Click image to open full size in new tab

Article Text

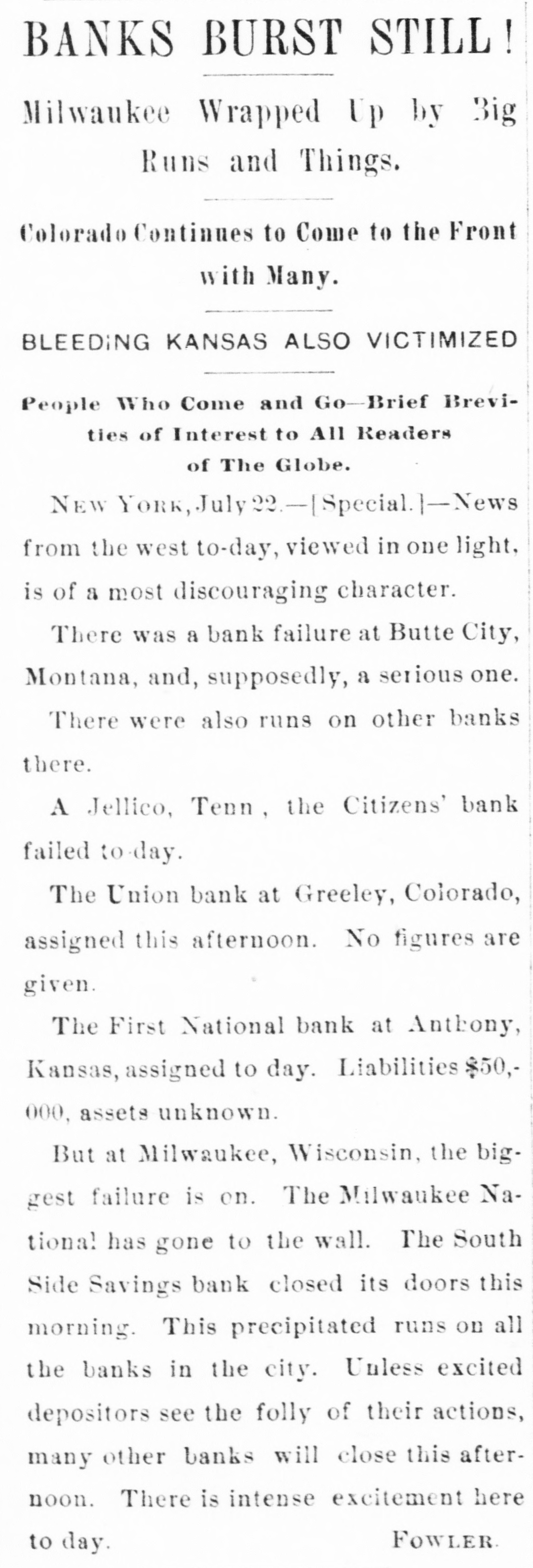

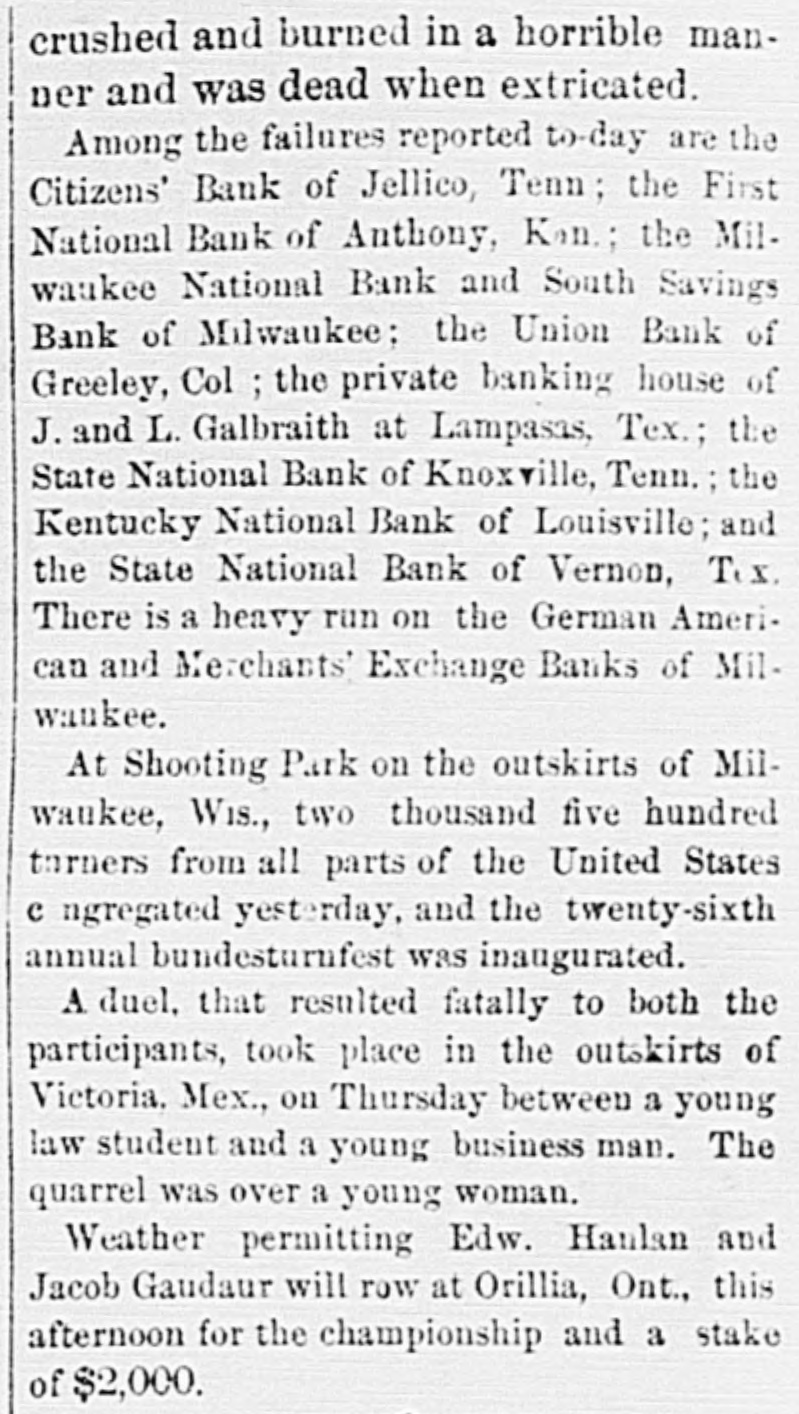

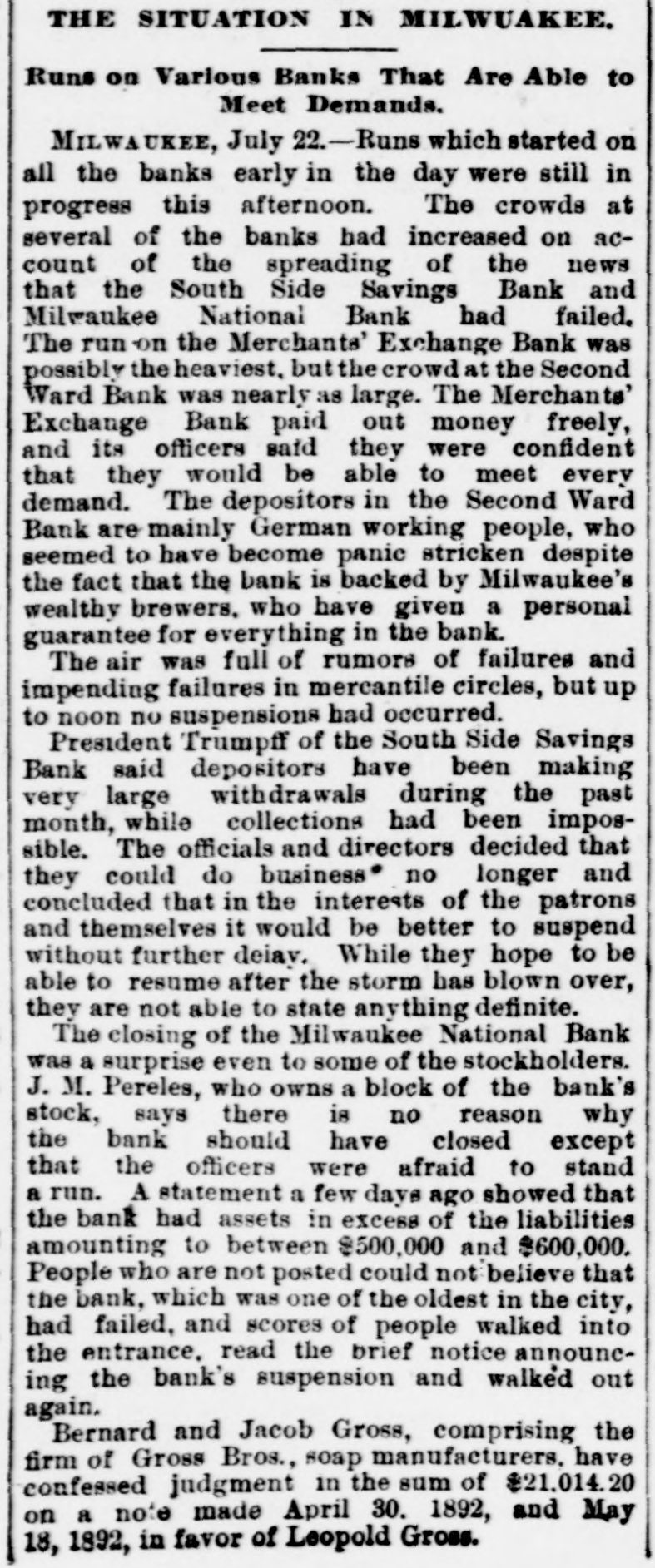

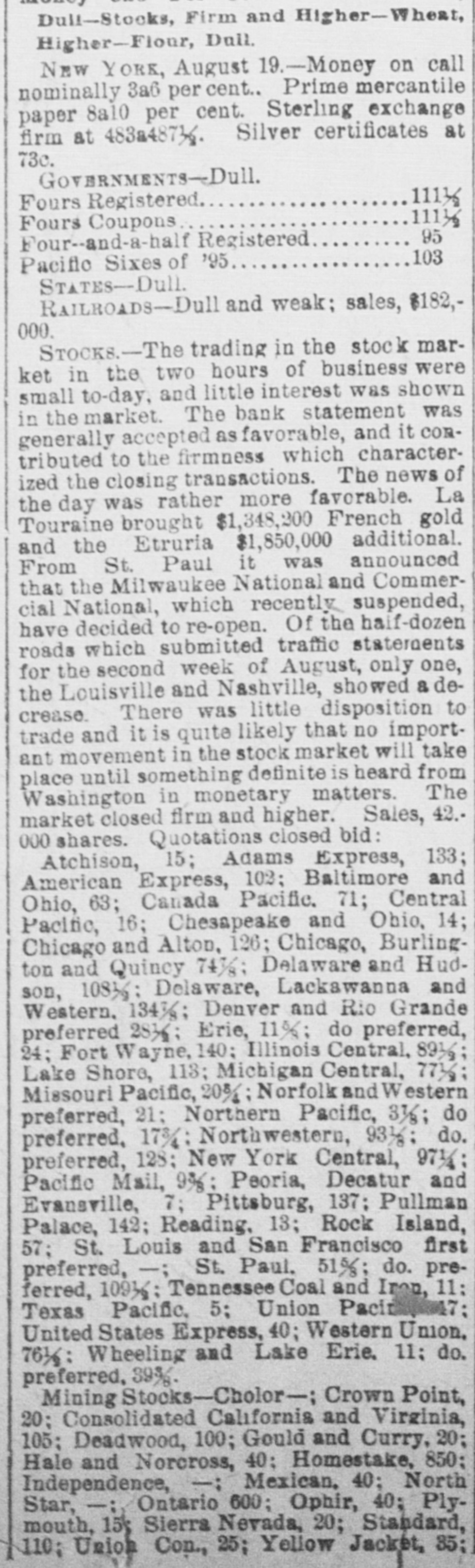

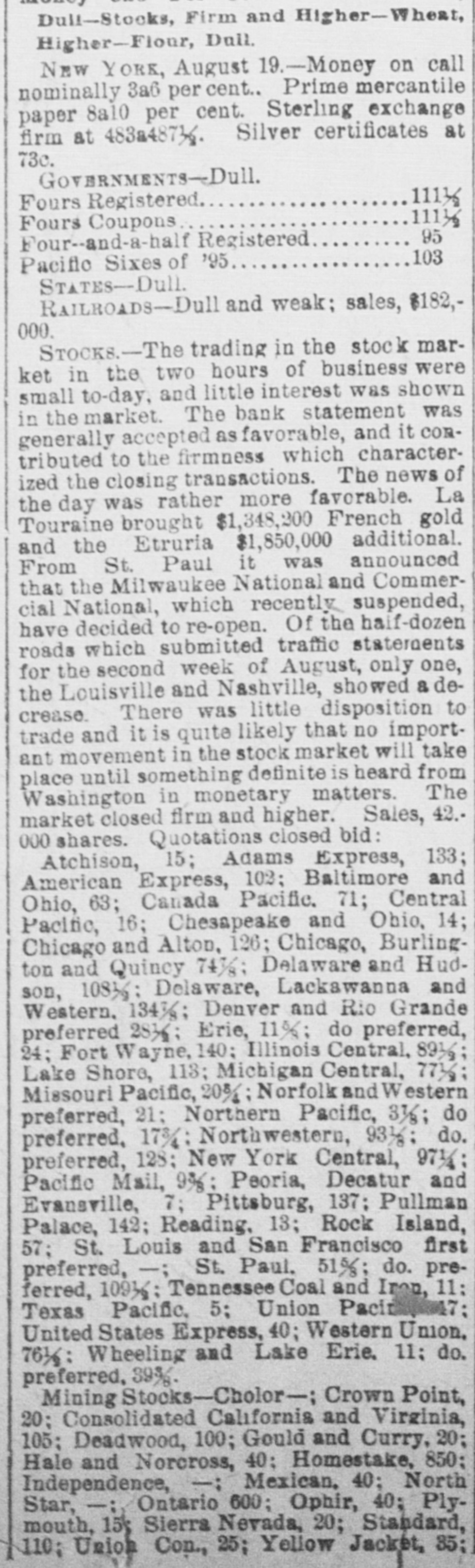

Dull-Stocks, Firm and Higher-Wheat, Higher-Flour, Dull. New YORK, August 19.-Money on call nominally 3a6 per cent.. Prime mercantile paper 8a10 per cent. Sterling exchange firm at 483a48734. Silver certificates at 73c. GOVERNMENTS-Dull. 111½ Fours Registered. 111½ Fours Coupons 95 Four--and-a-half Registered 103 Pacific Sixes of '95 STATES-Dull. RAILROADS-Dull and weak; sales, $182,000. STOCKS.-The trading in the stock market in the two hours of business were small to-day, and little interest was shown in the market. The bank statement was generally accepted as favorable, and it contributed to the firmness which characterized the closing transactions. The news of the day was rather more favorable. La Touraine brought $1,348,200 French gold and the Etruria $1,850,000 additional. From St. Paul it was announced that the Milwaukee National and Commercial National, which recently suspended, have decided to re-open. Of the haif-dozen roads which submitted traffic statements for the second week of August, only one, the Louisville and Nashville, showed a decrease. There was little disposition to trade and it is quite likely that no important movement in the stock market will take place until something definite is heard from Washington in monetary matters. The market closed firm and higher. Sales, 42.000 shares. Quotations closed bid: Atchison, 15; Adams Express, 133; American Express, 102; Baltimore and Ohio, 63; Canada Pacific. 71; Central Pacific, 16; Chesapeake and Ohio, 14; Chicago and Alton, 126; Chicago, Burlington and Quincy 743/8; Delaware and Hudson, 10836; Delaware, Lackawanna and Western. 1343/2; Denver and Rio Grande preferred 2836; Erie, 11%; do preferred, 24; Fort Wayne, 140: Illinois Central, 89½; Lake Shore, 113; Michigan Central, 773/2; Missouri Pacific, 20%; Norfolk and Western preferred, 21; Northern Pacific, 3½; do preferred, 17%; Northwestern, 93%; do. preferred, 128: New York Central, 971/4; Pacific Mail, 9%; Peoria, Decatur and Evansville, 7; Pittsburg, 137; Pullman Palace, 142; Reading. 13; Rock Island, 57; St. Louis and San Francisco first preferred, -; St. Paul. 51%; do. preferred, 10936; Tennessee Coal and Iron, 11: Texas Pacific, 5; Union United States Express, 40; Western Union, 76½: Wheeling and Lake Erie. 11; do. preferred, 39%. Mining Stocks-Cholor-; Crown Point, 20; Consolidated California and Virginia, 105; Deadwood, 100; Gould and Curry, 20; Hale and Norcross, 40; Homestake, 850; Independence, -: Mexican, 40; North Star, -:, Ontario 600; Ophir, 40; Plymouth, 15; Sierra Nevada, 20; Standard, 110; Union Con., 25; Yellow Jacket, 35;