,867. o FORT WAYNE, Ind., May 13.-The Citi. y zens bank of Monroeville, this county, I. olosed its doors at noon, causing much exo oitement. it was organized bv Dwiggins, 11 Starbuck & Co., of the Columbia bank, of Chicago. some years ago. e DULUTH, Minn., May 13.-The Dnluth a. roller mills assigned. Liabilities $67,000. at assets estimated from $75,000 to $125,000. at The Chicago squeeze in May wheat is said to be the cause. is of CHICAGO. May 13.-Confessions of judgment for $41,000 were entered this aftery noon against L. W. Fonner & Co., whole. sale boot and shoe dealers.